Announcements

Drinks

Italy: regional devolution plan could exacerbate divides, test predictability of public finances

By Giulia Branz, Senior Analyst, Sovereign Ratings

By Giulia Branz, Senior Analyst, Sovereign Ratings

Changing how Italy’s regions are financed is a thorny issue due to the need for large revenue redistribution from wealthier to poorer regions, particularly because healthcare accounts for most of regional government expenditure, helping to explain why a plan for comprehensive reform has stalled since 2009.

Partial reform could now be on its way. The Italian government last week presented a draft law to facilitate the “autonomia differenziata” project, a contentious devolution plan first presented in 2018 by three of the wealthiest regions – Emilia-Romagna, Lombardia and Veneto – but designed to be available to all.

The three northern regions proposed that they acquire greater responsibilities and related spending powers over a wide range of policy areas held by the central government. If reform proceeds as the government hopes, bilateral agreements with the applicant regions could be in place by next year.

The acceleration on the “autonomia differenziata” reform could bring some positive aspects in addressing some of the limits of Italy’s current regional financing dispensation.

However, with local political interests driving the plan forward before a broader overhaul of the financing system – or indeed as an alternative to it – the danger is that predictability and stability of the region’s finances deteriorates while administrative complexity and duplication increases, all at the cost of creating more political divisions between Italy’s richer north and poorer south.

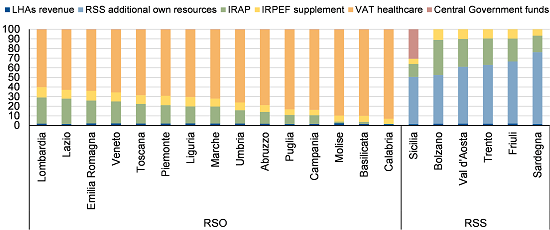

Figure 1: Healthcare financing resources

% of total, by region, 2019, RSO: ordinary status regions, RSS: special status regions

LHAs (Local Health Authorities); IRAP, IRPEF are regional taxes; we use 2019 data to exclude the effects of the pandemic

Taken from our previous report: Healthcare spending dynamics to challenge Italian regions’ fiscal framework

Sources: Ministry for Healthcare “Riparti 2019”, refers to the “fondo indistinto”, Scope Ratings

Limited revenue autonomy and large resource redistribution in regional financing

Credit implications for the regions will ultimately depend on how resources are allocated but the impact will likely be uneven. In the context of stretched general government finances, the attribution of additional powers to wealthier and faster-growing regions, especially if based on bilateral agreements, could reduce the pool of resources available for redistribution to the poorest territories in the years ahead.

Italian regions operate under a fiscal policy framework imposing prudent limits on their debt and deficit levels, which supports fiscal consolidation. However, regions have narrow margins to adjust their revenue and the financing system remains largely transfer-based. This is also a consequence of regions’ predominant responsibilities in healthcare services, accounting for over 80% of their operating budget. Given wide economic discrepancies across Italian regions, the need to ensure minimum standards of healthcare services through similar per capita spending necessitates significant redistribution.

Economically stronger regions finance a large part of their healthcare funding needs with taxes. Weaker regions rely more on transfers, reflected in the value added tax (VAT) shared with the central government, which is altered by equalisation processes given it is assigned to cover regions’ financing gaps with respect to predetermined healthcare funding needs (Figure 1). Special-status regions -- three small northern regions and the two islands – have a wider set of responsibilities and a different financing framework, as they retain additional local tax income.

The stalled broader reform directed at increasing the financing autonomy of all Italian (ordinary status) regions (federalismo fiscale) would target an increase in the share of taxes over transfers in regional revenue and the creation of an equalisation fund to ensure fundamental services can be provided uniformly across Italy, notwithstanding wide economic divergencies between northern and south. Implementation is also part of the national recovery and resilience plan reform agenda for 2026.

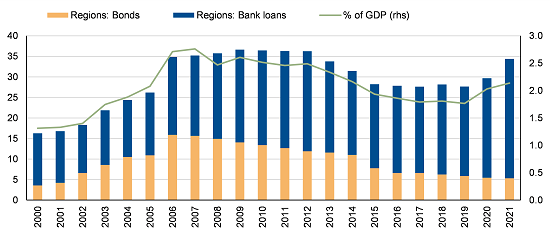

Figure 2: Debt at the regional level in Italy

EUR bn (lhs), % of GDP (rhs)

Source: Banca d’Italia, ISTAT, Macrobond, Scope Ratings

Complex political landscape leads to unbalanced progress on regional financing reform

The draft “autonomia differenziata” law provides for an acceleration by year-end of the definition of the essential levels of services and respective standard costs. If completed on time, their definition could help create a more efficient regional financing system, with objective criteria for resource allocation and redistribution, and more emphasis on revenue autonomy and accountability vis-à-vis the current transfer-based system.

The weakness of the reform lies partly in the party-political motivation behind it, which favours the devolution of additional competencies to wealthier regions, before the reform of the overall financing system is completed, testing its predictability and potentially increasing political fragmentation. The Lega is the main promoter, seeking to recover recently lost political ground in upcoming elections in the regions of Lombardy and Lazio. Among the opposition, the 5 Start Movement is opposed, given its voters are mostly in the south. Prominent members of the Democratic Party have spoked up against the reform.

The administrative and political complexity of implementing the reform is likely to frustrate the planned timetable, given the required back-and-forth between the central government, the sectoral conference with the regions and the Italy’s parliament, all before negotiation with the regions requesting devolution can start.

Less predictability of general government finances

The framework law includes safeguard clauses to prevent devolution from resulting in additional spending, which should prevent immediate risks for general government finances.

Still, for the central government, less control on regional finances in the context of weaker predictability is a risk.

The new reform is likely to test the prudent fiscal policy stance of the current regional financing framework, which so far has ensured that deficit and debt levels remained low at the regional level, contributing to the consolidation of general government finances (Figure 2).

Visit the following links to our related research pieces on the “autonomia differenziata”, Italian regional finances and healthcare spending, and the Sub-Sovereign Outlook 2023 including a section on Italian regions and cities.