Announcements

Drinks

Credit Lines: soft landing lies ahead for global economy; tougher outlook for cyclical companies

In our mid-year sovereign outlook, we forecast that China will put in the fastest growth this year of around 5%, followed by the US (+1.9%) and the euro area (+1%).

Germany is the only major Western economy projected to shrink (-0.1%) as export-orientated companies work through supply-chain bottlenecks.

The risk of stagnation – or stagflation – is most acute in the UK, facing around zero growth this year, given persistent inflation and correspondingly higher interest rates.

Optimism about Chinese growth fades

We are relatively optimistic about the longer-term growth outlook for the US and much of Europe but concerns over Chinese growth continue to mount. GDP is disappointing in the context of the high expectations of a strong post-lockdown recovery as domestic demand struggles from weak consumer confidence, high unemployment, low investment and soggy exports.

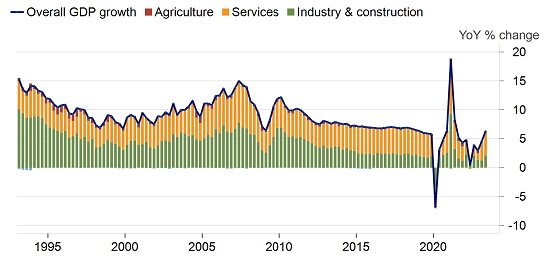

Chinese growth likely to remain well below pre-Covid path

Source: China National Bureau of Statistics

China’s latest GDP data showed a 6.3% rise in GDP for Q1 but the comparison is flattering: growth was particularly weak in the same period a year ago. The latest data does not suggest that there is much pent-up demand.

Growth will weaken to 4.3% in 2024, well below historical rates of 6% and above. More stimulus may well be in the pipeline, but with the real estate sector labouring under heavy debt and oversupply, the government in Beijing’s room for manoeuvre is limited.

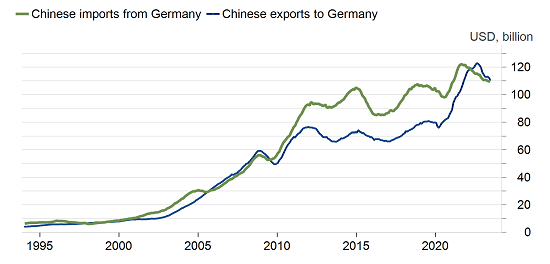

Lower Chinese growth reflects falling global demand for goods and but also negatively affects external demand in exporting nations such as Germany. It is worth noting that, measured in USD, German goods exports to China have been falling since 2021 and that the country has had a trade deficit with China since 2022, after a decade of substantial surpluses.

Falling Chinese demand has reversed trade flows with Germany

Source: China General Administration of Customs

European chemicals sector faces adverse cyclical, secular shifts in demand

A soft landing for Europe and the US is positive for credit from a top-down perspective. However, weaker demand overall, higher central bank interest rates which will last until at least mid-2024, and correspondingly tighter credit conditions create their own set of challenges for issuers seeking to refinance or fund new projects. The problem has been most apparent in real estate and related sectors such as construction up until now, but it is spreading to other cyclical sectors.

Most notably, the chemicals sector has been the source of string of profit warnings recently, from German specialty chemicals suppliers Lanxess AG and Evonik Industries AG to bigger diversified chemicals rival BASF SE and Belgium-based chemicals and materials firm Solvay SA. Chemical companies have reported falling demand from due to overstocking by customers, a weak recovery in China, and weak orders from interest-rate sensitive sectors such as construction. The profit warnings imply that companies have lost faith in demand recovering in the second half of this year.

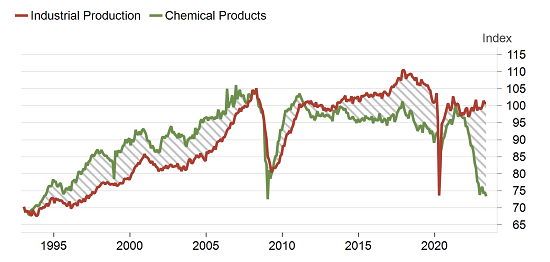

The micro picture is underlined by the steep fall in chemicals output in Germany, which dragged down industrial production figures for May, typically presaging economic weakness ahead.

Chemicals production had fallen in 2022 due to the steep rise in gas prices made worse by the aftermath of Russia’s war in Ukraine and the ensuing drive by the EU to cut gas consumption by 15% overall. The EU’s policy guidance remains in place even though gas prices have declined while inventories are much higher.

The upshot is that the chemicals industry faces not only a weakening demand cycle but lasting structural effects from the war in Ukraine, over and above the impact of the EU’s energy transition.

Germany’s chemical production at lowest point since GFC

Source: DESTATIS