Announcements

Drinks

Hungary: construction sector unsettled by low volumes, thin margins, uncertainty over EU funds

By Rigel Scheller, Director, Corporate Ratings

The outlook is least good for companies building civil infrastructure and new homes, though in the short term, the largest companies have the benefit of strong order books. For industrial building projects, continued foreign investment is benefiting Hungary’s bigger companies in the sector.

Under pressure too are micro and small local companies which lack diversification and are reliant on only a limited number of projects. This has resulted in a significant increase in bankruptcies from construction companies in Hungary since middle of 2022.

The sustained impact of inflation and high interest rates are exacerbating the impact of government cutbacks in infrastructure spending given uncertainty over Hungary’s receipt of billions of euros of EU funds, crucial in the past for financing projects in Hungary. Talks are continuing between the European Commission and Budapest about unlocking the funds (about EUR 13bn in regular EU payouts and pandemic recovery grants) which are in jeopardy because the dispute over civil rights and the rule of law in Hungary.

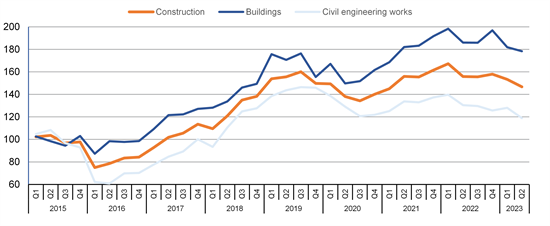

The important role of government spending in Hungary’s construction is visible in recent economic data. Without EU funds at its disposal, the government has reduced public procurement in its 2023 and 2024 budgets, notably in transport infrastructure and buildings. Output in the buildings and civil-engineering sectors fell 7.7% and 11.5% respectively in Q2 this year compared with the same period last year (Figure 1).

Figure 1. Off the boil: Hungarian construction sector output declines

(production index, monthly average, 2015 = 100, seasonally and working day adjusted)

Sources: Hungarian Central Statistical Office (KSH), Scope Ratings

Broader economic context weighing down on sector’s prospects

Hungary’s slowing economic growth provides a difficult context for construction firms to operate in. We expect GDP growth to be just 0.1% this year, down from 4.6% in 2022, with the economic rebound to set for a relatively modest 2.6% next year. Companies in several industries have postponed capital expenditure on existing and new production facilities which is shrinking construction-sector order books.

Competition for a dwindling number of construction projects is also squeezing construction companies’ profitability as government has cut back spending amid upward pressure on costs, most severely for the many small and medium-sized enterprises (SMEs) in the Hungarian sector.

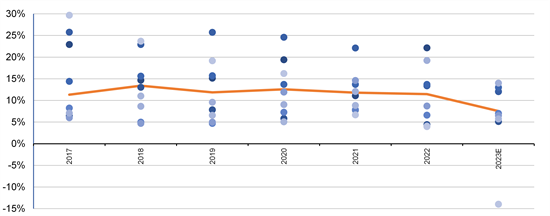

We expect EBITDA margins will remain under pressure. The average margin for selected construction companies fell to 11% in 2022 from 13% in 2018, with a sharper reduction likely by end-2023 (Figure 2) even though pandemic-related disruptions in supply chains have diminished and some price pressure is easing. There is typically little room to adjust pricing for existing contracts.

Figure 2. Shrinking: Hungarian construction companies’ Scope-adjusted EBITDA margin 2017-23E

(%)

Note: Average of top Hungarian construction companies (Ensi, Épkar, Duna Aszfalt, Kész Holding, Market Építő, Metál Hungária, Bayer Construct, DVM Group, Szinorg, Vasútvill).

Sources: companies’ financial reports, Scope Ratings

Civil engineering: tighter central government budgets weigh down on credit outlook

Hungary’s construction-sector SMEs are in general focused on the domestic market, with no foreign income to help offset declines at home, with firms in some cases heavily dependent on government procurement.

As the government tightens its belt, firms exposed to civil engineering face a dearth of new projects, leading to less predictable and more volatile profit and cashflow. This would weigh down on their business and financial risk profiles and ultimately reduce credit quality once they have worked through their backlogs.

Buildings: municipal, foreign investment support activity; residential demand weakens

Less vulnerable to the strains in Hungary’s construction industry is the building segment, for two main reasons.

First, projects financed by local municipalities investing in education, health, culture and welfare have partly mitigated the reduction in public procurement from the central government.

Secondly, some local construction companies have also benefited from foreign direct investment in industry, attracted by the country’s competitive tax system.

Hungary has attracted EUR 20bn in foreign investment in the past five years, concentrated in the city of Debrecen, and has become one of the leading European hubs for the electric vehicle industry.

China’s Contemporary Amperex Technology Co. is constructing Europe’s largest battery plant investing about EUR 7.3bn. German car maker BMW AG is developing a 400-hectare factory with more than EUR 2bn to be invested by 2025. Danish toy manufacturer Lego plans to invest EUR 138m in 2023-2025 to expand packaging and warehouse capacity. German engineering firm Robert Bosch AG’s local unit is investing EUR 181m in a logistics centre. Hungarian firms Market Építő Zrt. and KÉSZ Holding Zrt. are carrying out part of the construction work.

In contrast, the housing segment is facing a sustained slowdown. Mortgage rates have increased, making it harder for Hungarians to finance house purchases while pushing up the cost of monthly instalments on new loans. One offsetting factor is government housing subsidies such as the Family Home Creation Allowance (CSOK), designed to encourage investment in energy-efficient housing.

Sector looks for more diversified revenue streams

The leading domestic companies such as Market Építő, Duna Aszfalt Zrt. and KÉSZ have a robust backlog averaging around 2x which will support their performance even if the economy remains weak in the short term.

Smaller and less diversified companies are more vulnerable to profit and cashflow changing in current market conditions, as they are reliant on only a small number of projects. Some are seeking new business through developing real estate projects themselves to generate recurring income and possible future sale proceeds. Other companies are eyeing sectors like renewable energy, where investment funds are more readily available, and which can also provide recurring and stable income.

Such initiatives will be vital to fill construction-sector order books as uncertainty over the disbursement of EU funds continues.

For more on Scope’s recent construction and construction materials-sector research, please check out the following reports:

Europe’s building materials: soaring energy prices squeeze margins, strain cashflow, October 2022

Appendix 1: Scope’s coverage of construction corporates in Hungary

|

Issuer |

Country of domicile |

Issuer rating |

Outlook |

|

Hungary |

B+ |

Stable |

|

|

Hungary |

BB- |

Stable |

|

|

Hungary |

B |

Stable |

|

|

Hungary |

B+ |

Stable |

|

|

Hungary |

BB- |

Stable |

|

|

Hungary |

BB- |

Stable |

|

|

Hungary |

BB- |

Stable |

|

|

Hungary |

B+ |

Under review for possible downgrade |

|

|

Hungary |

BB- |

Stable |

|

|

Hungary |

B |

Negative |

|

|

Hungary |

B- |

Under review for possible downgrade |

Sources: Scope

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope’s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.