Announcements

Drinks

Serbia: growth momentum, policy discipline cushion economic blows from war in Ukraine

By Levon Kameryan, Associate Director, Sovereign and Public Sector

By Levon Kameryan, Associate Director, Sovereign and Public Sector

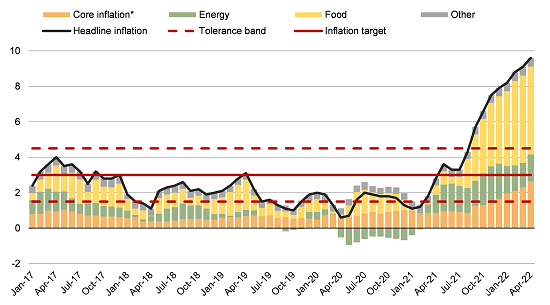

The Russia-Ukraine war represents a substantial exogenous shock to Serbia’s small, open economy. Effects of the war add to strong inflationary pressures in the short term by raising international prices for commodities and food, squeezing household and corporate budgets and putting pressure on external finances.

We forecast average yearly headline inflation of around 9% in 2022, broadly in line with that of peer economies, with Serbia’s current account deficit to widen to 6% of GDP this year from 4.4% of GDP in 2021, mainly due to the impact of higher energy and other commodity prices.

Energy and food prices fuel headline inflation; core inflation still relatively low

Headline inflation (CPI, YoY, %) and contributions (percentage points)

Source: Serbian Statistical Office, Scope Ratings; *core inflation excludes the prices of food, energy, alcohol and cigarettes.

Despite increased economic uncertainties, Serbia’s medium-run growth outlook remains favourable.

After projected growth of 3% for this year, growth is expected to stabilise around 4% in 2023, broadly in line with the economy’s growth potential of 4%-4.5% over the medium term. Underpinning the economy’s expansion is planned investment in transport and green infrastructure, with financing from a debut EUR 1bn green bond issued last year, as well as steady foreign direct investment.

We assigned Serbia a first-time rating of BB+ with Stable Outlook on 3 June, accounting for a number of the country’s vulnerabilities, including the reliance on foreign-currency funding of the public and private sectors, structural current account deficits and institutional deficiencies.

At the same time, Serbia benefits from monetary policy discipline, which has resulted in relatively stable exchange rate dynamics and adequate forex reserves contributing to low pre-crisis inflation. Despite significant hard currency sales of a net EUR 2.3bn over the first four months of 2022 to protect the exchange rate, the National Bank of Serbia’s gross forex reserves of EUR 14.1bn at end-April are comfortable, covering five months’ worth of imports and equivalent to twice outstanding short-term external debt.

Headline trade exposure to Russia and Ukraine is material but not outsized. Russia accounts for less than 4% of Serbia’s total goods exports and slightly more than 5% of its goods imports with almost half of the latter reflecting oil and gas imports. Ukraine makes up less than 1% of Serbia’s exports and imports of goods.

We expect no major disruptions of Russian gas supply to Serbia via the pipeline running through Bulgaria. However, an EU embargo of Russian oil could have a material adverse economic impact, as Serbia relies on supplies transported through EU countries, including Croatia. Serbia imports almost 90% of its gas and 60% of its oil from Russia.

Economic and foreign policy continuity has been observed so far under the presidency of Aleksandar Vučić, including a commitment to balance fiscal discipline and growth – benefitting from IMF policy support. Missing are far-reaching institutional reforms to curtail long-standing public-sector inefficiencies, notably in Serbia’s large and inefficient state-owned enterprises’ sector, which weighs on fiscal performance, and greater respect for the rule of law.

The government faces a difficult task in balancing relations with Russia – given reliance on energy imports, including a recent three-year gas deal with Russia, and the countries’ political ties – with economic and institutional convergence with the EU, without jeopardising future reforms and investor confidence.

Broader normalisation of relations between Serbia and Kosovo, a precondition for Serbia's EU accession for which the date is likely to be delayed considerably from the planned 2025, remains a longer-run challenge.