Announcements

Drinks

Egypt: foreign-currency liquidity increasingly at risk should IMF programme stall

By Thomas Gillet, Director, Sovereign and Public Sector Ratings

President Abdel Fattah El-Sisi has ruled out another devaluation of the Egyptian pound despite the central bank’s commitment to introduce a “durably flexible exchange rate regime” as part of the IMF Extended Fund Facility approved in December 2022.

Egypt has devalued the pound by 49% since January 2022, but the currency remains overvalued, with 12-month forward rates trading above EGP/USD 40, or about 23% weaker than the official rate of EGP/USD 31.

An overvalued exchange rate hampers the privatisation of state- and military-owned enterprises, a necessary condition to meet an IMF target of accumulating net international reserves* of USD 23bn, originally by end-June. The International Finance Corporation, the private-sector arm of the World Bank, has started to advise Egypt on privatisations, but the process remains challenged by the uncertainty in foreign-exchange markets, a major impediment for foreign investors looking to value Egyptian assets up for sale.

To date, Egypt has reportedly sold stakes in state-owned businesses worth USD 1.9bn out of an estimated USD 2bn in possible disposals. Although recent progress on privatisation may help approval of the first review of the IMF programme, uncertainty remains about Egypt’s capacity to sustain this momentum in the longer run and privatise at least 32 state-owned companies.

The El-Sisi government’s likely cautious economic policies ahead of general elections, set for end-2023 to early 2024, will hinder progress on the currency front, as further devaluation of the pound would aggravate inflation (36.8% YoY in June 2023, after 33.7% in May), potentially fuelling social discontent.

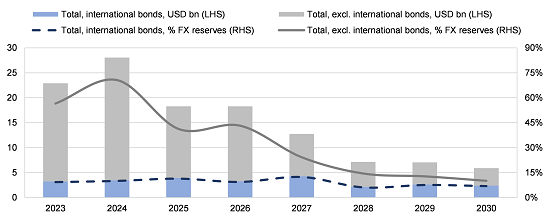

Egypt is likely to face a squeeze in its sources of external funding if it struggles to meet IMF conditions – among which a privatisation target of USD 4.6bn in FY 2023/2024 – given the bond repayments falling due (Figure 1). At least debt service on international bonds accounts for only a modest share of overall public and publicly guaranteed (PPG) external debt that is owed mostly by the government and central bank to official-sector creditors.

Figure 1: Medium- and long-term PPG external debt service

Note: International bonds – Eurobonds issued in USD and in EUR, Green bonds issued in USD, and Samurai bonds issued in JPY; FX reserves – Gross international reserves as of end-June 2023. Source: Central Bank of Egypt (CBE), Scope Ratings.

Risk of IMF renegotiation despite some progress on reforms

Should devaluation and privatisation plans fall short of initial expectations, Egypt may have to renegotiate the IMF arrangement as relinquishing state control over the economy is the main condition for strengthening external resilience.

Even though completion of the first IMF review was postponed by a couple of months, there is some progress such as a draft law eliminating tax exemptions for state-owned entities that would bring taxation of the state sector more in line with that for the private sector.

Such reform is unlikely to have a material impact on short-term economic activity, but it could contribute to raising Egypt’s longer-run growth potential estimated at 5.5% per year, above the 4.0% growth projected for this year.

International creditors are likely to provide near-term flexibility to keep the IMF programme on track, encouraged by recent progress on privatisation involving GCC investors. Egypt is one of the biggest beneficiaries of IMF support, while also being an increasingly important partner of Europe – in terms of Europe’s energy diversification and regional security.

Egypt also benefits from the dynamism of Suez Canal shipping fees, tourism receipts, and remittances that ease near-term pressures on supplies of foreign currency and help meet the country’s gross external financing needs, estimated at more than USD 20bn in 2023, or about 5% of GDP.

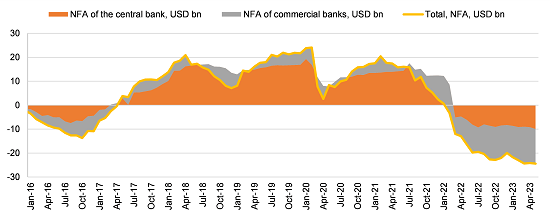

Even so, drawing foreign currency from local banks is proving difficult as the net foreign-asset position dropped to a record minus USD 24.4bn at end-June 2023 (Figure 2). Tapping international markets is also challenging. Yields on 10-year dollar bonds hovering around 15%.

Figure 2. Net foreign asset position of the monetary system

Note: NFA – Net Foreign Assets; Source: Central Bank of Egypt, Scope Ratings

Growing foreign-currency liquidity risks are captured by the Negative Outlook assigned to Egypt’s foreign-currency credit ratings of B. Scope’s next calendar review is on 15 September 2023.

* Defined as CBE’s foreign assets among which are CBE’s official reserves and CBE’s foreign-currency deposits with local banks.