Announcements

Drinks

Türkiye’s policy mix: will President Erdoğan’s post-election pivot be sustained?

By Thomas Gillet, Director, Sovereign and Public Sector Ratings

Türkiye’s economy is growing on the strength of credit and fiscal stimulus, which boosted domestic demand ahead of last month’s legislative and presidential elections at the cost of aggravating external imbalances.

Private consumption has been the main driver of GDP growth, supporting robust output growth of 5.6% in 2022. But we expect the Turkish economy to slow to 2.7% growth this year, below its potential of 3.9% per year.

Economic-growth momentum could be hurt by the short-run policy pivot widely expected from the new economic policy team that President Erdoğan has installed, which is expected to include a rise in the central bank’s main lending rate.

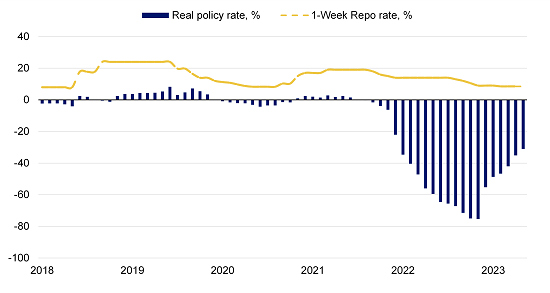

With another election victory behind him, the President might accept a period of tighter monetary policy, despite having ruled out rate increases to combat inflation in recent years (Figure 1), contrary to accepted economic thinking. The monetary policy committee is scheduled to meet Thursday 22 June.

Nonetheless, comparatively loose monetary policy and unorthodox policies are likely to prevail over the longer run as national policy making remain under the direction of President Erdoğan. The country is due to hold municipal elections in March next year, which might again see near-term political calculations overtake prudent economic and monetary policies.

Figure 1. Real policy rate is still largely negative

Source: Macrobond, Scope Ratings

Absent a sustained change in overall economic governance, capital controls and external bilateral support will remain a core part of the policy mix to contain erosion of net foreign-exchange reserves, which are negative once corrected for currency swaps, standing at a record low of minus USD 72.7bn at end-May.

The Turkish authorities resumed support for the currency following an early June sell-off, but further lira devaluation is likely as Türkiye faces large external gross financing needs, estimated at USD 230bn in 2023, equivalent to around 25% of GDP.

Large exchange-rate fluctuations exacerbate financial-stability risk

Moreover, large exchange-rate fluctuations might exacerbate financial-stability risk by weakening corporate and bank balance sheets.

This raises government contingent liabilities if the state is called upon to support local banks via capital injections. Türkiye’s fiscal outlook is also clouded by stimulus and social spending introduced ahead of the elections, as well as a government programme protecting lira deposits against exchange-rate devaluation.

The difficult economic context and our view of the long-term governance challenges constrain the foreign-currency ratings of Türkiye (B-/Negative Outlook).