Announcements

Drinks

Sound fundamentals protect Swedish banks from emerging challenges

“The challenge for 2023 will be to maintain lending volumes and asset quality in the face of greater pressure on households and corporates from the rise in interest rates and high and persistent inflation,” said Carola Saldias, senior director in Scope’s financial institutions team. “We expect a less profitable scenario for banks following more cautious demand for lending and lower margins due to pass-throughs of higher interest rates to deposits.”

Scope expects a slight increase in corporate lending volumes because refinancing will go through the banks rather than the bond market as large corporates would prefer to avoid locking in funding at the current high interest rates. “But we also expect commercial clients to show negative credit-quality migration because of weaker economic activity,” Saldias continued,” especially in the retail and wholesale sectors, and commercial real estate and property management, which could face liquidity pressures under tougher refinancing conditions.”

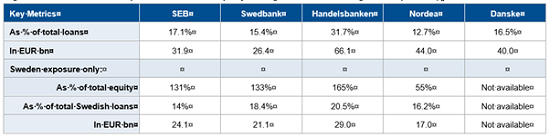

The significant exposure of Swedish banks to CRE and property management companies, accounting for 18% of banks’ loan portfolios on average, is under the spotlight. These sectors have represented historically high concentration risk for Swedish banks, with exposure levels as high as 32% of total loan portfolios. At an aggregate level, the exposure amounts to an estimated EUR 200bn, half of which is to Swedish counterparties. Potential vulnerabilities here could lead to higher capital buffers, although these could be easily implemented considering the ample capitalisation levels.

Swedish banks’ exposure to CRE & property management sector

Source: Company data, Scope Ratings estimates

Sweden’s household debt, at 91% of GDP in the second quarter of 2022, is among the highest in the EU and materially higher than the EU average of 59%. Given the scenario of rising interest rates and inflation and the slump in Swedish house prices, the effects on total disposable income are a key concern. It will likely lead to a further reduction in consumption and eventually a drawdown on savings.

“We expect this scenario will affect banks mostly in terms of volumes but also in a deterioration in asset quality. In the second half of 2022, most banks saws a higher migration from stage 1 to stage 2, mainly from corporate loans in the property, retail and wholesale sectors. We see asset quality moving to levels observed in 2018-2019, with stage 3 loans as proportion of gross loans towards the upper bound of the 0.7%-0.9% range,” Saldias said.

Scope has subscription ratings on:

- Nordea Bank ABP

- Svenska Handelsbanken AB

- Swedbank AB

- Skandinaviska Enskilda Banken AB

- Danske Bank A/S

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions such as for Credit Sphere.