Announcements

Drinks

France: cabinet reshuffle reinvigorates government; rebuilding reform momentum remains difficult

By Thomas Gillet and Brian Marly, Sovereign and Public Sector Ratings

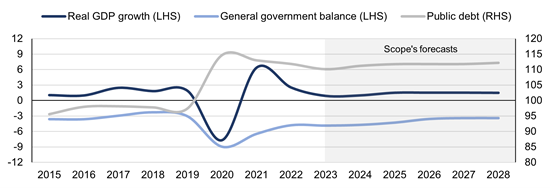

The implementation of supply-side reforms to enhance economic growth as well as containing public spending to reduce the fiscal deficit is critical to tackle France’s (AA/Negative) public finance challenges over the coming years, with a projected debt-to-GDP ratio of around 112% in 2028 (Figure 1).

Figure 1. Public debt likely to remain flat due to persistent deficits and moderate growth

% and % GDP (LHS); % GDP (RHS)

Source: IMF, Scope Ratings

While the new cabinet reflects more closely the political balance in parliament, the government will still face stiff opposition in the National Assembly given the country’s more fragmented political landscape after the 2022 elections in which Macron’s party and allies failed to win an absolute majority of seats. The ability of the current government to implement its reform agenda is an important factor for France’s credit rating trajectory.

Negotiating policies with the main centre-right party, Les Républicains, counting on other parties’ votes or forcing the passage of law without parliamentary vote remain necessary conditions to advance Macron’s reform agenda. However, each scenario could come with delays and carries political and institutional risks.

One risk is the political rise of the far-right Rassemblement National if Macron can pass reforms only with its opportunistic support, as was the case with the immigration law passed in December. The far-right party is currently leading opinions polls ahead of the European elections in June. Political gains by Rassemblement National could aggravate disagreements among Macron’s political allies about how best to preserve, if not enhance, his legacy.

Secondly, ad hoc alliances with Les Républicains could further disorientate Macron’s center-right coalition, raising greater risks of instability. Since July 2022, about 30 no confidence votes were rejected by the National Assembly. We expect Macron’s government led by new Prime Minister Gabriel Attal, who is set to deliver his general policy speech on January 30, to continue to survive them. However, the outcome of future votes would be less predictable if the presidential coalition splits. Current opinion polls suggest that the option of calling early legislative elections would only narrow Macron’s political room for manoeuvre.

Thirdly, circumventing the lack of absolute majority in parliament could test the effectiveness of institutions under the fifth Republic. The recurrent use of the so-called ’49.3 mechanism’, enabling the government to pass legislation without a vote in parliament, could raise questions about the separation of executive and legislative powers, as pointed out by the Council of Europe during debates around last year’s pension reform. More recently, the French constitutional court decided to reject large portions of the immigration bill, most of which had been concessions made by the government to gain parliamentary approval from Les Républicains.

Reforms remain vital for consolidating fiscal gains

The obstacles to advancing President Macron’s reform agenda raise concerns about how much government can do to continue to improve the labour market and business environment.

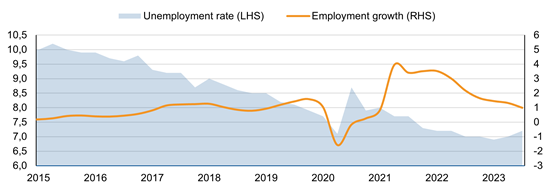

Planned reforms include a new simplification bill to reduce the red tape weighing on businesses, and a further set of labour market measures aimed at overcoming the recent deceleration in employment gains (Figure 2). Progress here is necessary to spur economic growth, which we estimate at 1.0-1.5% for 2024-25, and reduce public debt to the government’s target of 108% of GDP in 2027.

Figure 2. Labour market gains slow as economy cools

Seasonally-adjusted; % of total (LHS); year-on-year change, % (RHS)

Note: last point refers to Q3 2023. Source: INSEE, Scope Ratings

Relying more on reducing spending could also help bolster public finances. Savings in 2024 largely reflect the end of emergency measures to support business and households after the energy shock, such as taxes waived on electricity. The challenge will be to reduce permanent government spending in line with a target of saving at least EUR 12bn in 2025.

Uncertainties surrounding future reform implementation and the potentially adverse implications on fiscal consolidation plans underpin the Negative Outlook that Scope has assigned to France’s AA long-term credit ratings. Next calendar review date is 3 May, 2024.

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.