Announcements

Drinks

French banks and 2023 recession risk: a game of cat and mouse

French banks’ credit profiles are robust, benefiting from and contributing to the underlying resilience of the French economy and other markets to which they are exposed. Interest rates are likely to rise further, which is structurally positive for bank performance. Consumer price inflation is also expected to moderate next year. A recession, though a possibility, is not our base case.

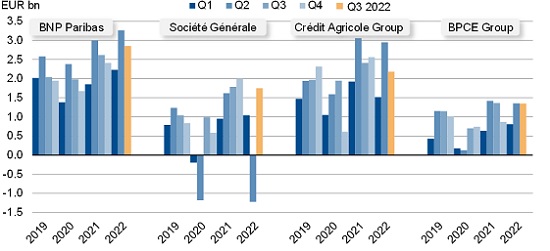

Quarterly net income

Source: Banks, Scope Ratings

Business sentiment has worsened as the energy crisis and inflation have drastically cut short Europe’s post-pandemic economic recovery, “but there are no clear early-warning signals of material asset-quality deterioration for France’s banks,” said Nicolas Hardy, deputy head of Scope’s financial institutions team. “Even in a less benign scenario in which the French economy enters recession, we believe loss-absorption buffers are in place, including resilient pre-provision profitability, accumulated precautionary provisions and conservative capital planning.”

Hardy anticipates two main scenarios for French bank performance in 2023. “Our upside scenario sees lending dynamics sustained, inflation controlled and no material deterioration in asset quality. Improving earnings capacity will help banks weather inflationary pressure and cost of risk,” he said. “Under our less supportive base case, higher interest rates curb loan demand and inflation takes more time to stabilise, weighing on costs, while non-performing loans increase moderately.”

Downside risks to the base case relate to a much deeper economic contraction. Even then, a comforting element for French banks is relatively conservative loss absorption buffers in the form, first, of management overlays adding to required provisioning efforts; second, a measured approach towards the distribution of ‘excess capital’. The Haut Conseil de la Stabilité Financière’s decision to raise the Countercyclical Capital Buffer from 0% to 0.5% in April 2023 will further strengthen banks’ ability to weather more challenging operating conditions.

The following issuer rating reports are available on ScopeOne, Scope’s digital marketplace: