Announcements

Drinks

Wildfires: Greece case study shows potential for more frequent, damaging outbreaks

The wildfires caused around EUR4.1 billion in damage to property across Europe in the first nine months of 2023, with EUR1.66 bn in Greece, equivalent to 0.8% of 2022 GDP, and EUR 871m in Spain.

Scope ESG has examined wildfire risk in Greece as a case study of the potential for rising climate-related costs in areas with hot dry summers such as the Mediterranean.

“Our scenario analysis assesses future wildfire likelihood and associated damage under three climate scenarios using our proprietary model, comparing it with average historical damage between 2006 and 2023,” says Arne Platteau, analyst at Scope ESG.

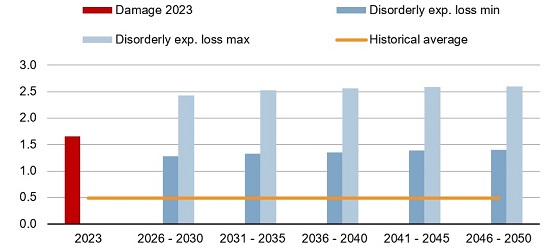

Projected yearly wildfire damage in Greece using expected loss method (disorderly scenario)

EUR bn (real 2023)

Source: Effis

“Under our disorderly scenario, extrapolating historical levels of damage show an increase in average yearly wildfire damage by 2050, but this doesn’t consider potentially greater damage which could arise should a wildfire reach the edges of a large metropolitan area such as the greater Athens region,” says Platteau.

Using an expected loss approach, annual expected wildfire damage could be 46% higher in 2026-2030 in Greece than the damage in 2023. By 2046-2050, annual expected damage could turn out to be 56% higher under the disorderly scenario than it will have been this year.

“The annual expected losses from wildfire could amount to EUR 2.4bn in 2026-2030, steadily rising throughout 2031-2040 to about EUR 2.5bn and could amount to EUR 2.8bn in 2046-2050, exceeding the high costs of wildfires in 2023,” says Hazem Krichene, analyst at Scope ESG.

Scope’s wildfire risk estimates are based on wildfire damage functions from Lüthi et al. (2018), and produced capital estimates from the World Bank. Following the IPCC recommendations, Scope’s scenarios are a combination of different shared socio-economic pathways (SSPs) and representative concentration pathways (RCPs). Scope associates the following SSP-RCP scenarios to these scenarios: Orderly: SSP1-RCP2.6, Disorderly SSP2-RCP4.5, Hot house SSP5-RCP8.5.

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.