Announcements

Drinks

European metals: smelter closures grab headlines; broader industry passes on rising costs for now

By Tommy Träsk, Director, Corporate Ratings

Rising costs and slackening demand will catch up with metals producers in the second half of the year, when we can expect a normalisation of earnings after a bumper first half.

Companies such as ArcelorMittal S.A., SSAB AB, voestalpine AG, Outokumpu Oyj, Acerinox SA and Aurubius AG reported blow-out earnings on record high commodity prices just as high freight costs and EU import duties on many processed steel and aluminium products have kept import volumes in check.

However, the companies face some compression of profit margins in the second half of 2022 due to rising costs, weakening demand and lower prices. Inflation is not confined to energy, but also visible in their own freight and other input costs, some of which feed through to earnings with a lag of a few months depending on contractual arrangements, hedging etc.

Steel industry less exposed to high power prices than primary aluminium producers

Could even steeper increases in European electricity costs have a more serious impact on the industry?

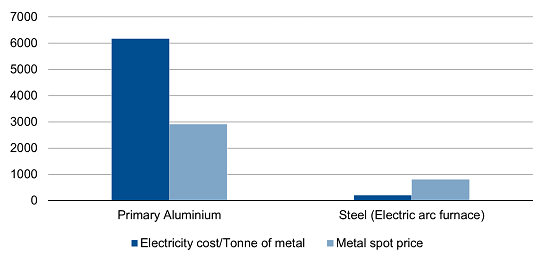

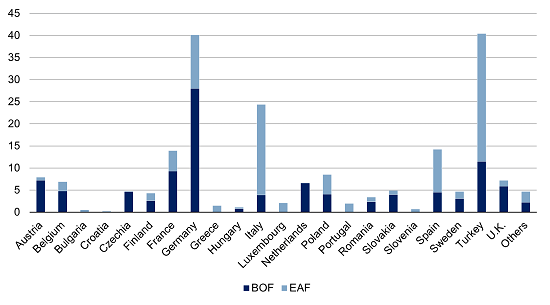

Electric arc steel production will likely become less profitable than in blast furnaces, also known as basic oxygen furnaces (BOF), in Europe under an extreme electricity price scenario, but the energy intensity is still far lower than that of aluminium production (see Figure 1). Of EU steel produced in 2021, 56.1% was through blast furnaces and 43.9% through electric arc furnaces, according to the World Steel Association (see Figure 2).

Figure 1: Aluminium vs steel: electricity costs and metal prices compared

(EUR/tonne)

Source: Scope Ratings

Note: illustration of electricity cost per tonne of metal produced for a hypothetical European producer, assuming electricity is purchased on the spot market, vs. the European spot metals price (incl. premium). Recycled aluminium production consumes about 90% less energy than using raw materials.

Electric-arc steel production is more versatile in that producers can take advantage of off-peak electricity price differentials. The larger producers have both blast and electric arc furnaces, so would be able to focus production on the more advantageous process, allowing the steel sector to cope relatively well with high power prices compared with other metal producers.

The outlook for suppliers of alumina, primary aluminium and zinc is different. Over one third of global aluminium smelters are now said to be losing money. The situation is particularly tough in Europe, with electricity prices set to rise further once colder weather sets in amid Russia’s weaponization of its gas exports in its war with Ukraine.

Figure 2: European steel production by furnace type (basic oxygen vs electric arc), 2021

Tonnes (million)

Source: World Steel Association

However, not all producers are equally vulnerable. The impact of the higher energy costs largely depends on plant location, the degree to which input and output prices are hedged, and whether plants have captive, low-cost energy supplies to meet their needs.

Norsk Hydro ASA, for example, benefits from captive relatively cheap hydro-electric power in Norway, helping it turn in record earnings over the past year. In contrast, its Slovakian subsidiary Slovalco, which does not have a long-term energy supply agreement, is closing its primary aluminium production by the end of September. Other producers that have slashed primary aluminium production in Europe include US-based Alcoa Corp.’s smelters in Spain and Norway, Alro SA (Romania) and Uniprom (Montenegro).

Closing European primary aluminium and alumina production is not necessarily the end for the companies in question, with Alro continuing to profitably produce processed aluminium products based on third-party supplies of primary aluminium. It is hard however to imagine the shuttered facilities restarting without long-term, preferential access to energy.

One tailwind for the European metals sector in general remains the weakness of European currencies against the dollar at a time of high and broadly steady dollar-denominated commodity prices, helping offset rising inflation and the prospect of falling volumes as economic growth slows in Europe under the impact of Russia’s war in Ukraine.

For more on Scope’s approach to rating the metals and mining industry please see Metals & Mining Rating Methodology – Call for Comments, 28 June 2022. For information on how Scope assesses ESG factors for Metals & Mining companies can be found in ESG Considerations for the Metals & Mining Industry, 23 April 2021

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope`s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.