Announcements

Drinks

UK grocery retailers: as winter approaches, inflation bites and profitability cliff looms

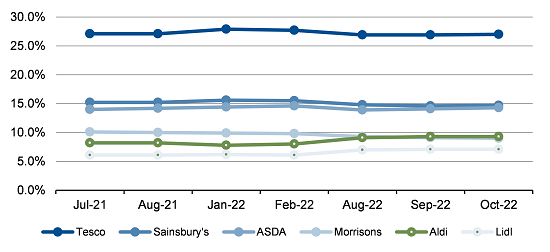

All grocery retailers are working to tackle an economic environment marked by soaring inflation, in which households could see their spending power cut by an average of GBP 3,000 over the next year. In this competitive and challenging background, Scope sees three challenges to the dominance of the Big 4 – Tesco, Sainsbury’s, Asda and Morrisons – which control 65% of the UK market.

“First, the larger retailers will be wary of losing market share to discounters in a depressed economic environment,” said Rohit Nair, a director at Scope Ratings UK. “While early signs point to an increase in market share for discounters, the larger retailers seem to be better prepared for the enhanced competitive environment this time round.

“Second, to hold on to or gain market share, all retailers must be prepared for a squeeze in operating margins of up to 100bp. Further declines could see retailers having to curtail capex or reduce investments in operational improvements so we expect credit metrics to weaken, although without deep impact on their credit ratings,” Nair continued.

“Third, while cash flows are expected to remain sufficient to support current debt levels, a sustained medium-term fall in operating cash flows could lead to increased borrowing, especially as the larger retailers battle to preserve market share.”

The market share of the Big 4 has never been as open for disruption as over the last year. The natural advantage of the larger stores in terms of larger product choice and perceived higher value in terms of luxury come second to the need for completing the weekly shop at minimum possible prices. The discounters have consistently provided the lowest-possible price while the Big 4 have varied in their ability to provide lower prices.

Market share evolution for selected UK chains

Source: Kantar

As the size of the average weekly shop decreases, the short term will see all chains compete for customers against a backdrop of declining consumer confidence. In normal times, most supermarkets would be able to pass on supply-cost increases to customers but in the face of unprecedented inflation, retailers must decide between turning away shoppers who balk at exorbitant price rises or swallowing some of the increased costs to shield market share.

In such a scenario, it is not too difficult to envisage the discounters gaining further market share over the next year as customers prioritise cash over luxuries. While there are no extinction-level threats on the horizon for the Big 4, a period of prolonged pain seems to await grocery retailers over the next 12-18 months.

The discounters, including Aldi and Lidl, which have around 16% of the UK market, are facing their own set of issues. They may well win market share from middle-class shoppers who want cheaper food items at slightly more reasonable rates but with deep cuts in discretionary spending on non-food items, the already razor-thin profit margins of the discounters will be further dented.

“The ability of the discounters to hold on to increased market shares as inflationary pressures ease will be the key battle for the next phase of grocery retailing in the UK,” Nair said.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope`s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.