Announcements

Drinks

European airlines: fuel prices, rising staff costs threaten profit margins despite traffic rebound

By Azza Chammem, Senior Analyst, Scope Ratings

By Azza Chammem, Senior Analyst, Scope Ratings

Only those airlines with flexible fleets and routes and the deepest pockets to continue investing in more efficient aircraft are likely to emerge unscathed from the crosswinds the sector faces.

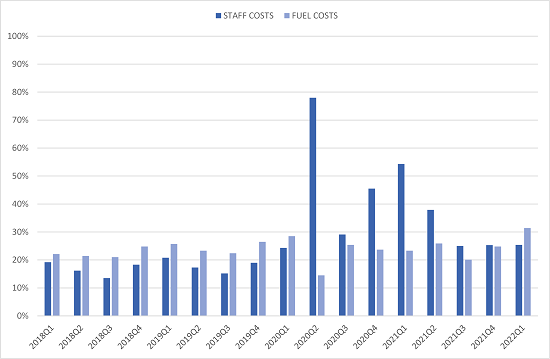

The sobering reality that the CFOs of Europe’s carriers face is that fuel and staff costs are by far their most important costs. But it has proven relatively uncommon for them to rise simultaneously in recent years – until this year. Fuel costs reached 30% of revenues in the first quarter of 2022 and are set to go up further. Staff cost declined as a percent of revenues as business improved after Covid but there are signs that airlines’ cuts during the pandemic were too deep and, with wage inflation set to pick up speed, it is unlikely that they return their pre-pandemic levels of less than 20% of revenues.

Figure 1: European airlines face worsening cost squeeze

Staff and fuel costs as share of total revenues

Source: Scope Ratings, Bloomberg

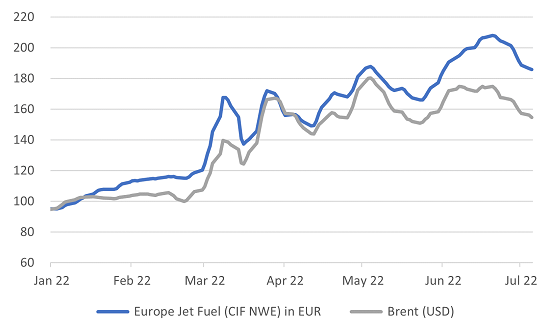

On the fuel front, a lack of spare refining capacity as airline traffic has picked up has widened the spread between crude and jet fuel prices, exacerbating the impact of surging oil prices on Europe’s carriers. While the oil price measured in USD has declined recently, jet fuel prices in euros are still up by more than 80% this year. Airlines are refreshing their fuel hedging strategy and opting for more rationalised capacity behaviour across the industry. Hedging is further complicated by the much shorter booking cycles, which make it hard to predict fuel needs.

Figure 2: Euro weakness vs dollar exacerbates fuel price headache for European carriers

Jet fuel (EUR), Brent crude (USD) indexed for comparison

Source: Scope Ratings, Capital IQ

On staffing, the industry is struggling to staff back up to meet strong demand after the prolonged Covid-related slump in activity, putting bargaining power in the hands of pilots, cabin crew and ground staff whose cost of living is being eroded by rising inflation. Several airlines have already been negatively affected by industrial action in Spain, and the threat is likely to spread with unions threatening strikes in the UK and Germany.

Meanwhile, airports, including European hubs such as Schiphol or Heathrow, are putting caps on the number of flights operated by airlines given staff shortages with the objective to stabilise flight operations, improve baggage handling, and increase punctuality. In response, airlines have had to cut their flight schedules, which leads to lower revenues.

With debt-servicing costs also on the rise, airline cashflow and profitability is being squeezed despite pent-up summer demand for air travel. We expect 2022 EBITDA margins to be above 5% for legacy airlines and slightly higher for low costs carriers, though visibility remains very low. Q2 2022 marked a return to profitability for most airlines which benefitted from surging travel demand that allowed the sector to raise fares though it was forced to limit seat availability in short haul.

While demand is strong for now, it is unclear how resistant it will be after the summer with rising inflation, fuel and labor costs challenges and continuing geopolitical concerns. Unit costs will be difficult to contain which may put the path into recovery to pre-covid level for some airlines at risk.

These set of circumstances have punished those airlines which emerged from the Covid crisis with relatively a high cost-base, such as SAS AB, the airline part-owned by the Danish and Swedish governments, which has gone into bankruptcy protection as it seeks to restructure its debts. Yet it was through government indirect and direct support for the sector that no big carriers went out of business during the pandemic, ensuring Europe’s long-term problem of having a far more fragmented sector than in the US remains.

Europeans’ desire to travel is seemingly insatiable despite air travel chaos, inflationary pressure, and geopolitical crisis within its borders. In Europe, the Russia-Ukraine war will continue to disrupt travel patterns within Europe and between Europe and Asia-Pacific. However, the war is not expected to derail the travel recovery, with the region edging closer to profitability in 2022. According to IATA, demand is expected to reach 82.7% of pre-crisis (2019) levels, with capacity at 90%.