Announcements

Drinks

Spain: fiscal outlook improves on resilient economy but jobs, inflation, pension challenges remain

By Jakob Suwalski, Director, and Brian Marly, Analyst, Sovereign Ratings

Spain’s (A-/Stable) credit strengths lie in its large and diversified economy, visible in GDP growth of 5.5% in 2022 despite repercussions of Russia’s war in Ukraine, which set back growth across much of Europe. Spain’s economic output should exceed its pre-pandemic levels by the second half of 2023 – catching up with that in the rest of the euro area – with robust real growth of 1.6% in 2023 and 2.1% in 2024. Spain's medium-term growth prospects are expected to benefit from significant EU funding and public investment through its Recovery and Resilience Plan, with allocated grant funding amounting to EUR 69.5bn (5.6% of pre-pandemic GDP).

The continued rebound of international tourism as well as strong performance in non-tourism services exports and household consumption underpinned last year’s recovery. Spain’s renewable energy production capacity and substantial regasification infrastructure have given it a comparative advantage in withstanding the energy crisis.

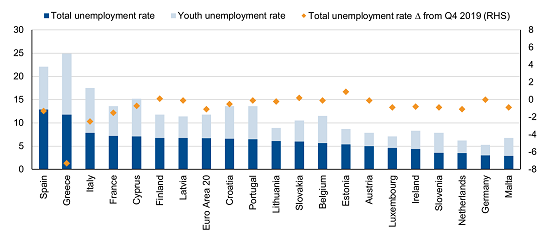

Spain’s unemployment rate has reached a decades-low of 12.9%, reflecting the relative strength of the labour market, with improvements in job quality since the 2021 labour market reform. Nevertheless, employment gains are expected to moderate in the medium term, while joblessness still runs at the highest rate of euro area countries (Figure 1).

Figure 1 – Spain’s unemployment rate is the highest in the euro area

% share of the active population

Source: Eurostat, Scope Ratings

Consumer price inflation declined to 3.3% YoY in March 2023 from a peak of 10.8% in July 2022 due to more favourable base effects and lower energy prices. However, core inflation remained elevated at 7.5% in March, partly reflecting the pass-through of energy costs. Headline inflation is expected to further decline over the medium term due to the ECB’s tighter monetary policy, although underlying price pressures are likely to ease only gradually.

Spain's fiscal outlook: medium-term improvements, but long-term challenges remain

Spain's fiscal outlook improved in 2022: the government deficit declined to 4.8% of GDP, a 2.1 percentage point improvement from the previous year. This was down to robust revenue growth and despite the roll out of sizeable measures aimed at mitigating the impact of the energy crisis on the private sector, which amounted to 1.5% of GDP.

However, rising pension payments and the extension of energy-support measures are expected to put pressure on the budget. The fiscal deficit is expected to decline only moderately in 2023 to 4.4% of GDP.

The Spanish government is forecasting an approximately 6% increase in its tax revenues this year, supported by a new wealth tax, temporary windfall taxes on banks and energy companies, and higher social security contributions. This forecast looks optimistic given expectations of subdued consumer and business confidence over the medium term. Spain's public expenditure is also on a clearly upward trend, reaching unprecedented levels in the 2023 budget.

Growth in value-added tax and personal-income tax collections will likely lose momentum, limiting any further narrowing of the headline budget deficit to about 3.7% of GDP by 2024. We expect the deficit to stabilise above 3% of GDP in subsequent years.

Spain's debt-to-GDP ratio decreased to 113.2% in 2022, a five-percentage point decline from the previous year, driven by strong nominal economic growth. But it remains 15 percentage points higher than before the pandemic. We expect the ratio to moderate to 111.4% in 2023, with only a further gradual decline to around 109% by 2027 due to the persistence of primary deficits and higher debt-servicing costs.

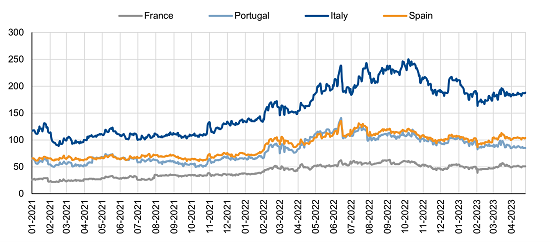

Figure 2 – Spreads over German 10-year bonds have steadied

Yields on 10-year government bonds, %

Source: Macrobond, Scope Ratings

Spain's capital market access in the face of elevated funding costs

The Spanish government has net funding needs of EUR 70bn in 2023, in line with the previous year. Like other countries, funding costs have increased since the second half of 2021, due to tighter global funding conditions. At the same time, steady spreads over German 10-year bonds signal investor confidence (Figure 2).

Spain’s favourable debt structure mitigates to some extent risks posed by its large stock of debt and elevated interest rates. The country has a relatively long average maturity of debt of 7.9 years, a moderate share of inflation-indexed bonds (around 5% of the total), and stable ownership (Banco de España held 28% of government bonds in Q2 2022). The government refinancing profile compares favourably against that of many highly-rated sovereign peers, given the significant amount of high-coupon bonds maturing this year, suggesting a more gradual impact of higher market borrowing rates than that for much of rest of the euro area.

An additional factor relieving medium-term pressure from rising borrowing costs and representing a potential boost to growth is the Spanish government’s request for EU loans worth EUR 84bn under the Recovery and Resilience Facility set to bolster public finances in the near to medium term.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope’s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.