Announcements

Drinks

Germany: special funds are reducing fiscal transparency; debt ratio still trending down

By Eiko Sievert, Director, and Julian Zimmermann, Senior Analyst

Germany (AAA/Stable) retains significant room for budgetary manoeuvre with the prospect of lower debt-to-GDP in the medium term. However, the financial flexibility of the central government in Berlin is constitutionally constrained by the so-called debt break which limits structural deficits of the central government to 0.35% of GDP, or around EUR 15bn a year.

By increasingly making use of special funds, exempted from debt brake provisions, for core areas of central-government spending such as energy, the environment and defence, the government is reducing the visibility for public finances just as the German economy makes an unexpectedly sluggish post-Covid recovery.

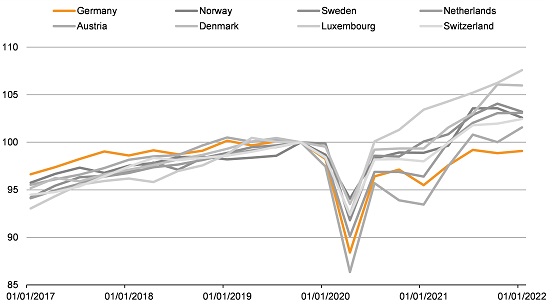

Germany is the only AAA-rated economy that has not returned to pre-pandemic output and, given a likely significant Q2 slowdown, that may not happen until the end of 2022.

Germany’s economy finds itself in the slow lane

Real GDP levels in AAA-rated countries

2019Q4 = 100

Source: Eurostat, Scope Ratings

In response to the escalation of the Russia-Ukraine war, the government intends to significantly increase military spending. Parliament approved a special military fund on 3 June with support from the CDU/CSU opposition to enshrine it in the country’s constitution. The additional borrowing of EUR 100bn, equivalent to around 3% of GDP for which repayments would start in 2031, will be excluded from deficit-limiting calculations of the debt brake.

The move is just the latest in a series of measures that will side-step debt brake limitations in the coming years which are worth around EUR 212bn (6% of GDP).

The government’s goal of complying with the debt brake from 2023 looks ambitious. Berlin will likely be confronted with additional spending requirements. On top of extra investment needed for the energy transition, digitalisation and social security, there is the cost of the accommodation and integration of more than 800,000 Ukrainian refugees. We expect a general government deficit of 4.5% of GDP this year and 2.9% next year, and general government deficits to exceed 1% of GDP until 2025.

Additional funds are also much needed to tackle Germany’s significant investment gap. We have previously estimated this at around EUR 410bn compared with other highly rated countries. As demographic pressures will reduce Germany’s growth potential over the next decade, it is important that the additional funding is spent on growth-enhancing investments where possible.

In the near term, Germany’s recovery from the pandemic is being held back by supply-chain disruptions and price hikes, both factors exacerbated by the Russia-Ukraine war. Producer prices were up 34% YoY in April 2022, mostly driven by high input prices for electricity, gas and crude oil, but also basic metals and chemicals, while Germans are lowering their consumption due to a loss in real disposable incomes this year.

We therefore expect real GDP to grow by just 2.3% in 2022, half the rate we expected last December. Significant downside risks remain, not least the risk of Russian countersanctions leading to interruptions of gas flows into Germany before the currently envisioned phase-out. China’s zero-Covid policy and trade disruptions are also set to hold back German exports.

That said, Germany’s general government debt levels will gradually decline from an expected 72% of GDP in 2022 to around 65% in 2027 despite the increased use of special funds and slower growth than in other AAA-rated countries.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions such as for Credit Sphere