Announcements

Drinks

Spain: lower growth, rising interest rates increase need for reforms to ensure public debt declines

.jpg) By Jakob Suwalski, Director, Sovereign and Public Sector Ratings

By Jakob Suwalski, Director, Sovereign and Public Sector Ratings

We expect the Spanish economy to grow by only 1.5% in 2023 compared with 4.1% forecast this year underpinned by the strong rebound from the pandemic in the first half with employment already well above pre-pandemic levels.

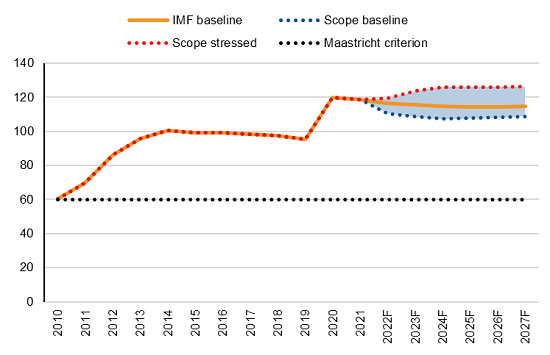

Such good recent growth has helped fiscal consolidation in Spain (A-/Stable). Government debt-to-GDP stood at 118.7% at end-2021, among the highest in the euro area and about 20pps above pre-pandemic levels, but it should gradually fall to around 110% by 2027.

However, the challenge of fiscal consolidation is getting harder as economic conditions deteriorate. The economic benefits of post-lockdown trends such as the strong rebound of tourism and refilled order books have faded fast in the third quarter. Higher energy prices are weighing down on household consumption and consumer confidence. Residual supply-chain friction and weaker global demand are taking their toll on business sentiment and likely future demand.

Figure 1: Debt-to-GDP forecasts for Spain under different scenarios

% of GDP

Source: IMF, Scope Ratings

The financial burden on firms and households is expected to pick up as the ECB accelerates its withdrawal of monetary stimulus. Inflation remains high, despite tighter monetary policy, and could become further entrenched, making it more difficult for the central bank to bring prices down quickly.

Tackling high unemployment remains critical for government

Under such circumstances, Spain’s implementation of Next Generation EU funding needs to be accelerated to improve fiscal capacity to deliver on public investment and raise the country’s economic growth potential. This is important to help government address long-running challenges such as a high level of structural unemployment and low productivity growth.

Rising unemployment is a big risk as Spain’s structural unemployment is running at 13%, among the highest of the euro area. Another challenge is reducing the persistent duality of the labour market – with still widespread use of temporary contracts at about 21% of those employed, compared with 11% for the euro area as a whole – despite recent labour market reforms encouraging firms to hire permanent staff. The elevated rate of youth unemployment, at 27% in July 2022, also restrict long-run growth.

More encouraging is Spain’s relatively advantageous position compared with the euro area’s other large economies within the context of Russia’s weaponisation of energy exports. Spain faces a less acute energy crisis than Germany and Italy. Spain benefits from strategic advantages of gas pipeline connections to North Africa. The country’s LNG terminals account for the highest regasification capacity in Europe, with six facilities, though energy imports still cover above 70% of final energy consumption.

Healthy debt profile, low real interest rates support debt sustainability

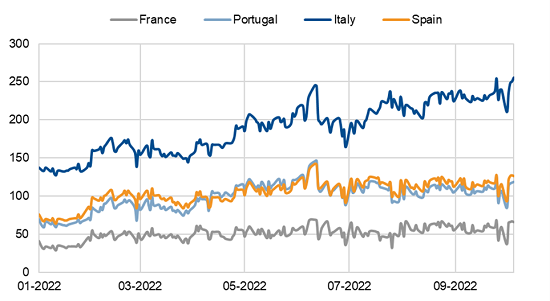

Rising euro area bond yields will also take time to have their full impact on the cost servicing of Spanish public debt considering the average maturity is around eight years.

Figure 2: Ten-year sovereign spreads vis-à-vis Germany

bp

Source: Macrobond, Scope Ratings

Under our baseline scenario, we expect real interest rates when compared against headline inflation rates to remain negative in the medium term, thus facilitating gradual consolidation of Spain’s public finances. The unexpectedly high rate of inflation erodes the value of the outstanding stock of government debt. The phasing out of Covid-related emergency measures has also helped government reduce the debt ratio, with a sharp improvement during the first half.

However, under our stressed scenario, we assume a longer period of below-trend economic growth across major economies and real interest rates to turn positive, which would weigh on investment and consumption. This would align with a more aggressive policy response from the ECB compared with our baseline scenario, with threatening to reverse Spain’s declining debt-to-GDP trajectory. The planned pace of fiscal consolidation would slow given spending pressure on the government along with falling tax collection and higher borrowing costs.

Even so, the Spanish government is under pressure to provide extra fiscal handouts as the cost of living rises. Coordination of tax policies between the central government and the regions – the latter whose governments hold some autonomy in terms of budget management - will be another crucial factor for the central government budget, not least with general and regional elections due next year. Seven Spanish regions have announced tax breaks, in addition to the income tax reductions announced by the national government recently.

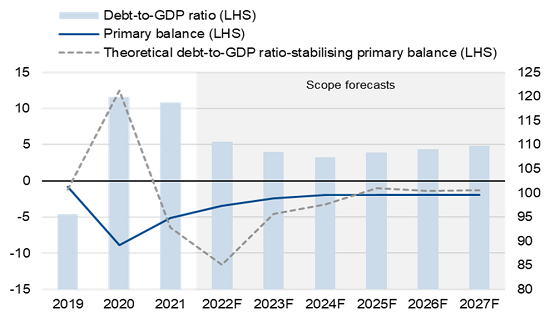

Figure 3: Primary balance forecasts vs. theoretical debt-stabilising primary balance

% of GDP

Source: Scope Ratings

Spain’s capacity to provide more budgetary support is limited due to persistent primary deficits, so the left-wing central government recently announced introduction of a temporary wealth tax in 2023 to fund further inflation relief such as free public transport and subsidised petrol. This contrasts with tax cuts planned by centre-right-run regions such as Andalusia and Galicia, intending to roll back wealth taxation.

The uneven record successive Spanish governments have had in meeting budgetary deficit targets and recording a primary surplus – the last time was in 2007 – puts the onus the national government to raise the country’s growth potential while running a broadly balanced primary account to keep debt-to-GDP on the decline.