Announcements

Drinks

CEE Sovereign Outlook: Recovering growth, diverging fiscal paths, and persistent geopolitical risks

Download the 2024 CEE Outlook here.

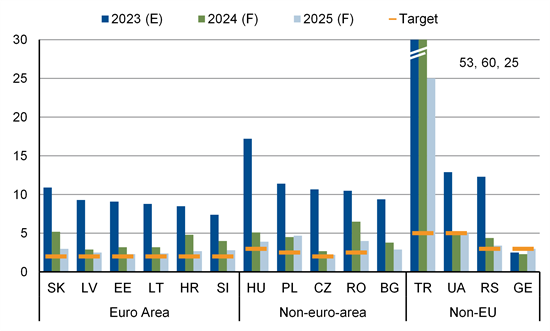

“For the CEE-11* as a whole, we are forecasting a reduction in headline inflation from an expected 11.2% last year to 4.6% in 2024,” said Jakob Suwalski, analyst in Scope’s sovereign and public sector team. “Strong nominal wage growth and a potential wage spiral signal downside risks.”

External deficits will remain relatively stable, owing to a gradually reversing regional terms-of-trade shock, constraining import growth amid lower domestic demand and sufficient natural gas reserves. At the same time, export performance continues to lag due to weak external demand.

Headline inflation, annual average, %

Source: National central banks, Eurostat, IMF, Scope Ratings forecasts

“Fiscal outlooks remain challenging, though, as governments in the region balance the task of reducing budget deficits post-Covid with providing support to strategic sectors and boosting spending on energy, infrastructure, and defence,” said Julian Zimmermann. “The challenge of financing persistent budget deficits is compounded by the rise in interest payments in 2024, notably for sovereigns with substantial borrowing requirements and shorter debt durations.”

Governance risks also remain. The flow of EU funds is critical to the region’s economic performance. Substantial EU transfers to Poland (A/Stable) and Hungary (BBB/Stable) are blocked due to rule of law issues, curbing the economic recovery. Meanwhile, higher policy rates in CEE countries compared with the euro area have complicated market-based financing.

“In terms of ratings, the balance of risks to ratings of CEE sovereign issuers is broadly balanced in 2024, after a series of sovereign downgrades and Outlook adjustments in 2023,” Suwalski said. “CEE sovereign downgrades in 2023 reflected structural economic risks and lingering impacts of the energy and inflation shocks, which affected real growth, public finances and economic resilience.”

Scope downgraded Hungary (to BBB), Czech Republic (to AA-), and Poland (to A), and maintained a Negative Outlook for Slovakia (rated A+). We revised downwards the Outlooks for Estonia (AA-/Negative), Latvia (A-/Stable), and Lithuania (A/Stable), reflecting economic challenges and rising geopolitical tensions caused by Russia’s war in Ukraine. Outside the EU, we have a Negative Outlook on Ukraine's CC foreign-debt ratings, while in January 2024, we revised the Negative Outlook on Türkiye's B- foreign-currency ratings to Stable due to the recent shift towards more conventional monetary policy supporting a progressive rebalancing of the economy.

*EU CEE-11: Bulgaria , Croatia, Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Romania, Slovakia, Slovenia

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.