Announcements

Drinks

France: higher-than-expected 2023 deficit tests ability to achieve fiscal targets

By Thomas Gillet and Brian Marly, Sovereign and Public Sector

Rebuilding France’s (rated AA/Negative) fiscal buffers post crisis is now more difficult because of the higher-than-expected budget deficit of 5.5% of GDP in 2023, exceeding government projections of 4.9%. This deviation reflects excess deficit of around EUR 17bn or 0.6% of GDP – a figure close to government spending cuts planned for next year. Public debt of 110.6% of GDP in 2023 also exceeded an earlier projection of 109.7%.

To be sure, the government recently announced spending cuts of EUR 10bn in 2024 and EUR 20bn in 2025, equivalent to about 0.3% and 0.7% of GDP, respectively. Still, reducing the fiscal deficit to under 3% of GDP and stabilising public debt around 110% of GDP by 2027, as planned under the 2023-2027 programming law, will require extra savings, not least to narrow the deficit to 4.4% of GDP this year. In the longer run, the Cour des Comptes estimates necessary savings of around EUR 50bn between 2025 and 2027.

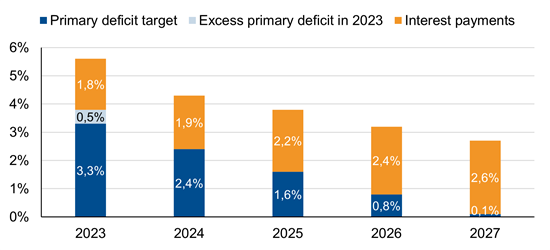

Meeting the targets will also prove challenging given a rise in interest payments, from 1.8% of GDP in 2023 to 2.6% by 2027 (Figure 1), and an economic outlook that is likely to be more modest than the average 1.7% growth projected by the government over the coming years.

Figure 1. Meeting government’s deficit targets will require larger, upfront spending cuts

% of GDP

Note: government estimates; figures may not add up due to rounding. Source: Ministry of the Economy, Finance and the Recovery, INSEE, IMF, Scope Ratings

Savings challenged by the fiscal framework, welfare state, and electoral calendar

In the absence of higher growth, rebuilding fiscal buffers depends on budgetary trade-offs. The first hurdle is the identification and implementation of spending cuts, which may prove slower than envisaged in the projected deficit reduction. The government announced a spending review in January 2023 and a report reviewing the quality of public services and administration was published in July.

Yet, completing the spending review at all levels of the public administration – including welfare agencies, regional and municipal governments – is likely to be a multi-year process. The scale of the review is unprecedented for a country having an uneven record of significantly and sustainably reducing public expenditures.

Secondly, difficult policy tradeoffs will be needed to reform the welfare state and reduce rigidities in public expenditure. Spending on social policy stands about four percentage points of GDP above the EU-27 average. Reducing safety nets is on the government agenda, for example, by restricting access to unemployment and social benefits. Even so, social discontent may hinder swift progress given the scale of recent protests against pension reform. Capital investment required for the energy transition and enhancing military infrastructure, alongside direct support for Ukraine (CC/Negative), also make reallocation of spending more likely than permanent cuts.

Thirdly, reducing the budget deficit and stabilising debt may require continuing, if not intensifying, consolidation efforts shortly before the next general elections scheduled for 2027. However, as elections approach, political commitment to implementing cost cutting may fade, leaving part of the necessary reforms and consolidation efforts for an incoming administration.

Constraints on tax policy, uncertain economic outlook weigh on budgetary prospects

Current geopolitical tensions and a reform agenda frustrated by the government’s lack of a majority in parliament raise uncertainties over the economic growth outlook and the strategy of consolidating the budget centered on more dynamic economic activity. The government has ruled out tax increases, while planning a middle-class household tax cut possibly in the 2025 budget.

Rebuilding fiscal buffers between external shocks remains a longstanding credit challenge, with public debt increases during crises significantly exceeding post crisis consolidation. This implies a structurally rising debt trajectory, underlined by the steady increase in debt-to-GDP from 60% in 2002.

Higher-than-expected public deficits drive the Negative Outlook assigned to France in May 2023. France’s next scheduled rating publication date is 3 May.

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register