Announcements

Drinks

Europe and Ukraine: how much financial support can the EU offer for rebuilding the country?

Alvise Lennkh-Yunus, Executive Director, Sovereign and Public Sector

The cost of Russia’s invasion of Ukraine is expected to exceed EUR400bn if the conflict continues until the end of this year. Ukraine has secured unprecedented financial commitments from the EU and other international partners including the US and G7 to assist with rapid reconstruction once the war ends.

A significant European contribution, most likely of more than EUR 100bn over a multi-decade period, would result in higher outstanding liabilities for the EU (AAA/Stable). Such support for Ukraine would lead to substantially higher euro bond issuance and further underpin the EU’s presence in the capital markets beyond the recovery-fund and social debt issued for the NGEU and SURE programmes.

However, Ukraine might also become the EU’s second largest debtor after Italy (BBB+/Stable), and possibly the largest, once Italy and other member states repay their Next Generation EU loans, latest by 2058. The EU’s asset quality would thus decline at least until Ukraine’s (CC/Negative) creditworthiness improves, which is probable, but will take time and ultimately depend on the implementation of reforms and resulting institutional gains on which EU disbursements will be conditional.

An essential component of EU lending to Ukraine will thus be its preferred creditor status, excluding it from any future debt restructuring. Additional member state guarantees and/or upfront provisions for the loans would also enhance the EU’s asset quality. Conditionality and monitoring over Ukraine’s use of the loans will be vital to ensure repayment by multiple future Ukrainian governments, and thus the EU’s AAA rating, despite the reassurance provided by Ukraine’s EU candidate status and eventual membership.

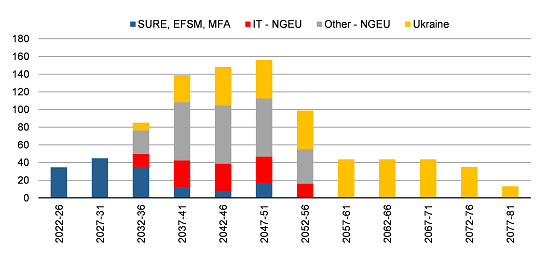

EU loan repayment profile, assuming a EUR 350bn facility for Ukraine

EUR bn

NB. Assumes EUR 350bn of Ukraine loans, disbursed over 10 years, with 10-year grace period and repayment over 40 years until 2081. Other NGEU assumes full use of loan envelop (EUR 386bn, excl. Italy).

Assumptions based on dedicated 10-year financing instrument for Ukraine

To determine the scale of possible EU financial support for Ukraine’s longer-term reconstruction, we need to address several issues: first, how much does Ukraine actually need; second, how much can the EU afford financially to retain its AAA rating, and politically, given stretched member-state budgets; third, how should it be provided, through grants or loans; and fourth, how much can Ukraine reasonably be expected to repay on an annual basis.

The first assumption we make to inform our broad estimates is that the EU uses a dedicated financing instrument involving loans disbursed in line with existing assistance programmes, financed in equal 10-year tranches, with a grace period of 10 years, and an amortisation profile of 40 years, similar to the ESM’s financial assistance programme for Greece. Such a long repayment horizon presumes a significant level of trust between the EU and Ukraine.

Since the bonds issued to support Ukraine will ultimately be backed by the EU budget, the EU’s future repayment profile, including SURE and NGEU, matters from a credit perspective. Here, we assume conservatively that the EU’s NGEU programme will be taken up in full, including all available loans, and that consequently, annual EU bond repayments will be close to their allowed annual ceiling: EUR 29.25bn for NGEU and EUR 10bn for SURE. Add another EUR 5-10bn for other existing programmes and the EU’s maximum annual bond repayment once all disbursements are completed could reach around EUR 50bn.

Assuming the EU’s annual budget of around EUR 170bn does not change significantly, the EU’s maximum bond repayments from 2028 onwards will correspond to around 25-30% of its annual budget.

EUR 350bn facility implies EUR 10bn in annual payments over 40 years

Against this background, how much are member states willing and able to provide Ukraine?

We estimate three stylised scenarios ranging from EUR 100bn (in line with the SURE programme), EUR 250bn (similarly to the EUR 256.6bn provided to Greece via member states, the EFSF (AA+/Stable) and ESM (AAA/Stable)), and EUR 350bn based on the latest estimate by the Ukrainian government, the European Commission and the World Bank on the cost of reconstruction and recovery in Ukraine.

Based on the stated assumptions, EUR 100bn (250bn) provided to Ukraine would result in principal repayments starting in 2033 until 2081 of about EUR 2.5bn (EUR 6.3bn) and correspond to about 1.5% (3.7%) of the EU’s annual budget or about 1.3% (3.1%) of Ukraine’s 2021 GDP. Assuming full absorption, a EUR 350bn facility for Ukraine would imply almost EUR 10bn annual repayments over a 40-year horizon.

Depending on the volume ranging between EUR 100-350bn, the EU’s annual maximum bond repayments would likely increase by around EUR 10-15bn to allow sufficient flexibility or about 6-10% of its annual budget. Similarly, the impact of such a repayment profile should also be manageable for Ukraine as it would not exceed 5% of its GDP, broadly in line with Greece’s repayments to the ESM/EFSF.

However, in case Ukraine were to face financial distress, the EU has important liquidity buffers to ensure timely repayment of Ukraine-related debt, beyond the expected repayments by the Ukrainian government. These include an average cash balance of about EUR 20-25bn and, critically, potential resources the EU can draw from highly rated member states without requiring additional decision making.

Adjusting for expenditures and excluding resources earmarked for NGEU repayments, this safety margin corresponds to at least EUR 60-90bn a year. In addition, the actual EU budgetary flexibility to delay significant amounts of annual expenditure of about EUR 40bn-60bn from the European regional and cohesion funds provides further assurance.

Finally, the EU may also benefit from new income streams, which, depending on the final proposals and the timeline of their adoption, will help cover a significant share of the expected expenditure related to the repayment of EU bonds. These include the EUR 5.8bn in revenue obtained in 2021 from taxing plastic packaging waste, and possible additional revenues from a carbon border adjustment mechanism, the revised Emissions Trading Scheme, a contribution based on reallocated profits of very large multinational companies (OECD Pillar One), and new own resources related to the corporate and financial sectors.