Announcements

Drinks

Russia: financial strains set to grow as sanctions worsen structural weaknesses

The Russian economy shrank less than expected in 2022 despite sanctions, with real GDP falling by an officially estimated 2.1%. However, the outlook remains challenging.

One year into the conflict, the significant uncertainty related to the war in Ukraine makes forecasting Russian economic trends difficult. In addition, the Russian authorities have stopped publishing some key economic data in the past year. New legislation allows the government to suspend publication of official statistics, raising further questions about their reliability.

Russia’s economy faces a second consecutive year of recession in 2023, likely to be significantly more severe than the 0.8% contraction assumed in the government’s latest budget which is based on an optimistic average oil price of USD 70 a barrel. The Urals oil price averaged less than USD 50/barrel in January 2023, down from USD 85.6/barrel in the same period of last year, due to discounts offered to Asian refiners and a cap of USD 60/barrel set by the G7.

Erosion of Russia’s long-term growth potential

The challenge for Russia is that the war and intensifying sanctions are eroding strengths of the economy and public finances, namely energy exports and government savings. They also deprive Russia of foreign direct investment and access to western technology while making it difficult for the government to address long-term structural weaknesses of the economy, whose longer-term growth potential is running at only 1-1.5%.

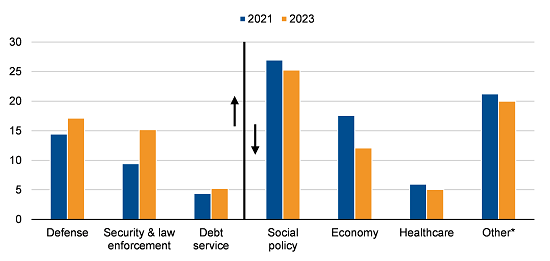

War-related spending is crowding out the public and private non-military investment (Figure 1) necessary not just to reduce Russia’s dependence on oil and gas exports and reliance on foreign technology imports but to improve labour productivity to counteract the adverse effects of a shrinking workforce and ageing population.

Figure 1: Russia’s wartime budgeting crowds out non-military investment

Federal budget expenditure, 2021 vs 2023 (planned), % of total

Source: Ministry of Finance of Russia, Scope Ratings; *Other includes spending on education, housing, environment, culture, sport, media, intergovernmental transfers, and other national initiatives.

Higher energy prices, central bank action supported economy in 2022

Two main factors explain why, at least in the short term, sanctions had less impact on Russia’s economy than initially assumed. First, the Russian government and the Bank of Russia have created fiscal and monetary room for manoeuvre to counter Western sanctions since the annexation of Crimea in 2014. The central bank has limited capital flight by responding quickly to sanctions in 2022 through capital controls and higher interest rates.

Secondly, high foreign-currency inflows from fossil fuel exports – as energy prices soared and imports collapsed – created steady demand for the rouble. Western energy sanctions were fully enforced only last December.

Russia’s current account surplus widened to USD 227bn last year, or 11% of GDP, from USD 122bn (6.9%) in 2021, making up for a large part of the roughly USD 300bn in international reserves frozen by sanctions. The EU imported more than USD 150bn oil, gas, coal, and related energy products from Russia last year.

Russia will continue to adjust to sanctions, by exploring alternative trade routes and financing, ensuring continued current account surpluses. Russia intends to sell more than 80% of crude oil exports to “friendly” countries this year. The Bank of Russia will start issuing digital roubles this year to help domestic banks with cross-border payments.

Little prospect of more windfall oil, gas revenues this year

Still, with the EU's sanctions against Russian crude oil and refined products in place, Russia will not receive the windfall energy revenues this year as it did in 2022. The current account surplus is likely to halve to 5-6% of GDP in 2023, as sanctions and supply-chain disruptions curtail exports, while imports continue to recover.

The resulting downward pressure on the value of the rouble will be a challenge for the central bank in managing sanctions-related risks for the economy amid elevated inflationary pressures from increased public spending and supply-side restrictions related to the war.

Furthermore, sanctions and the war are constraining Russia’s fiscal flexibility. We expect the budget deficit to widen to 3.5% of GDP in 2023 – versus the government’s forecast of 2% – due to lower energy export revenues, higher war-related spending and a steady decline in GDP.

For now, Russia can finance its deficit relatively easily by drawing down the National Wealth Fund, set to amount only 3.7% of GDP by end-2024 from the 10.4% of GDP at end-2021. Another route is issuing domestic bonds to state-owned banks, backed by liquidity provided by the Bank of Russia.

Of greater concern is where the Kremlin is spending its money, noting that it doesn’t disclose details of nearly a quarter of state expenditure. Spending on defence and security is to rise to RUB 9.4tr (USD 126bn) in 2023, 60% higher than in 2021. This will be almost three times the funds earmarked for the national economy. They fall to RUB 3.5tr (USD 47bn), 20% below pre-war levels, with cuts in spending on infrastructure, digitalisation, housing and environment. The structural shift in spending will negatively affect Russia’s longer-term economic prospects.