Announcements

Drinks

European construction: healthy backlog supports stable outlook, thin margins remain challenge

By Rigel Patricia Scheller, Director, Corporate Ratings

Government stimulus for infrastructure projects, spurred by offsetting the impact of the pandemic and investment for the energy transition, has boosted the sector in Europe as well as in Latin America and the US – regions where European companies are active – despite rising interest rates and sluggish economic growth.

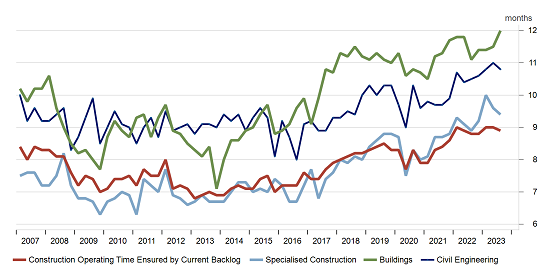

In fact, the sector backlog averaged an unusually high nine months in Q2 2023 (Figure 1). In contrast, higher rates and slow growth have set back demand for the construction of new commercial and residential buildings.

Figure 1. European construction sector: healthy infrastructure backlog contrasts with other sectors

Months of operating activity covered by order backlog

Source: European Commission

Recurring cashflow from managing infrastructure lures more companies

Even where order books are strong, construction companies face a squeeze in profit margins from supply-chain bottlenecks and rising costs, so more of Europe’s large firms are seeking to expand their concessions business.

Concessions typically generate less cyclical cashflow and higher margins through fee-based infrastructure management such as highways and bridges. Concessions provided only around 20% of the revenue in 2022 of large companies in the sector, such as France’s Vinci SA and Eiffage SA, but more than 65% of EBITDA and operating profit respectively.

Companies such as Spain’s Ferrovial SA, ACS SA and Sacyr SA have their sights set on increasing the volume of their concessions business in the coming years. The three companies have sold assets worth EUR 7bn in the past two years, providing funds for acquisitions, including several in the US. Ferrovial has invested in a EUR 9.5bn project to revamp passenger terminals at JFK Airport (New York). ACS purchased 56.7% of the SH 288 toll road in Texas for EUR 1bn. A Sacyr consortium is in negotiations to build, operate and maintain a stretch of highway in Louisiana for 50 years.

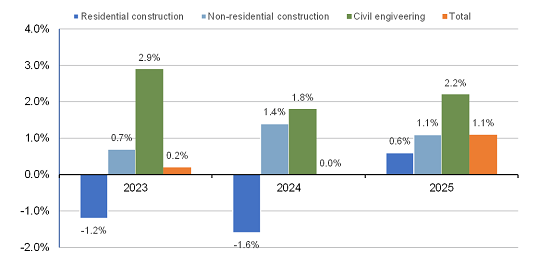

In Europe, funding by the European Commission and national governments for renovating roads and railways are good examples of the stimulus for civil-engineering and social infrastructure projects which are driving growth in the sector, estimated at around 2% to 3% a year by Euroconstruct (Figure 2).

Figure 2: Forecasted growth in construction-sector output by segment 2023-2025, YoY%

Sources: Euroconstruct, Scope Ratings

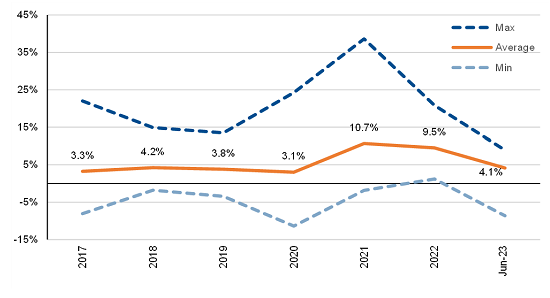

Large contractors recorded unusually long construction backlogs in the past two years with growth rates of around 10% in 2021 and 2022 (Figure 3). The robust backlog will support the companies’ performance even if the European economy remains weak.

Figure 3: Backlog growth rate of large European construction companies, 2017 to 2022

Note: Simple average of top construction companies (Vinci, Grupo ACS, Ferrovial, Eiffage, Bouygues, Skanska, Strabag).

Source: public information, Scope Ratings

The outlook looks less good for construction companies with more exposure to building construction. Tightened credit conditions are constraining demand, hence the downturn in residential construction, with several projects delayed or stopped due to clients’ inability to obtain financing. One offsetting factor will be government programs to encourage refurbishment of old residential building stock.

Inflation contributes to squeeze on profit margins

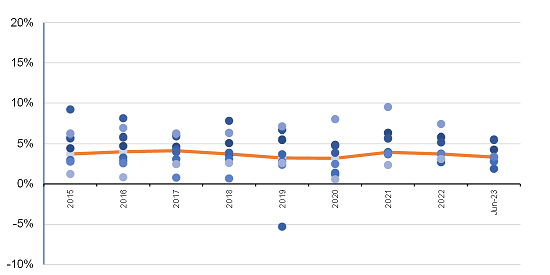

Profitability remains under pressure for construction firms amid high energy costs and a scarcity of some raw materials despite the healthy backlogs. Even though pandemic-related disruptions in supply chains have diminished, and some pricing pressure is easing, we expect EBITDA margins will remain stable but below 5%. Inflation will continue to squeeze construction companies’ profit margins, as there is typically little room to adjust pricing for existing contracts.

Figure 4: Top European contractors – reported EBITDA margin of construction activities

Note: Median of top construction companies (Vinci, Grupo ACS, Ferrovial, Eiffage, Bouygues, Skanska, Strabag).

Source: public information, Scope Ratings

Scope’s rating actions point to stability with some weak spots

Credit quality for companies in the sector covered by Scope is mostly stable. In past quarters, most rating actions resulted in a rating affirmation, mainly in the case of large companies in our coverage, which had a robust business performance in the 12 months to June 2023, supported by a strong backlog that provides good visibility on revenue in the next few years.

The outlook for smaller companies, relatively poorly diversified by sector and country, is less favourable. Economies of scale are important in the construction industry: size enhances a company’s ability to participate in tenders and negotiate better prices and access to raw materials as bulk customers.

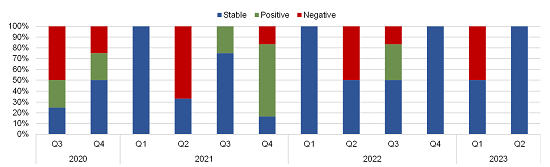

Figure 5: Rating actions* for European construction and building-materials companies

% of companies (Q3 2020-Q2 2023)

*Positive: Outlook change to Positive from Stable or Stable from Negative; Upgrade, under review for possible upgrade

Negative: Outlook change to Negative from Stable or Stable from Positive, Downgrade, under review for possible downgrade Stable: Affirmation, under review for developing outcome

For more on Scope’s recent construction-sector research, please check out the following reports:

ESG considerations for rating construction companies: industry faces complex sustainability task, December 2022

Europe’s building materials: soaring energy prices squeeze margins, strain cashflow, October 2022

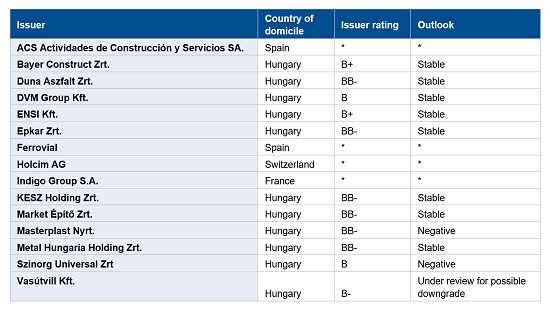

Appendix 1: Scope’s coverage of construction and construction material corporates

* Subscription ratings available on Scope’s digital platform ScopeOne

Sources: Scope