Announcements

Drinks

Italy: primary surpluses and sustained growth critical to ensure public debt sustainability

Alvise Lennkh-Yunus, Executive Director, and Giulia Branz, Senior Analyst

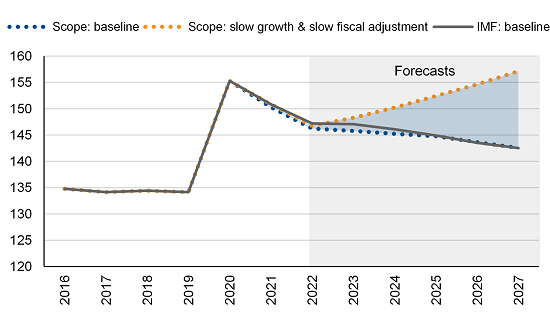

We expect Italy’s (BBB+/Stable) debt-to-GDP ratio to decline this year to about 146% of GDP from 150% in 2021 on real economic growth of around +3.2% despite a material weakening of the outlook in the second half of this year due to the energy crisis.

However, from next year, more moderate nominal GDP growth and higher interest rates will weigh against further reductions in debt-to-GDP. Italy’s financing rates have substantially increased over the past 12 months, with the 10-year government bond yield surging to above 4.5% from below 0.6% in the summer of last year – levels not seen since 2013.

Rates are rising for all euro area economies, but their impact is most severe for highly indebted countries such as Italy: the spread to German bunds has increased by about 100bps since January to 250bps, adding to financial-market pressures to the international and domestic political and economic challenges facing Italy after last month’s election.

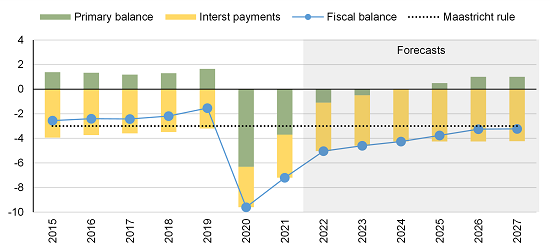

Italy’s interest payments will rise to around 4% of GDP this year, up from 3.6% in 2021, or by over EUR 10bn to about EUR 75bn, mainly driven by higher servicing costs on the large proportion of inflation-linked bonds, which account for more than 10% of the stock of outstanding government debt securities.

Italy’s interest expenditure and primary balances 2015 – 2027F

General government; % of GDP

Source: Eurostat, Italian Ministry of Finance, Macrobond, Scope Ratings

Despite the one-off effects of higher inflation, which should be limited to this and next year only, interest payments are set to remain at similar levels relative to GDP over the medium term, as a growing proportion of government debt carries higher financing rates. Assuming financing costs stabilise at current levels, annual interest payments will be EUR 20-25bn higher in 2026-27 than in 2021. This will be the case even if the impact is smoothed by Italy’s favourable debt structure given a long average maturity of more than seven years.

Consequently, a rapid return to an elevated primary surplus of at least 1% of GDP will be needed for Italy to maintain the headline deficit within the 3% of GDP Maastricht threshold. The EU’s fiscal rules are currently suspended and under revision, but we expect a modified version of the rules to become binding again from 2024.

Meeting deficit limit important for future debt-sustainability assessment

For Italy, but also France (AA/Stable) and Spain (A-/Stable), future European Commission assessments of debt sustainability will depend, among other factors, on the reinstated 3% fiscal deficit rule – which we do not expect to change significantly if at all. This will inform the ECB’s decision on bond eligibility in its Transmission Protection Instrument, should it be activated.

Contrary to France and Spain, Italy has a record of prudent fiscal policy, with elevated primary surpluses averaging 1.4% of GDP in the five years before the pandemic. Once the impact of one-off measures to address the Covid-19 and energy crises fades, the new government inherits a budget which, in the absence of additional fiscal measures, should favour a return to primary surpluses.

Italian public finances have recovered rapidly from the substantial scarring from the pandemic. The fiscal deficit is likely to decline to near 5% of GDP this year, below the target of 5.6% and 7.2% recorded in 2021, despite higher interest costs. The primary deficit should fall to just above 1% of GDP on higher tax revenue – boosted by the elevated rate of nominal GDP growth amid resurging inflation – a strong labour market and less pandemic-related spending.

Still, the further 2% of GDP in fiscal consolidation in that Italy needs the years ahead to maintain the headline deficit below 3% of GDP, and thus a gradual decline in the debt-to-GDP ratio, is all the more important because of slowing economic growth amid Europe’s energy crisis and rising public expenditure related to Italy’s ageing population.

We estimate GDP growth at around 0.5% next year, a 1.5% rebound in 2024, and only around 1% in the years thereafter. This underscores the need for the new government to stick to, if not enhance, the pro-growth reforms of the Mario Draghi administration and maintain a gradual fiscal consolidation path to ensure Italy’s public debt sustainability.

Italy’s general government debt

% of GDP

Source: IMF, Macrobond, Scope Ratings.

Scope’s stressed scenario assumes, for the 2022-27 period, average growth of 0.9% and primary deficits -0.8% of GDP.

Download updated slide deck on presentation on Italy’s credit outlook after the elections