Announcements

Drinks

European Sub-Sovereign Outlook: risks balanced as crisis support eases, growth recovers

“The expected moderate economic recovery in the euro area (+1.4% average real growth in 2024/25), in Norway (1.2%) and in Switzerland (1.4%) will ensure steady tax receipts which, combined with prudent budgeting, will lead to broadly stable fiscal performance for regions, municipalities and other sub-sovereign borrowers this year,” says Julian Zimmermann, analyst at Scope Ratings and co-author of Scope’s Sub-Sovereign Outlook 2024.

“Sub-sovereign issuers benefit from resilient institutional frameworks and continued central government support, albeit reduced from the high level during the pandemic and energy shock,” says Zimmermann.

Sub-sovereign budgets in France (AA/Negative), Germany (AAA/Stable), Italy (BBB+/Stable), Norway (AAA/Stable), Spain (A-/Stable) and Switzerland (AAA/Stable) will feel the full impact of inflation on costs, overtaking the initially favourable impact on revenue recorded in 2022.

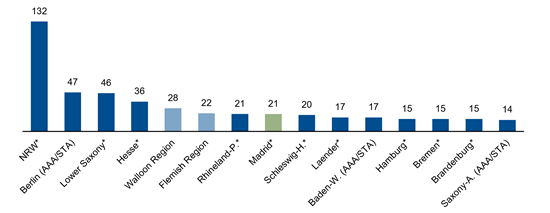

Leading sub-sovereign debt issuers in Europe

* Rated on subscription, accessible on ScopeOne. As of 25 January 2024. Source: Bloomberg Finance L.P., Scope Ratings

Sub-sovereigns will contribute to fiscal consolidation as European fiscal rules are re-activated, notably in Italy and France.

“Robust debt profiles shield issuers from rising financing costs,” says Jakob Suwalski, analyst at Scope. “The expected cuts in interest rates in the second half of 2024 will provide further support,” Suwalski says.

In the report, Scope identifies the following key themes for sub-sovereigns this year:

- Post-crisis institutional and fiscal changes: Central government support is vital for sub-sovereign resilience, but reduced transfers pose challenges. Structural costs, influenced by population growth and investment requirements, highlight a need for increased budgetary autonomy to address long-term fiscal pressures. Possible changes in the Spanish regional framework may involve partial debt absorption, revealing systemic vulnerabilities. In Germany, the recent constitutional court ruling reinforces the budgetary constraints of the debt-brake and will thus influence Länder fiscal strategies.

- Coping with structural budget pressures: Sub-sovereign budgets will stabilise, driven by a moderate economic recovery, steady tax revenue and prudent financial policies. Still, issuers face long-term spending pressures, which vary according to budget structures and spending responsibilities.

- Sub-sovereign funding: subdued volumes, robust profiles: Issuance volumes should remain subdued due to sovereign on-lending funding practices, front-loaded issuance in 2020-21, the availability of EU funds, and the re-instatement of fiscal rules in Europe.

- Rising relevance of environmental and social factors: European regions face diverse climate and transition risks. Sub-sovereigns play an important role in implementing climate strategies. Demographic dynamics and social factors directly impact revenue allocation, expenditure, and economic outcomes.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope’s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.