Announcements

Drinks

European Bank Capital Quarterly: New year, new requirements

For the 17 EU banks in our sample, six saw a small increase in their Pillar 2 requirements, three saw a decline and the rest remained the same. UniCredit saw the biggest increase at 25bp while Danske Bank saw the largest decline at 80bp.

Authorities continue to see risks related to excess credit growth so are using countercyclical capital buffers (CCyB) to complement other measures, including those related to the resilience of borrowers such as loan-to-value, loan-to-income and debt-service ratios as well as loan maturity and amortisation requirements. Authorities in the UK, Netherlands and Sweden are also making use of the countercyclical nature of the CCyB framework to require banks to build up buffers that can used in downturns.

“Banks are generally starting from sound solvency positions so should not have problems meeting the new requirements,” said Pauline Lambert, executive director in Scope’s financial institutions team. “The increases in Pillar 2 requirements are relatively limited and banks have been aware of the G-SII leverage buffer and countercyclical capital buffer requirements for some time.”.

“Given the still uncertain macroeconomic outlook, though, we expect regulators and banks to maintain some caution on capital distributions, which should support already solid solvency positions,” Lambert added.

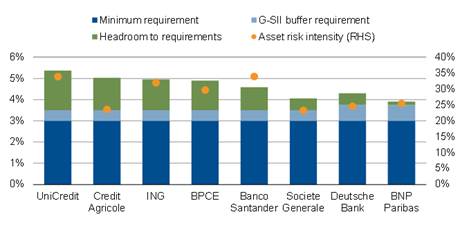

The new leverage ratio buffer requirement, equal to half of the applicable G-SII buffer, can be met with Tier 1 capital. The EU G-SIIs with the highest G-SII buffers are BNP Paribas and Deutsche Bank at 1.5% while the others are subject to a buffer of 1%. Most banks are comfortably above their requirements based on leverage positions as of Q3 2022. “The new leverage buffer requirements are relevant for AT1 investors as issuers that do not meet the requirement face distribution restrictions, like with the combined buffer requirement,” Lambert said.

Headroom to 2023 leverage requirements

As of Q3 2022

Source: Banks, Scope Ratings

Regular readers of Scope’s European Bank Capital Quarterly will know that we have been aiming to improve our assessment of where banks stand against their MREL requirements. This has not been easy due to incomplete disclosures. According to the EBA’s latest MREL Quantitative Monitoring Report, though, banks are well positioned against the average requirement of 22.6% plus a combined buffer requirement of 3.3%, or nearly 26% in total.

Under the Capital Requirements Regulation (CRR), the EBA is mandated to monitor the quality of all forms of capital instruments to ensure they meet the criteria to qualify as CET1 capital. Following a recent review, changes to Norwegian regulations governing capital distributions are being proposed to ensure that the shares and equity certificates of Norwegian banks continue to qualify as CET1 capital.

Download the Capital Quarterly here.