Announcements

Drinks

Germany: Successful implementation of infrastructure investment key to growth, fiscal sustainability

By Julian Zimmermann, Sovereign and Public Sector

Germany’s (AAA/Stable) intention to borrow up to EUR 850bn (20% of GDP) over the next five years to bolster defence (14%) and infrastructure (6%) is somewhat higher than the EUR 625bn we had anticipated, mostly reflecting its increased ambition around defence spending. The government had paved the way for this additional borrowing with the debt brake reform of March 2025.

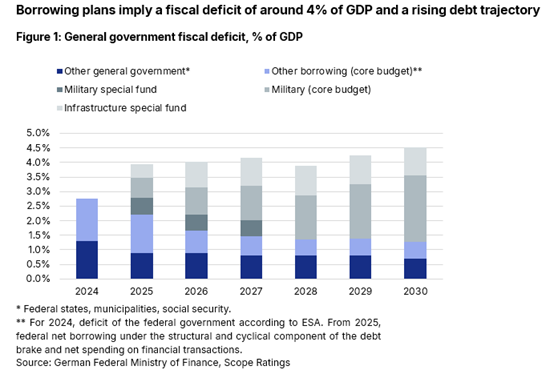

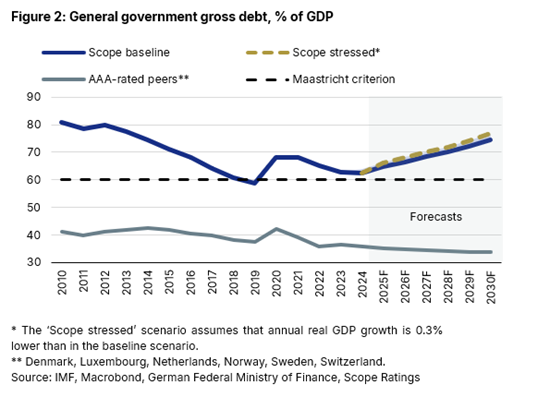

We now project that Germany’s fiscal deficit will increase to around 4% of GDP over the medium term, from 2.8% in 2024 and 2.5% in 2023; and the debt-to-GDP ratio will rise to around 74% by 2030, from 62.5% in 2024 (see Figures 1 and 2). We assume a more gradual increase in borrowing relative to the government’s fiscal plans, reflecting expected capacity constraints on rapidly increasing defence and infrastructure spending, and the fact that the 2025 budget has yet to be passed.

After the fiscal plans were announced, the federal debt management agency raised its funding target for Q3 2025 to EUR 119bn, from EUR 100bn. While the expected increase in deficits and the debt ratio is sizeable, Germany retains unique credit strengths, including its wealthy, large and diversified economy, robust fiscal policy framework and strong track record of fiscal discipline as well as its highly competitive external sector. (see our latest rating decision on 21 March 2025, which anticipated the change in the fiscal trajectory).

Fiscal space will shrink without pension and labour market reform

Despite the increase in borrowing, pressure to consolidate the federal core budget will increase over time. Growing expenditures on interest and social security, including pensions and healthcare, will reduce fiscal flexibility. Projected revenue and expenditure trends imply a reduction in the headroom of non-mandatory spending to only 3% of total expenditure in 2035, from 24% in 2024, according to Dezernat Zukunft. We estimate an increase in net interest expenditure to 1.6% of GDP by 2030, from 1% of GDP in 2024, which, while favourable compared to euro area peers, will reduce Germany’s fiscal space.

With limited fiscal headroom, German governments will likely become even more reliant on exemptions to the existing debt brake rules or use special funds more frequently to address future challenges. However, both mechanisms come with significant political hurdles as these decisions require a two-thirds parliamentary majority. The current government lacks such a majority, and we believe it will be increasingly difficult also for future governments to meet that hurdle given the country’s rising political fragmentation.

To create fiscal flexibility over the medium term, structural reform efforts will need to focus on pensions, since top-ups to the pay-as-you-go pension system are projected to increase from EUR 93.1bn in 2025 to EUR 116.4bn (2.3% of GDP) in 2030. Tax revenues could be supported by increasing employment, including by increasing full-time employment among women and the elderly.

Infrastructure spending vital to closing investment gap and boosting growth

The timely disbursement of the EUR 500bn infrastructure special fund out to 2035 is critical for Germany’s growth trajectory. To ensure additionality, investment levels in the core budget will need to be maintained. Planned investments target high-impact projects primarily in road, rail and digital infrastructure, which should address the most urgent needs to narrow the existing investment gap.

If well executed, these investments could lift Germany’s growth potential towards 1%. Before the special fund was announced, we had projected that potential growth would decline to around 0.7% at the end of the decade. Nevertheless, execution risks remain high since many projects need to be completed in a short period of time. This could stretch planning and construction capacity but also lead to higher inflation. Investments also need to be supported by supply-side and labour-market reforms to raise the country’s growth potential above 1% in line with the government’s goal.

Germany aims to meet revised NATO target by 2029 with uncertain growth effects

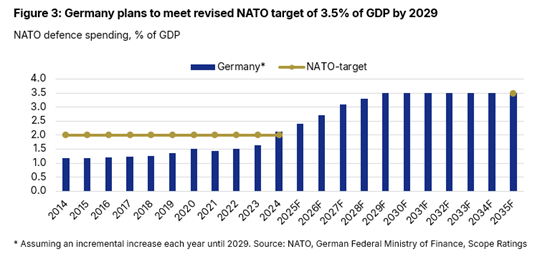

The government has significantly raised its ambitions for defence spending. Spending under the NATO definition is planned to increase from 2.1% in 2024 to 2.4% this year and then trend towards 3.5% by 2029, six years ahead of the agreed timeline (Figure 3). As the planned increase affects Germany the most among EU member states relative to central government revenues, the German government proactively reformed the debt brake to borrow in excess of 1% of GDP for defence spending.

But the growth impact associated with higher defence spending is likely to be moderate, although that remains somewhat uncertain at this stage. The Kiel Institute estimates that fiscal multipliers for defence spending are around 0.5x, depending on the extent to which equipment is procured domestically, and how quickly production capacity can be increased.

See also:

See also:

Meeting NATO’s higher defence spending target will weigh on EU credit profiles, June 2025

Germany’s borrowing to rise by EUR 625bn for infrastructure and defence, March 2025

Scope has completed a monitoring review on the Federal Republic of Germany, March 2025