Announcements

Drinks

Türkiye’s economic and financial risks eased by recent shift towards policy normalisation

By Thomas Gillet, Sovereign Ratings

We revised the outlook for Türkiye (foreign-currency ratings of B-) to Stable from Negative on 12 January based on the recent record of a more conventional policy following the general elections in May 2023. The shift by the central bank of the Republic of Türkiye (CBRT) towards consistently tighter monetary policy to bring down double-digit inflation has improved its credibility and repaired some of the damage done in previous years to the country’s reputation for sound economic management.

Several interest-rate increases and selective credit tightening have started to slow credit growth and private consumption, reducing the current account deficit and external gross financing needs, which we estimate at USD 250bn in 2024 (about 19% of GDP). Covering financing requirements should also be easier as improved foreign investor sentiment translates into capital inflows. The Ministry of Treasury and Finance plans to raise USD 10bn of external funding in 2024.

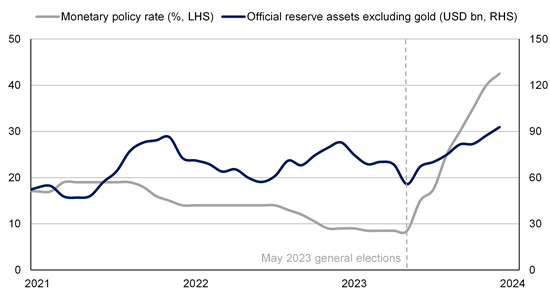

Another benefit of tighter monetary policy is the recovery of Türkiye’s gross international reserves excluding gold, rising to USD 92.8bn in December from USD 55.7bn in May 2023 (Figure 1). Even so, international reserves remain inadequate to cover gross financing needs.

Figure 1. Monetary policy pivot leads to rebound in critically low international reserves

Source: CBRT, Scope Ratings

More conventional macroeconomic policy-mix balanced by record of policy reversals

Should the CBRT sustain its recent orthodox policy approach, we would expect a gradual rebalancing of Türkiye’s economy, resulting in improved resilience to external shocks.

Yet, external and financial risks remain prominent until further progress is made in bringing inflation down. This is also because the CBRT has relinquished control on the lira with no commitment to maintain any level for the exchange rate.

Real policy rates remain deeply negative at -22% in December, up from -31% in May 2023, and containing surging consumer prices will require time. We thus expect inflation to average 60% in 2024, up from 53% last year, with the increase due to the lira’s depreciation and lags in the transmission of monetary policy.

Economic growth robust but to slow this year

GDP growth is expected to moderately decline as tighter funding conditions are offset by the reconstruction efforts following the February 2023 earthquake. We project real GDP growth at 3.3% in 2024, down from 4.1% in 2023.

President Recep Tayyip Erdoğan publicly supports the central bank’s policy – having previously argued that low interest rates would curb inflation. Still, a sharper-than-expected economic slowdown due, for example, to an external shock and/or heightened geopolitical tensions, could test the durability of the recent shift towards policy normalisation.

One test will be the government’s commitment to orthodox economic policies in the run-up to local elections in March as the economy slows under the impact of the tighter monetary policy of recent months.

Under a stressed scenario, political interference in monetary decisions could resurface. This could increase the risk of policy reversals, lowering the likelihood of making further gains on reducing inflation and further rebalancing the economy. Decision-making remains highly centralised and independent institutions frequently politicized. The government is reportedly cracking down on internet access ahead of the local elections.

The risk of mistakes in the calibration of policy normalisation and/or reversals constrain Türkiye’s long-term foreign-currency ratings at B- given the country’s enduring external and financial vulnerabilities. Our next calendar review date is 28 June, 2024.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope’s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.