Announcements

Drinks

European retailers: inflation, weaker demand underline negative outlook; refinancing risk low

Click here to read the full report

“We maintain a negative outlook on the European sector as profitability will come under greater strain in the coming quarters,” says Adrien Guerin, Senior Analyst at Scope Ratings.

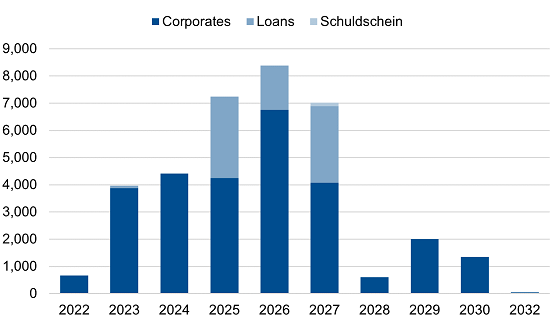

“However, deteriorating credit metrics need to be set against the success many large retailers have had in refinancing borrowing at low rates in the past two years and extending bond maturities, thereby reducing short- to medium-term refinancing needs,” says Guerin.

Debt schedule for a sample of 31 European retailers (EUR m)

Sources: public information, Scope

The squeeze on retailing revenues is mostly a result of the unfavourable macro-economic context, as Russia’s war in Ukraine has exacerbated inflation and supply-chain disruptions to cut short the robust post-Covid economic recovery. Pent-up demand after the lockdowns in 2020 and 2021 had underpinned the rebound but that now looks increasingly exhausted.

Even so, the impact on retailing revenues is likely to be uneven across the sector as consumers restrain spending on non-essential or discretionary goods as inflation erodes their purchasing power while maintaining spending on essential, non-discretionary items.

Inflation has an adverse impact not only on demand but also on retailers’ own costs, notably real estate leases which are often inflation adjusted. The aggravation of supply bottlenecks and blockages from the war in Ukraine, sanctions on Russia and Russian retaliation and China’s zero-Covid policy is another adverse factor squeezing profitability and cashflow as suppliers have to contend with soaring commodity prices while having to hold more inventory amid product shortages and supply-chain disruptions.

Retailing company management has many ways to respond. “Passing on cost increases to customers through high prices is the obvious option though it comes with the risk of damaging reputations for cost-competitiveness and losing market share,” says Guerin. Other measures that retailers will resort to include consolidation of supply chains – through greater use of private labels to get more price flexibility and increase the range of products on offer – and/or revamping their stores to justify higher selling prices.

However, profitability will suffer, despite past initiatives to diversify their businesses and justify higher prices. “Capex requirements remain significant as retailers adapt to the challenges of improving efficiency and reducing costs, luring shoppers back to physical stores while continuing to invest in e-commerce,” says Guerin.

Capex-to-revenue will remain relatively high for most retailers at 3.5-4.0%, helped by the normalisation of post-Covid trading conditions which should increase business visibility. Capex demands will constrain retailers’ ability to remunerate shareholders and embark on ambitious M&A.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Credit Sphere, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.