Announcements

Drinks

Italian banks: strong Q1 results pave the way for a promising 2023

An excellent set of first-quarter results across our sample (Intesa Sanpaolo, UniCredit, BPM, MPS, BPER, Mediobanca, Credem, BP Sondrio) supports our positive view about the direction of the banks’ credit risk profiles. Spreads widened significantly in the first quarter (net interest income grew by 52% YoY) thanks to the rising interest-rate environment, which also pushed up interest accruals on bond reinvestments. Earnings were also supported by contained cost growth and record-low loan losses.

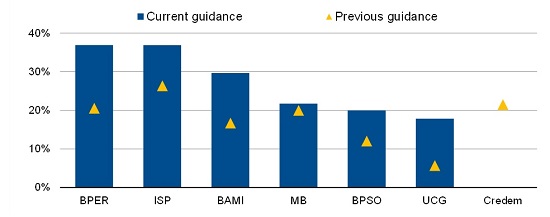

Annual growth in net interest income expected for 2023

Note: Mediobanca’s guidance on its FY 2023 ending in June. MPS did not provide precise guidance.

Source: Company data, Scope Ratings.

But dangers lurk. “High inflation,and rising borrowing costs are weighing on banks’ risk tolerances as well as loan demand,” said Alessandro Boratti, a senior analyst in Scope’s financial institutions team. The first quarter already saw a reversal in loan growth as demand faded and banks prioritised quality over volume. Although it’s too early to talk about a ‘credit crunch’, lending dynamics may be much weaker than projected, which would hurt banks’ revenues.” More financial markets turmoil and a potential windfall tax on bank profits add to downside risks for the sector.

Customer deposits declined in the first quarter as large customers withdrew excess liquidity accumulated during the pandemic and retail clients sought higher yields in government bonds and elsewhere. But the decline was from all-time highs so is not of concern at this point. Banks have not actively chased deposits, highlighted by minimal repricing.

Fee and commission income was weak across the board due to a combination of declining loan origination, lower asset management product sales, and lower performance fees.

Banks’ operating expenses only slightly increased YoY, despite high inflation. MPS was a clear outlier, reporting around 14% YoY decline in costs due to a reduction in full-time employees. BP Sondrio disclosed a c.10% YoY increase in costs as result of new hirings and the impact of energy prices. But as revenues expanded at a much higher rate than costs, the average cost- income ratio fell sharply, from an average of 59% in Q1 2022 to 49% in Q1 2023. Credit losses were remarkably low, at 36bp (51bp in FY 2022).

“Based on banks’ own guidance, earnings are expected to peak between Q2 and Q3, when growth in interest margins slows and cost of risk rebounds as default rates rise,” Boratti said. “Even so, on an annual basis, average ROE could surpass that of 2022.”

Non-performing exposures were stable in the first quarter, reflecting record-low default rates but banks continued to increase coverage (+1.3pp to 56%) ahead of a potential rise in delinquencies. All the banks in our sample display gross NPE ratios below 5%, once considered a common key de-risking target. Yet some institutions expect further improvements in 2023. “Nevertheless, we see the situation reversing soon,” Boratti said, “as the impacts of tighter financial conditions start to have an effect".

Download the Italian bank report here.

Scope has public ratings on the following Italian banks:

Scope has subscription ratings on the following Italian banks. To view the ratings and rating reports on ScopeOne, Scope’s digital marketplace, or to register, please click on the following links: