Announcements

Drinks

EU alignment strengthens Spain’s covered bond framework

“Compared to other European framework updates, Spain’s experienced the most substantial changes. Instead of recourse to the full mortgage book, Spanish covered bonds now also have the concept of a clearly defined and more easily segregable cover pool. This required more concise eligibility criteria that serve as security for investors throughout the lifetime of the bonds,” said Mathias Pleissner, deputy head of covered bonds.

Over-collateralisation (OC) has fallen to 5% from the previous 25% for mortgage covered bonds (Cédulas Hipotecarias, CH) and from 42.9% for public-sector covered bonds (Cédulas Territoriales, CT). There are additional changes, among other things, to liquidity provisions and the rules guiding maturity extensions as well as strict loan-to-value requirements and frequent valuation updates. Also, a mandatory requirement to provide regular investor information improves the transparency of covered bond programmes.

“Our credit-positive view of the strength of the improved Spanish legal framework generally translates into the maximum two-notch uplift,” said Reber Acar, senior covered bond analyst. “Transposing the CBD into local law lifted the framework in most aspects to European best practice and ensures that Spanish covered bonds can use the “European Covered bonds (Premium)” label.”

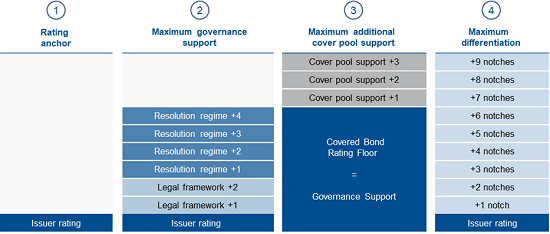

“Spanish covered bonds can achieve the maximum six-notch governance support uplift according to our covered bond methodology,” Acar continued. Governance support provides a floor to how much a covered bond can be rated above the issuer’s rating and constitutes an anchor for additional credit differentiation based on cover-pool support.

Maximum rating differentiation for Spanish covered bonds

Source: Scope. Credit differentiation is expressed as a rating notch above the issuer’s rating

“Spanish covered bonds have a high systemic importance, benefit from a preferential status in a resolution scenario and we believe, in most cases, regulators would maintain the issuer and its covered bonds upon regulatory intervention,” Pleissner concluded.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope`s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.