Announcements

Drinks

Portugal’s government formation to test political stability, economic and fiscal prospects

By Jakob Suwalski and Alessandra Poli, Sovereign and Public Sector Ratings

Portugal’s (A-/Stable) general election resulted in a more fragmented parliament, with the strongest party, the centre-right Democratic Alliance (AD) obtaining 80 out of 230 seats, just ahead of the long-governing Socialist Party (PS) (78 seats) and the third-placed far-right Chega (Enough) party (50 seats).

As both the AD and PS have rejected forming a coalition with Chega, AD plans to lead a minority government in alliance with the right-liberal IL party (8 seats). The new government faces no constitutional risk of a vote of no-confidence from the opposition but a failure to pass a new budget in the fall could lead to new elections.

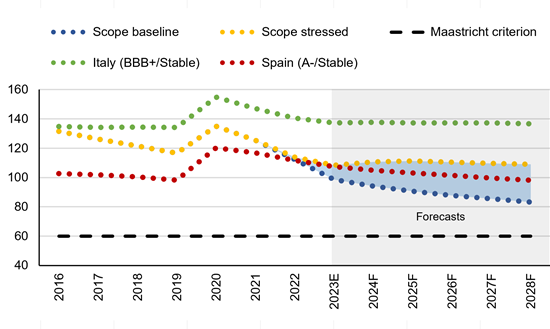

This raises questions over the next government’s ability to agree on taxation, spending priorities, and economic reforms, all of which will influence Portugal's fiscal stance and public debt outlook (Figure 1). A fragmented political landscape may jeopardize government stability and impede effective policy responses to increasing structural expenses, notably higher interest costs and pension obligations, potentially requiring adjustments, especially if interest expenses surpass our projections.

Figure 1. Portugal is steadily reducing debt-to-GDP

% of GDP

Sources: IMF WEO, Scope ratings

Firm downward trend in debt-to-GDP continues in the medium term…

Portugal has demonstrated robust fiscal discipline in recent years, with a notable reduction in the debt-to-GDP ratio and a favourable debt profile, helped by the government’s budget surplus estimated at 1.0% of GDP last year, up from a 0.3% deficit in 2022. We forecast a slightly lower budget surplus of 0.1% of GDP in 2024, driven by some relaxation in budgetary constraints, partly due to better-than-expected fiscal outcomes last year.

The economy is growing robustly, helped by post-pandemic surges in tourism and investment, with real GDP expanding by 6.8% in 2022 and an estimated 2.3% in 2023. Low interest expenses, amounting to 1.9% of GDP in 2023, contributed to reducing Portugal's public debt-to-GDP to an estimated 99.0% in 2023 from 124.5% in 2021. Public debt is set to decrease to 94.2% of GDP in 2024 and further to around 90% in come years, based on current policies.

The favourable fiscal outlook to date, bolstered by substantial cash reserves providing a buffer against unexpected financial shocks, has assured investors, with Portuguese government bonds trading similarly to peers. Additionally, half of Portugal's annual debt issuance of government bonds has been completed in the first two months of 2024.

…but concerns are growing about Portugal’s future fiscal stance.

In the coming years, Portugal's government debt-to-GDP trajectory will face challenges due to increased structural expenses.

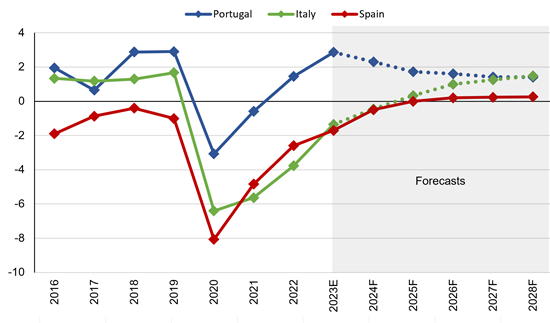

We expect a trend towards smaller primary surpluses due to higher pension costs and other demands on government spending. Political pressure from voters is growing for more government intervention, for instance, in the residential housing sector, where rents are rising sharply amid limited supply. The 2024 budget recognised many of the pressures with reductions in income tax, salary hikes for civil servants, pension adjustments, and an increase in the national minimum wage.

Despite these pressures, we still expect Portugal to record an average primary surplus of 1.5% between 2024-28, down from 2.1% of GDP from 2016 to 2019, but still above most euro area peers. However, Portugal's budgetary flexibility will diminish gradually, with moderately higher interest expenses likely to reach 2.3% of GDP in 2024, due to an increase in the cost of debt at issuance to 3.6% in 2024 from 1.7% in 2022.

Figure 2. Primary balance will decline over time but still remain in surplus

% of GDP

Sources: IMF WEO, Scope ratings

Finally, Portugal’s fiscal space may also decline given a more subdued economic growth outlook compared to recent years. We expect Portugal’s relatively small and open economy to grow by 1.2% in 2024 and 1.8% in 2025, constrained by weak external demand.

The current concern is that a more fragmented political landscape could impede a more effective policy strategy for addressing the increasing structural expenses, particularly higher expenses in social areas and pension-related obligations. These factors exert long-term pressure on the budget and may necessitate policy adjustments, particularly if interest rates were to stay higher for longer.

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.