Announcements

Drinks

Hungary: credit ratings constrained by uncertainty over EU funds, elevated public debt

By Jakob Suwalski, Senior Director, Sovereign and Public Sector

Hungary's BBB/Stable credit ratings face constraints due to high public debt, even if it is set to decline slightly to 69% of GDP this year from 70% in 2023. This situation is compounded by rising borrowing costs, weak governance, limited policy predictability and the uncertainty regarding the inflow of EU funds.

Hungary partially met requirements for judicial independence stipulated by the EU in December 2023, but the European Commission (EC) has other concerns, restricting Budapest’s access to EUR 10.2bn of the allocated EUR 22bn in 2021-2027 Cohesion funds. The 2021 Rule of Law Conditionality Regulation empowers the EC to freeze most of Hungary's EU cohesion funding and block EUR 10.4bn from the Recovery and Resilience Fund due to rule-of-law violations.

We expect that the amount of EU funds allocated to Hungary under the 2021-2027 cohesion period and the Recovery and Resilience Facility will be maintained. However, the EU disbursement process is unlikely to be smooth or speedy which presents risks to the credit outlook.

Significant further delays in the disbursement of EU funding would prove credit negative by putting more pressure on Hungary’s widening budget deficits. The fiscal balance is set to average around 4.5% of GDP in 2024-2025, above peers such as Bulgaria (3.0% of GDP) but below Slovakia (6.5% of GDP). If Hungary ends up relying more on domestic borrowing at high interest rates, this will contribute to a growing debt-servicing burden and leads to less vibrant economic growth.

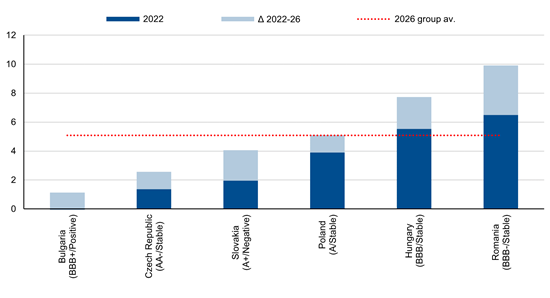

Hungary's net interest payments will rise to 7.8% of government revenues in 2025, up from 7.5% this year and from 5.5% of government revenues in 2022, according to our forecasts. This is also above most of its similarly rated EU peers (Figure 1).

Figure 1: Hungary has relatively onerous debt servicing compared with EU neighbours

Net interest payments as % of general government revenue

Source: Scope Ratings

Strained EU relations, continued Russian dependence, and weakening governance

Easing some of these pressures is the fact that Hungary benefits from a robust public debt structure, with much owned by domestic institutions (37% in 2023) and households (24%), reducing its reliance on foreign creditors.

However, Hungary’s intricate balancing act of leveraging long-term EU funds while relying on Russia-connected infrastructure amid Russia’s war in Ukraine continues to complicate the government’s relationship with European institutions.

Hungary stands out among EU nations in terms of its dependence on Russia, with 40% of its energy consumption tied to Russian gas. This raises concerns about potential risks of supply cuts and their potential impact on industrial output.

At the same time, as the war in Ukraine goes on, Hungary will continue face escalating pressure from its European partners on politically sensitive issues such as aligning its energy and foreign policies with that of the EU.

The Hungarian government’s frequent use of emergency measures, first introduced during the pandemic crisis, rather than governing through parliamentary democracy, also risks leading to less transparent and more centralised decision-making, eroding the quality and predictability of economic policy.

To be sure, Hungary's credit ratings benefit from the economy’s robust growth prospects, with output set to rise by around 2.8% a year in the coming years, supported by substantial capital inflows, partially offsetting delays in the disbursement of EU funding.

Recent foreign investment, particularly in electric vehicle battery factories, positions Hungary well in the global automotive industry. Hungary's market is increasingly open to Chinese investors as ties between the two economies become closer, likely to support industrial investment and growth.

Scope affirmed Hungary’s credit ratings at BBB with Stable Outlook on 26 January 2024. Scope’s next scheduled publication dates on Hungary’s ratings are 7 June and 8 November 2024.

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.