Announcements

Drinks

Egypt faces uneasy reform mix to address build-up of external vulnerabilities

By Thomas Gillet, Associate Director, Sovereign Ratings

The nearer Egypt (rated B/Negative) gets to the 2024 presidential election, the less likely the army-backed administration of President Abdel Fattah El-Sisi will be to reduce the military’s role in the economy. Vested political interests and the risk of social tensions are likely to result in policy inertia over the coming 12-18 months, despite the reform commitments the government agreed to secure the IMF’s 46-month USD 3bn Extended Arrangement in December 2022.

Yet, diminishing state control of the economy is crucial for Egypt to sustainably finance persistent current-account deficits. Greater exchange-rate flexibility and a level playing field between public and private enterprises would lower external financing requirements and help shore up international reserves. They fell to USD 34.4bn at end-March this year from USD 45.4bn at end-2019.

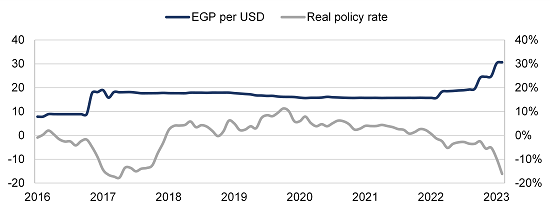

Figure 1. Weaker Egyptian pound, behind-the-curve rate hikes reflect slow policy adjustment

Egyptian Pound per USD (LHS), real policy rate % (RHS)

Source: Central Bank of Egypt, Scope Ratings

Accelerating the pace of reform agreed with the IMF would support investor confidence and foreign direct investment, improving access to debt capital markets, and, ultimately, boosting the country’s medium-term growth prospects. However, near-term implementation risks are high given weak governance, the military’s role in the economy, and heightened socio-economic tensions, which may escalate further depending on the scale and sequence of the reforms.

Still, without comprehensive and timely reforms, including the full liberalisation of the exchange rate and successfully privatising state enterprises, Egypt would likely enter a disorderly adjustment cycle. This would further impair market access, curtailing Egypt’s debt servicing capacity, which is already constrained given yields of 24% on domestic treasury bills and 15% on international bonds as policy adjustment and reform progress fall short of expectations.

Devaluation, negative real rates, and slow privatisation put IMF programme at risk

Controlling the pace of the currency devaluation is proving difficult to manage. The government is struggling to issue debt locally given downside pressure on the pound, increasing the likelihood of another devaluation, which, however, would raise the cost of servicing foreign-currency debt. As inflation soars at 32.7% YoY in March and real rates remain negative (Figure 1), pressure is rising on the central bank for a steeper increase in its lending rates.

The lack of near-term policy adjustment in line with the IMF’s recommendations, makes filling immediate financing gaps more difficult as external financial support diminishes. The government’s slow reform implementation is also a risk for the longer-run development of the private sector and of energy-related exports, as foreign investment and stable capital inflows depend on greater policy predictability and a more growth-friendly business environment.

Rising external vulnerabilities and reduced market access amid difficult structural, fiscal, and monetary policy trade-offs underpin our first-time B/Negative credit ratings that we assigned to Egypt on 31 March.