Announcements

Drinks

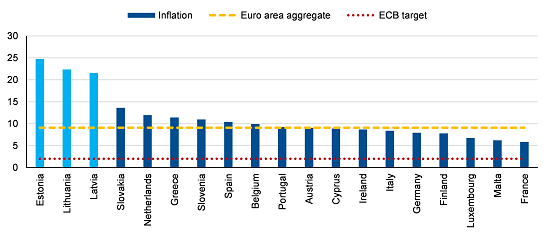

Baltics: small, open economies face highest European inflation; underlying credit resilience intact

By Giulia Branz, CFA, Senior Analyst, Sovereign and Public Sector Ratings

By Giulia Branz, CFA, Senior Analyst, Sovereign and Public Sector Ratings

Soaring inflation is a widespread challenge for many economies. However, for the Baltics, the challenge is especially acute. Inflation in August was running above 20%, more than 10 times the ECB inflation target.

Specifically, inflation stood at 24.8% for Estonia (AA-/Stable), 22.4% in Lithuania (A/Positive) and 21.6% in Latvia (A-/Positive), in all three cases more than double the euro area average of slightly above 9%.

Inflation is set to average 17-20% for the year across the three economies, before dropping by around a half by next year, as base effects improve, to still unusually elevated levels.

Inflation among euro area countries

% YoY, August 2022 (or most recent month available)

Source: Macrobond, Scope Ratings

High vulnerability to inflation leads to sharp economic slowdown

Baltic economies are especially vulnerable to current inflationary pressures given comparatively higher shares of energy and food items in their respective consumption baskets, which reflects, among other factors, the Baltics’ still relatively lower income levels vis-a-vis euro area peers. As prices for these items have soared since the Russia-Ukraine war, the inflationary pressures have risen significantly.

Such high inflation has adverse consequences particularly for small economies such as the Baltics, notably for social stability by eroding purchasing power and savings, creating regressive redistribution among different income groups and between creditors and borrowers. Inflation also creates uncertainty for businesses about future costs and prices which deters investment.

The economic impact of soaring prices on businesses and households is visible in the region’s slowing GDP growth. Output contracted in the second quarter across the Baltics, between -0.5% and -1.3% quarter-on-quarter. We expect annual growth to remain moderate this year – between positive 1% and 2% for Estonia and Lithuania and around 2.5% in Latvia.

The headline annual growth figures are deceptive as they reflect a carry-over from robust growth at the beginning of the year. The economies face a sharp slowdown during the second half. Next year, growth will slow further but we do not expect a full-year contraction, with the recovery delayed into 2024.

Limited solutions to high price pressures ahead, but solid fundamentals cushion ratings

The ability of the ECB to curtail high inflation appears especially limited in the case of the Baltics despite the 75bp rate hike last week, and this is not only due to a dominant role of supply-side factors in current inflation, exacerbated by the war in Ukraine and Russia’s weaponization of its energy exports.

Although inflation in the Baltics is far higher than euro-area averages, the ECB focuses monetary policy on average inflation in the single currency area, inherently skewing policy toward largest member states. As such, ECB policies remain overly accommodative for inflation conditions in the smaller Baltic economies.

Also, demand-driven inflation is stronger than in other euro-area member states, after comparably modest economic contractions during the 2020 Covid-19 crisis, which were swiftly followed by robust recoveries. Tight labour markets are likely to favour longer-lasting inflation risk, as vacancies remain high and unemployment rates low even after inflows of Ukrainian refugees.

Baltic governments are under growing pressure to step up budgetary support to alleviate present price pressures on businesses and households, though such support – depending on its overall volume and target – may further contribute to underlying inflation.

However, the three countries share common strengths. These include access to significant EU funding over coming years via the Cohesion Policy and NGEU programme, solid economic fundamentals, profitable banking systems and robust institutions, helping the region cope with the energy crisis and supporting credit ratings.

Estonia, Latvia and Lithuania benefit from comparatively low public debt ratios. Relatively robust growth in nominal terms should thus help stabilise debt-to-GDP despite widening budget deficits and rising financing costs in the euro area.

Our next sovereign calendar review dates are:

- Lithuania: 18 November 2022

- Estonia: 25 November 2022

- Latvia: 2 December 2022