Announcements

Drinks

German Länder: budgetary pressures, energy funds to lead to higher borrowing needs in coming years

By Julian Zimmermann and Jakob Suwalski, Sovereign and Public Sector

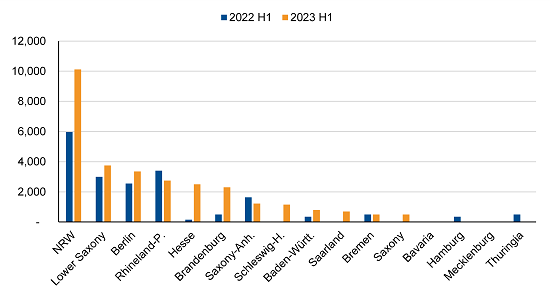

The 16 German federal states (or Länder) have been more active on bond markets in the current year, with gross issuance by end-June of EUR 30bn already matching that of the whole of last year. North Rhine-Westphalia (NRW), Lower Saxony and Berlin (AAA/Stable) (Figure 1) have been the most active issuers.

For the full year, we expect Länder gross debt issuance to amount to between EUR 55bn-65bn, up significantly from EUR 32bn in 2022. This includes redemptions to be refinanced of around EUR 15bn in the second half of the year.

Figure 1. Länder debt issuance has outpaced last year’s in H1 2023

Amount issued on public capital markets, EUR m

Source: Bloomberg Finance L.P., Scope Ratings

Financing needs are partly driven by Länder governments resorting to capital market borrowing allowed under emergency provisions of their debt brake laws to finance near-term and structural measures related to the energy shock. Similar emergency borrowing authorisations and/or special funds were set up by the German federal government (AAA/Stable) during 2020-22 and all Länder governments in the Covid-19 pandemic. The increased use of special funds during the pandemic and energy crises highlights the limited headroom in regular, core budgets for capital expenditure.

NRW, Bremen and Saarland (all rated by Scope on a subscription basis) have allowed for credit authorisations of up to EUR 11bn to fund measures in response to the energy shock, but also in the medium-term to support the green transition and reduce fossil-fuel dependency in their economies and societies. The Land of Berlin’s new coalition government also announced their intention to set up a special fund of up to EUR 5bn – to be topped up potentially by another EUR 5bn – to fund the Land’s green agenda.

Near-term fiscal outlook remains challenging

Secondly, higher borrowing needs are driven by an expected aggregate budget deficit of around EUR 10bn this year. Länder budgets are facing a moderate decline in tax revenue, in stark contrast to high nominal growth rates in 2021/22, driven by the rebound from the pandemic and high inflation. For this year, tax projections estimate total tax intake of around EUR 381bn, EUR 4bn (or 1%) lower than last year. Indeed, latest tax revenue up to May was down 2% on the same period last year. Tax revenue should return to more robust growth in 2024, in line with real GDP growth of 1.6% and strong labour markets. Nevertheless, balancing budgets will remain challenging in 2024, given adverse expenditure trends.

This year’s lower tax revenue is driven by a slowdown in private consumption, weighing on value added taxes, as well as structural measures taken last year, lowering total tax intake in Germany by an estimated EUR 34bn annually. Less-buoyant revenue growth is exacerbated by broad-based cost pressures and rigid expenditure structures. Most of the Länder’s spending is on personnel, pensions, transfers to municipalities, and interest costs. For example, personnel costs are expected to rise further next year, with wage negotiations of Länder employees scheduled for this autumn.

Interest costs will increase to around EUR 10bn in 2023, from EUR 8.4bn last year, driven by the ECB’s monetary tightening and wider spreads to Bunds (see Figure 2). Compared with June 2021, NRW’s spread to the Bund at the ten-year maturity has almost doubled to around 66bps at the end of June 2023, with a yield to maturity of around 3.1%. One compensating factor will be higher interest income on term deposits, where part of ample cash reserves are held.

Figure 2. Yield curves have shifted up, spreads to Bunds have widened

Yield to maturity per residual maturity, %

Source: Bloomberg Finance L.P., Scope Ratings

Revenue and expenditure pressures have led to the aggregate budget balance turning negative to around EUR 9.8bn as of May 2023, from a EUR 11.3bn surplus at the same time last year. For the full year, we expect the sector’s budget deficit at around EUR 10bn, or 2% of operating revenues. Downside risks relate to a sustained economic downturn that would lead to structurally lower tax revenue and higher deficits, resulting in increased borrowing needs. Furthermore, there are disparities between the Länder in terms of their financial strength, revenue generation capacity and economic strength. Some Länder face greater challenges due to structural economic weaknesses, higher levels of debt, or more limited fiscal flexibility.

Länder credit quality remains robust; close ties to central government

Despite these individual challenges, the Länder’s excellent credit quality remains well-anchored by conservative financial planning, financial reserves and the close link to Germany’s sovereign rating. The comprehensive fiscal equalisation framework and the Länder’s influence over national policymaking further contribute to the stability of their finances. The central government’s role as a primary shock absorber in the crises from 2020-23 anchors and supports Länder finances.

Even so, the federal government has identified limited additional fiscal space, and has firmly committed to the debt brake in its recent 2024 budget proposal and financial planning until 2027. In the proposal, all federal ministries – except defence – will implement cost savings of a total EUR 3.5bn in 2024-25, and the federal government plans to make use of the maximum allowed borrowing as per its debt brake, amounting to around EUR 15bn, or 0.35% of GDP. This will have implications for the Länder, visible already this year with relatively moderate compensation for costs associated with looking after refugees from Ukraine.