Announcements

Drinks

Covered Bond Quarterly: H1 primary deluge leads to market strains

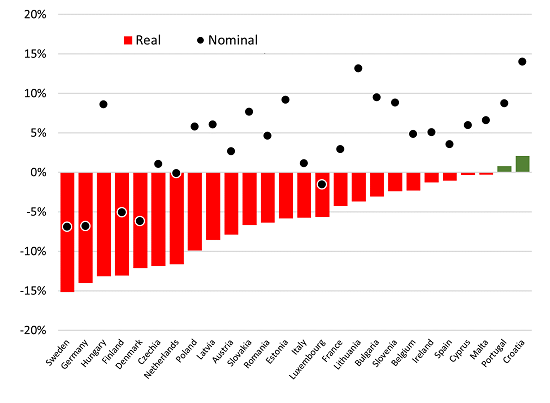

Market participants expect the market to slow in the second half, given tighter credit standards and lower credit demand on the back of higher mortgage rates and faltering house prices. House prices fell in real terms in all but two countries of the EEA in the year to Q1 2023, led by Sweden with a 15.2% decline and Germany with 14%. Across Europe, there was a real weighted average fall of 8.4%.

In real terms, we are back on average to 2020 levels. For Sweden, though, house prices in Q1 2023 had fallen to 2016 levels. Germany fell back to 2019 levels. The most severe impacts are in Finland, where deflated house prices are at levels not seen for more than 20 years.

Annual house price growth to Q1 2023: real vs nominal

Source: Eurostat, Scope Ratings

“While deflated house prices reveal real value loss, they may on the plus side help to push some European mortgage markets into recovery mode more quickly than expected,” said Mathias Pleissner, deputy head of covered bonds. “And if employees can benefit from inflationary wage increases, even marginally, low real-term house prices may help to boost affordability more quickly than expected, despite higher mortgage rates.”

For most covered bond markets, translating the European Covered Bond Directive is a done deal. Digging into the legislative details, however, what becomes apparent is that they can often be interpreted in unintended ways. This became apparent in Spain, where the first amendment of the covered bond law has now been finalised. Ambiguity about when a covered bond programme can be accelerated was removed, and cover-pool management was clarified. As was the ability to use updated, automated valuations when registering mortgages for the first time in the cover pool.

In the aftermath of the Poland’s mini-banking crisis, the adequacy of asset- liability management is back on the regulator’s table. Polish regulators have presented their ideas about how to place the refinancing of residential mortgages on a more stable footing. They will likely open up to a funding mix, although a minimum ratio has not yet been determined yet.

“Polish banks will be free to choose whether to back mortgages with senior unsecured debt, equity or covered bonds. They still need to ramp up their MREL funding but the introduction of quotas could boost covered bond issuance,” said Karlo Fuchs, head of covered bonds.

Meanwhile, Croatia solved its problems with CHF-denominated mortgages loans some years ago. Now that it has joined the euro area, the Covered Bond Directive has been transposed into local law. “For now, covered bonds remain a theoretical funding option,” Fuchs said. “Croatian mortgages, mostly long term and fixed rate are the perfect collateral for covered bonds. We expect housing finance to grow and covered bond funding to become the natural choice, although Croatian regulators might need to give a gentle nudge to kickstart the market.”

Download the Covered Bond Quarterly here.

See all covered bond ratings here.

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.