Announcements

Drinks

Germany: fiscal strength and financial reserves sufficient to weather severe energy shock

By Eiko Sievert, Director, and Jakob Suwalski, Director, Sovereign Ratings

Germany’s (AAA/stable) growth prospects have deteriorated significantly following the escalation of the Russia-Ukraine war six months ago. We now expect the economy to expand by just 1.6% in 2022 and by 1.7% in 2023 having originally expected more than 4% growth this year and 3% in 2023. In this baseline scenario, sharp increases in the prices of energy coupled with new disruptions to global supply chains will lead to a technical recession – an economic contraction in two successive quarters – in Germany’s export-oriented economy starting in the final quarter of 2022.

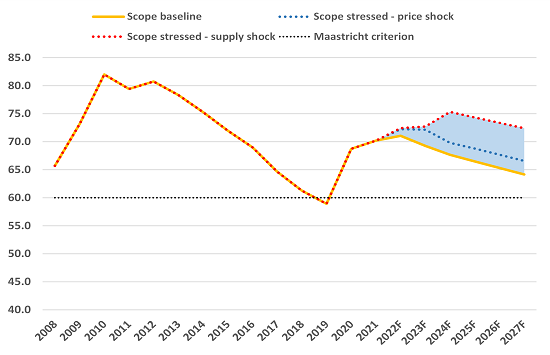

Even so, Germany’s debt-to-GDP ratio will remain on course to fall below 65% by 2027 due to low interest rates and quickly recovering tax revenues after the pandemic.

However, there remains huge uncertainty about Russia’s approach to exporting gas to Germany and the rest of Europe to finance its war effort while simultaneously seeking to punish its western neighbours for their support of Ukraine and the imposition of sanctions.

Figure 1: Growth and debt-to-GDP forecasts for Germany in different gas-shock scenarios

Source: Scope Ratings

If tensions on gas markets remain higher for longer, a more severe gas market shock in which prices doubled from Q2 2022 levels (as modelled by IW Köln) would result in a deeper recession than in our baseline scenario, implying slower growth in 2022 of around 1.3%, before a contraction of 0.7% in 2023. This would push debt-to-GDP to more than 72% in 2022 before gradually declining thereafter. Such a scenario is increasingly likely as upward price pressure is visible in energy futures markets where prices have more than doubled since Q2 2022. Today’s historical peaks in European energy future contracts also reflect markets’ concerns about obstacles to Germany’s diversification from reliance on gas imports.

Acute gas shortages could cause long-term economic damage

Under an even more pessimistic scenario in which President Vladimir Putin decides to maximise economic pain for Germany with periodic or permanent interruptions in gas exports, leading to acute shortages, debt-to-GDP would rise to just over 75% in 2024. This would assume GDP falling 6.6% short of our baseline scenario over 2022-2024 and some permanent degradation of Germany’s medium term growth potential. Here, growth would be around only 1.0% in 2022, before contractions of 2.1% in 2023 and 0.7% in 2024, with inflation running at around 7% over 2022-24. While rising gas storage levels and falling structural demand have made such a scenario this winter less likely, Germany’s limited gas storage capacity leaves a small opportunity to adjust the energy mix.

Figure 2: Debt-to-GDP forecasts for Germany under different gas shock scenarios

% of GDP

Source: Scope Ratings

However, high fiscal buffers built up before the pandemic, sufficient financial reserves and a mature fiscal policy framework support Germany’s fiscal resilience and debt sustainability even in these circumstances. While economic damage would be unavoidable from Russia’s “weaponization” of its energy exports, Germany maintains ample financial capacity for further temporary relief, such as the announced VAT reduction on gas, in the autumn budget to support consumers should gas prices continue to rise. In the pessimistic scenario, state intervention in the energy sector will likely increase, potentially including further demand-side measures beyond voluntary gas savings.

Even with fuller storage facilities, reduction in gas consumption will be crucial

The government’s efforts to secure Germany’s gas supply before the winter continues to progress, lowering the risks of even higher gas prices or even possible gas shortages. Storage facilities were filled to 83% in late August and thus on track to meet legislative targets for 85% by 1 October and to 95% by 1 November, suggesting Germany is close to the gas reserves needed to get through this winter.

Despite the rebound effect following the pandemic, we expect the structural decline in energy demand in Germany to continue in the coming years. Low-volume consumers, including households, have reduced demand by around 6% from March after the escalation of Russia’s war against Ukraine. Industrial consumers started to reduce demand much earlier, back in August 2021, when wholesale gas prices rose sharply. This has led to average reduction in industrial demand of around 11%.

However, natural gas will remain a crucial energy source in Germany as it accounts for around 40% of household’s total energy consumption, more than 30% of industry’s consumption and around 13% of the country’s electricity generation.

The faster Germany can replenish its gas storage, diversify its sources of supply and lower household and industry demand for gas, the less emergency financial support from the government will ultimately be needed. Such moves will require coordination with other EU members, which would reassure participants in gas markets, and allow Berlin to swiftly return to a structurally balanced budget, thereby ensuring the sustainability of public finances.