Announcements

Drinks

Italy: wider budget deficits may challenge ECB’s TPI-eligibility, and weaken credit profile

By Alvise Lennkh-Yunus and Alessandra Poli, Sovereign and Public Sector

The projections of EU member states’ 2024-25 fiscal deficits matter, as they not only confirm authorities’ expectations of their fiscal consolidation efforts following the Covid-19 and energy crises, but also because they indicate whether one of the conditions for the ECB’s potential TPI activation – compliance with the EU fiscal framework – continues to be met.

While EU fiscal rules are set to be reinstated next year, they are likely to be introduced with a “grace period”, possibly until 2025, placing a greater policy-relevance on the 2025 deficit forecasts. In this context, the downward revisions by the Italian government of the country’s economic growth and fiscal outlooks confirm our concern that Italy has a narrow path to consolidate public finances, particularly as the expected impact of NGEU funds and reforms is further delayed.

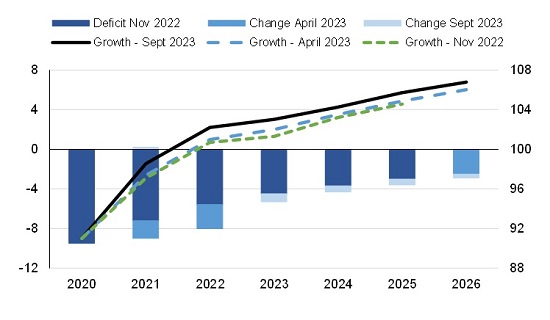

The Italian government has revised down its forecasts for Italy’s economic growth over 2023-2025 to 1.1% on average (NADEF, September 2023) from 1.3% (DEF, April 2023 and NADEF, November 2022). While Italy's post-pandemic recovery has been strong, highlighted by revised growth of 8.3% for 2021 from 7.0% previously, the growth outlook is weakening.

We expect growth of 0.8% next year, below the government’s 1.2%, which was now revised down from 1.5% (April forecast) and 1.9% (September 2022). A potentially mitigating factor is the refocused NGEU programme with a larger share of grants/loans toward private investment support rather than public investment, which could help accelerate spending and growth.

Still, Italy’s economic slowdown is accompanied by higher fiscal deficits, driven by the prolonged impact of the larger-than-expected construction tax credits implemented by the previous government and higher interest rates. Their associated fiscal cost is more than originally estimated, increasing the deficit by 1.1% of GDP for 2023. Overall, the government now targets a fiscal deficit of 5.3% of GDP for 2023, revised up from 4.5% seven months ago, and 4.3% of GDP for 2024, up from 3.7%.

Figure 1: Italian government’s headline deficit and growth forecasts

% of GDP; Real GDP 2019 = 100 (RHS)

November 2022 = Document of Economic and Finance (NADEF) 2022. Change April 2023 = Difference between NADEF 2022 and DEF 2023. Change Sept 2023 = Difference between DEF 2023 and NADEF 2023.

For 2025, the government targets a fiscal deficit of 3.6% of GDP, up from the Maastricht-compliant 3% estimated previously. Consequently, the government now expects to achieve a primary surplus only by 2025, one year later than previously assumed, and the debt-to-GDP ratio to decline only by 2.1pp between 2022 and 2026 to 139.6%, compared with a previously expected 4pp decline. The government expects to be compliant with the 3% fiscal deficit criterion only by 2026, and for the debt-to-GDP ratio to decline to its pre-pandemic level of 134% only after 2030.

ECB decisions could further pressure need to consolidate public finances

Italy’s higher interest expenditure, which is set to reach 4.6% of GDP by 2026, requires the government to run a primary surplus of at least 1.6% of GDP to remain compliant with a 3% of GDP fiscal deficit. The government’s goal to reach that level by 2026 requires ambitious fiscal consolidation of 1.8pp over 2024-26 compared with the 1.3pp previously assumed.

The lower primary surplus reflects the government’s moderate fiscal interventions aimed at preserving households’ purchasing power, supporting larger families amid demographic decline and boosting private demand with a reduction in tax contributions to lower the tax wedge.

Higher interest and social expenditure, and the resulting need for a fiscal adjustment, could jeopardise government plans for comprehensive fiscal reform aimed at reducing the number of tax brackets for personal income tax from four to three.

However, higher policy rates are not the only channel through which the ECB’s restrictive monetary stance could pressure Italian authorities to further strengthen their fiscal consolidation efforts.

As inflation remains above the ECB’s 2% target, the ECB could accelerate the end of its flexible reinvestments of its Pandemic Emergency Purchase Programme (PEPP), which so far is expected to continue “until at least the end of 2024.” This implies that reinvestments could stop by the end of next year. If so, the ECB would not purchase Italian securities worth around EUR 50bn, about 10% of estimated gross financing needs in 2025.

For 2025, this places greater focus on the TPI to support Italy’s government bond markets – if needed. It remains our baseline that the deployment criteria, including compliance with the EU fiscal rules, the absence of severe macro-economic imbalances, fiscal sustainability, and compliance with the reform commitments of the recovery and resilience plans, provide a strong incentive for Italian policymakers to ensure Italian bonds remain eligible under the TPI.

This assumption underpins our expectation that Italy’s government will stick to the reform agenda and gradual fiscal consolidation over the coming years, which supports our BBB+/Stable rating. Still, the risk of slightly wider and persistent fiscal deficits and further delays related to the implementation of recovery plan projects is rising. The government now estimates that most of NGEU expenditure will be concentrated in 2025-2026.

Italy’s high public debt, low growth potential, and the ECB’s continued restrictive monetary policy stance, thus highlight the need to accelerate the implementation of NGEU reforms and investments.

Scope’s next scheduled review of Italy’s sovereign credit rating is 1 December 2023.

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.