Announcements

Drinks

Germany’s development banks set for sustained rise in business volume, more ESG-linked debt issuance

By Jakob Suwalski, Eiko Sievert and Julian Zimmermann

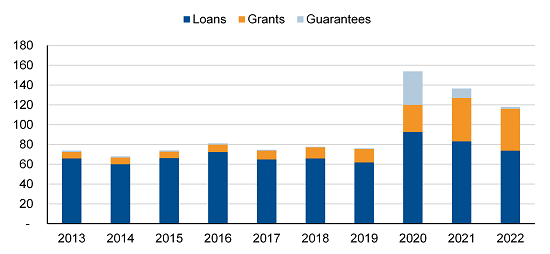

The rise in overall volumes of loans, guarantees, equity injections and grants to a projected EUR 100bn a year from the EUR 77bn yearly average in 2015-19 reflects the need for development banks to contribute to Germany’s resilience to future economic shocks and modernise the country’s infrastructure in line with environmental and digitalisation goals.

The sustained increase in the banks’ activities is crucial in the context of Germany’s large historic investment gap and will entail increased issuance of ESG-labelled securities as the sector plays a more important role in tackling the country’s energy transition. This will also entail a greater policy role for their public owners, the German federal government and federal states who guarantee the banks’ debt securities.

The growing policy importance of development banks will pressure them to modernise their operations and improve efficiency to counter rising cost-to-income ratios as demand for their business activities rises. Total business volumes in the sector almost doubled in recent years (Figure 1) in response to the pandemic shock, which also pushed banks to align their products to the shifting needs of businesses, households and municipalities.

Figure 1. Three years of record volumes underscore importance of German development banks

Development business by type, EUR bn

Note: Includes all 17 German regional development banks, as well as the two federal institutions. For a list of institutions, see here, p.22.

Source: Association of German Public Banks (VÖB), Scope Ratings

Energy transition in focus as banks’ funding activity has grown

The sector consists of 17 regional banks, responsible for implementing development policies on behalf of their respective federal state, and two federal banks, namely KfW (AAA/Stable) and Rentenbank, which implement policies on behalf of the central government. There is significant disparity in size with NRW.Bank, the largest regional institution, reporting total assets of EUR 160bn at YE 2022, while the smallest, Bremer Aufbau-Bank, reported EUR 1bn. The banks also have diverse business models resulting from geographic and economic differences among federal states.

Since the state-aid temporary framework related to Covid-19 was phased out in June 2022, banks no longer offer Covid-19 specific products, but continue to provide grants to businesses and households worst affected by surging energy prices.

The institutions adapted their product range to support businesses with liquidity and introduced new products aimed at increasing energy efficiency and promoting the expansion of renewable energy sources to progress Germany’s energy transition.

Innovative solutions include L-Bank’s sustainability bonus, which incentivises businesses to report their CO2 emissions and develop credible plans for reducing greenhouse gas emissions by offering reductions in interest costs. This helps to align banks’ environmental policies with climate goals of the respective federal states, such as Baden-Württemberg (AAA/Stable), which recently updated its climate policy.

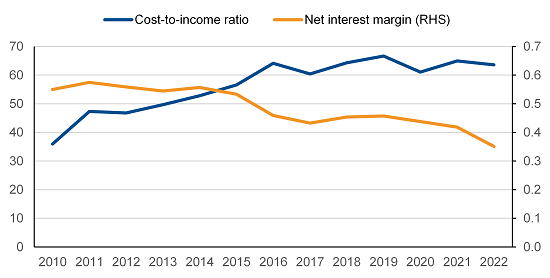

Development banks, with specialised financing and public policy objectives, typically exhibit distinct cost structures and operate at low profit margins, often resulting in higher cost-to-income ratios compared to universal banks.

To be sure, their low refinancing costs and status as tax-exempt entities have helped to maintain profitability in recent years. We expect that higher interest rates should moderately strengthen profitability, especially on hold-to-maturity investment portfolios (Figure 2).

Figure 2. A rising cost-to-income ratio highlights profitability challenge

Cost-to-income ratio in % (LHS); Net interest margin in %, (RHS)

Note: Simple average of the five largest regional development banks (NRW.Bank, L-Bank, WIBank Hessen, LfA Förderbank Bayern, IB Schleswig-Holstein). Source: S&P Capital IQ, Scope Ratings

Increased business volumes underline the need for operational efficiency

The recent surge in applications for support programmes is an opportunity for the banks to reduce overlap and streamline funding processes, fostering digitalisation and potential future operational efficiencies.

For example, the largest development banks have digitised and automated approval procedures for some traditional banking products. Further, the relatively greater simplicity of the development banks’ lending products compared with those of commercial banks facilitates standardisation. This is because their borrowers – small and medium-sized enterprises, housing associations and private borrowers seeking housing loans, and municipalities – share similar credit requirements.

Encouraging cooperation among banks, such as a first joint bond issuance of EUR 500m by the smaller development banks of Brandenburg, Hamburg, and Rhineland-Palatinate, improves efficiency and resource sharing.

Still, challenges remain. Development banks, especially smaller ones, are exposed to a changing regulatory landscape. Due to their concentrated lending books, both geographically and by sector, regulatory changes can have outsized effects on regional development banks compared with more diversified commercial banks.

The development banks also often do business in different ways, such as the idiosyncratic processing of grants during the recent energy shock, reflecting a lack of harmonisation which creates inefficiencies for clients.

Scope Ratings currently rates three German development banks publicly (KfW, L-Bank and LfA Förderbank, all rated AAA/Stable), as well as two entities available on subscription.