Announcements

Drinks

Oil and gas sector: contrasting IOC low-carbon capex strategies change risk profiles

By Rohit Nair and Marlen Shokhitbayev, Corporate Ratings

European IOCs are choosing different paths. They are adapting, first, to favourable short-term oil and gas prices amid lingering uncertainty over how soon prices might enter secular decline. Secondly, they are factoring in less favourable near-term returns from sustainable energy projects as the cost of capital rises, despite the assured longer-term advantages of investing in them and the risk of the future stranding of hydrocarbon assets.

One reason for the divergence in IOC capital expenditure plans is that there is no consensus on when the shift to low-carbon fuels will start to shrink in global oil demand. The International Energy Agency expects this to happen by 2030, but the Organisation of Petroleum Exporting Countries (OPEC) forecasts the shift after 2035, while The US Energy Information Administration doesn’t see this happening until 2050 according to its scenarios.

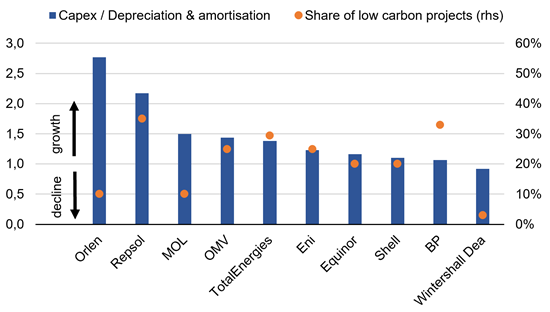

We see three distinct types of IOC strategy: “oil first”, led by the US majors and Shell PLC; hybrid, typified by TotalEnergies SE among the majors, and “going green,” which Repsol SA and, until recently, BP PLC are proponents. The variation offers investors choice in terms of how they want to best balance their exposure to the sector.

Figure 1: Capex intensity and the share of low-carbon projects in 2023

Source: Company reports, Bloomberg, Scope Ratings

Oil first: making the most of high crude prices as cost of capital rises

US-based IOCs continue to make fossil fuel investments their priority over spending on low-carbon energy projects amid still favourable commodity prices and the rising cost of capital (see also IOCs’ caution on renewables reflects financing conditions, market uncertainty). ExxonMobil’s USD 59.5bn deal for oil & gas producer Pioneer Natural Resources is the latest and most dramatic example.

In Europe, Shell is most closely aligned to this approach, having reversed a reduction in oil output and announced plans to scale back investments in renewable energy. The company is reportedly considering disposals of existing low-carbon projects.

For IOCs in this category, investing in lower-cost oil and gas projects is crucial to reduce risk that any unexpectedly early decline in demand and prices leaves them to unable to compete with big Middle East producers at the bottom of the oil and gas cost curve, led by Saudi Arabia’s Aramco.

Hybrid: multi-energy approach keeps options open

Several European IOCs are pursuing a ‘multi-energy approach’ with stable or growing investment in hydrocarbon and renewable energy projects, such as TotalEnergies, Italy’s Eni SpA, and Poland’s Orlen SA among others.

TotalEnergies plans to grow its oil & gas production by 2-3 % per year over the next five years, predominantly from LNG, while spending around 30% of its capex on low-carbon projects.

Going green: making the switch sooner rather than later

Some IOCs are intent on a more fundamental transformation of their business models with accelerated investments in low-carbon technologies including decarbonisation of their traditional activities. This group includes Spain’s Repsol, and until recently BP.

At Repsol, in addition to high and growing share of low-carbon projects in organic spending, the Spanish producer has also recently signed deals to sell its E&P assets in Canada while also buying renewable energy assets in the US.

For BP, the outlook is less clear as the company looks for a permanent replacement for former CEO Bernard Looney. BP said in 2020 that its goal was to be a “net zero” company by 2050, before backtracking slightly in February this year when it announced larger investments in oil and gas than previously expected, following record-setting profits across the sector in the previous two years.

Oil investments good for the bottom line, but could weigh on business risk profiles

Short-cycle oil and gas investments clearly benefit profitability and credit metrics in the today’s favourable commodity price environment.

However, investments in low-carbon projects enhance diversification and reduce the risk associated with any drop in oil demand and stiffening in environmental regulations.

Continuing investments in traditional oil & gas venues increases the risk of stranded assets and could reduce IOC’s diversification and, in turn, their business risk profiles.

Investments in sustainable energy projects with long lead times weigh down on profitability, especially during the development phase: any favourable impact on credit quality happens only when they contribute a significant share to total cash generation.

The IOCs can improve their medium- and long-term competitiveness by high-grading their portfolios through investments in low-cost projects with low greenhouse-gas-intensity potentially combined with carbon capture and storage technologies. However, for the viability of business models in the very long term, there is no way around investments in low-carbon technologies.

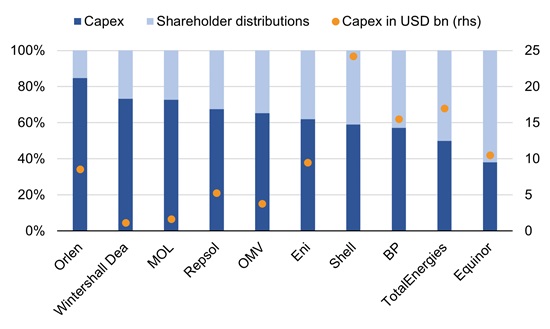

Figure 2: Getting the balance right: European IOC capex vs shareholder remuneration

% of main cash use in 2023 (forecast)

Source: Company reports, Bloomberg, Scope Ratings

Strong cash flows also pressure companies to ‘do something’

IOCs do share some common strategies. In recent years, they have deleveraged significantly, hitting or even exceeding their leverage targets, so that further debt reduction is not on top of the agenda.

In this context, it is hard for the IOCs to neglect shareholders. There is pressure on management to distribute spare cash amid the uncertainties over how best to deploy spare capital for investments. Norway’s Equinor, TotalEnergies, BP and Shell are set to pay out the highest proportion of cash in dividends and share buybacks in 2023 among Europe’s IOCs.

Some companies face special circumstances. In the context of Russia’s war in Ukraine, Poland’s Orlen is deploying a high proportion of spare capital for investment, driven by national energy security considerations. Orlen has ambitious targets for the development of low-carbon projects (around 40% over 2023-2030) – take its project to develop a USD 5bn offshore wind project in the Baltic Sea – in addition to investing in its existing fossil fuel activities.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope’s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.