Announcements

Drinks

Multilateral development banks: could enhancing almost EUR 1trn in callable capital boost lending?

“Clarifying the process by which multilateral development banks (MDBs) can make capital calls on their shareholder governments – and how they in turn account for them from a budgetary perspective – could raise the loss-absorbing capacity of MDB balance sheets,” says Alvise Lennkh-Yunus, deputy head of sovereign and public sector ratings at Scope.

Callable capital, which constitutes an obligation for or promise by shareholder governments to provide capital if ever needed, accounts for about 60-90% of each MDB’s capital.

“This is far from insignificant as a potential loss-absorbing instrument if we look at the pressure on the MDBs’ resources, whether it is to finance the reconstruction of Ukraine, accelerate the green transition, help countries meet SDGs and/or facilitate debt-relief without jeopardising the high MDB credit ratings,’” says Lennkh-Yunus.

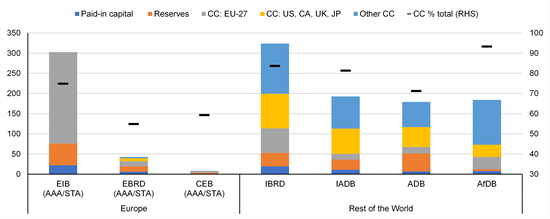

Around 60% of the near EUR 1trn in callable capital is held by the G7 and EU-27 shareholders, and 50% is concentrated at the EIB (AAA/Stable) and World Bank (IBRD). By contrast, for the select MDBs analysed, paid-in capital is just over EUR 74bn and accumulated reserves stand at around EUR 177bn.

Figure 1: Paid-in capital, accumulated reserves and callable capital of select MDBs*

EUR bn; % of total capital (paid-in, reserves, callable)

NB. CC = callable capital

Source: Respective MDBs, Scope Ratings

As MDBs aim to maximise their resources, clarifying how and under which circumstances callable capital could be deployed would give this instrument greater value as a financial backstop when assessing MDB capital adequacy.

“Another consequence would be that rating agencies, including Scope, would reassess how to measure the creditworthiness of the MDBs, particularly if callable capital was treated as a ‘going concern’ instrument. This would allow MDBs to access capital from their shareholders to recover from a temporary crisis that weakens their balance sheets,” says Lennkh-Yunus.

To date, callable capital is untested as there has never been a capital call by any major MDB for two main reasons. First, MDBs generally state that callable capital would only be used in a so-called ‘gone concern’ scenario, that is, when all other MDB resources have been used up to repay its creditors before permanently shutting down. MDBs are therefore managed such that a capital call is not expected to occur.

Second, few international rules or sanctions oblige a sovereign to comply with a call and, even then, such compliance may still require approval from a national parliament. “To the best of our knowledge, callable capital is usually not appropriated or provisioned for by shareholder governments,” says Lennkh-Yunus.

*European Investment Bank (EIB), European Bank for Reconstruction and Development (EBRD), Council of Europe Development Bank (CEB), International Bank for Reconstruction and Development (World Bank), Inter-American Development Bank (IADB), Asian Development Bank (ADB), African Development Bank (AfDB)

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope’s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.