Announcements

Drinks

Sovereign Mid-Year 2023 Outlook: negative rating outlook framed by slowdown, high debt, rising rates

Download the Mid-Year Sovereign Outlook.

“The challenging economic outlook reflects cost-of-living crises and higher global interest rates,” said Giacomo Barisone, head of Scope’s Sovereign and Public Sector ratings. “Several positive factors for growth outlined entering the year have crystallised, such as resilient demand and employment, China ending most of its zero-Covid policies, and the energy crisis in Europe being less severe than anticipated, but those factors have been partly offset by downside risks that have also crystallised, such as persistent inflation, more aggressive rate rises and real-estate corrections.”

In December, Scope outlined a neutral balance of overall risk for 2023 economic expectations.

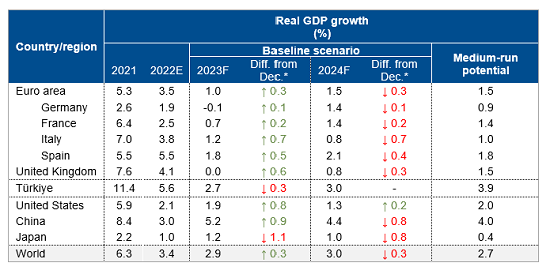

Scope’s updated projections (Figure 1) assume slow growth for this year in the euro area (1.0%), stagnation in the United Kingdom (zero growth), resilient although slowing growth for the United States (1.9%) and recovery in China (5.0%). Euro-area projections assume a 0.1% contraction this year in Germany, alongside growth of 0.7% for France, 1.2% for Italy and 1.8% in Spain.

Next year, the European economy is seen picking up modestly (1.5% growth for the euro area; 0.8% for the UK), counterbalanced by weakening of the US economy (1.3%) and China (4.3%).

“The global slowdown is raising labour-market slack, although unemployment remains near multi-decade lows and continues to exert pressure on prices,” said Dennis Shen, lead author of the Sovereign Outlook. “Our view has been for higher-for-longer inflation even though we assume inflation receding gradually from its peaks. We have slightly cut global and euro-area inflation forecasts for this year from our December 2022 estimates but 2024 inflation forecasts have been raised.”

“Based on prevailing inflation conditions, our expectation is for official rates from the Federal Reserve, ECB and Bank of England to be held at coming peaks until late 2024 at least,” said Barisone. “Tighter monetary policy raises risks of policy mistakes that could facilitate financial instability.”

Scope maintains a negative outlook for sovereign ratings this year. Since the start of the year, negative sovereign rating actions have outweighed positive actions; downside rating actions have accelerated since escalation of the Russia-Ukraine war. Year to date, Scope downgraded the sovereign ratings of China, Czech Republic, Hungary and Poland; and lowered seven countries’ Outlooks: Austria, Estonia, France, Latvia, Lithuania, South Africa, United States. Three sovereigns’ ratings or Outlooks have been revised up: Ireland, Portugal and Ukraine.

Ten sovereign borrowers, or 26% of publicly-rated sovereigns, are rated presently with a Negative Outlook alongside two sovereigns (5% of the sovereign portfolio) rated with a Positive Outlook.

Figure 1. Scope’s global forecasts, summary, as of 18 July 2023

*Changes compared with December 2022’s 2023 Sovereign Outlook forecasts.

Negative growth rates presented in parentheses. Source: Scope Ratings GmbH forecasts, Macrobond.

Download the Sovereign Mid-Year 2023 Outlook (report).

Download the global macro projections (Excel).

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.