Announcements

Drinks

Euro area sovereign credit: some ratings under pressure as fiscal challenges mount

Download the full report here.

“We are concerned about heavily indebted countries with large primary deficits, and governments operating in highly fragmented political environments and struggling to implement reforms,” says Alvise Lennkh-Yunus, head of sovereign and public sector ratings at Scope.

Former crisis-hit countries such as Greece, Ireland, Portugal, Spain and Cyprus have implemented important reforms under EU financial assistance programmes, resulting in more favourable macroeconomic trajectories. However, not all euro area countries have used the past years of loose monetary policy as effectively to address the fiscal challenges they face.

France and Belgium, both of which Scope rates with a Negative Outlook, risk failing to fully acknowledge their financial constraints. Government plans that only aim to stabilise public debt at current elevated ratios imply that debt will continue to rise whenever the next crisis emerges.

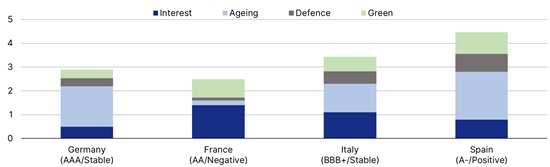

Rising expenditure and investment needs in France, Germany, Italy and Spain

% GDP

Source: Latest National Energy and Climate Plans, European Commission, NATO, Scope Ratings

Definitions: Interest: difference between 2020 and 2028 Scope forecast. Ageing: difference between 2035 and 2023 total cost of ageing expenditure based on EC 2024 Ageing Report. Defence: difference between 2023 defence expenditure and 2% target. Green: estimates based on latest National Energy and Climate Plans, assuming 1/3 public and 2/3 private investment shares

The recent upward revision of France’s fiscal deficit to 5.5% of GDP for 2023 further challenges the government’s consolidation plan which, according to the Court of Auditors, may now require additional savings of around EUR 50bn, or 2% of GDP, in coming years ahead of 2027 presidential elections.

Similarly, in the absence of policy changes in Belgium after the federal and regional elections in June, we expect Belgium to record the largest fiscal deficit in Europe, exceeding 5% of GDP in coming years. This would result in a steadily increasing debt trajectory, and the third-highest public debt level in Europe by 2028, after Greece and Italy.

“The difficult context for euro area governments stems from three challenges: moderate growth, high public debt, and rising interest payments, which coincide with pressures for higher spending and investment principally destined for the elderly, the environment and defence,” says Lennkh-Yunus.

Together, these trends will strain fiscal budgets by roughly 3%-4% of GDP on average in coming years. This includes substantial investment needs to become carbon neutral by 2050, estimated at about 0.5% to 1.0% of GDP per year for the public sector alone, based on European Commission data.

Public debt is higher on aggregate and fiscal disparities across euro area sovereigns have widened since the crises. The debt-ratio differential between Germany and France has surged from 38pp in 2019 to nearly 50pp, contrasting sharply with the near zero differential between 1992 (when the Maastricht Treaty was signed) and 2012, the height of the euro area crisis.

“Different public debt levels imply varying capacities to respond to the next shock. Such divergent fiscal positions may complicate discussions about future solidarity and fiscal risk sharing, especially in case of country-specific rather than region-wide shocks,” says Lennkh-Yunus.

Stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.