Announcements

Drinks

EU banks NPL Heatmaps: modest increases to continue

“The increase in NPLs was moderate but it still represents a reversal of the long-term trend of asset-quality improvement,” said Nicolas Hardy, deputy head of financial institutions. “And even though we are forecasting a modest economic rebound in the second half of 2024 aided by expected rate cuts, NPL formation will likely continue rising moderately this year because of a time lag.”

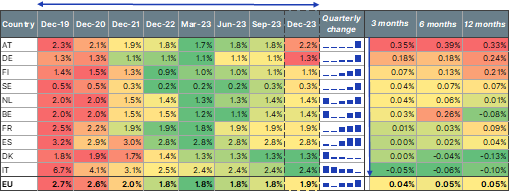

The situation differs among countries. Germany and Austria suffered the largest NPL increases, contrasting with continuing improvements in Italy and the Netherlands.

Heatmap 1: Non-performing loan ratios

Ranking according to the increase of NPLs in Q4 2023 (column ‘3 months’). Change over 3 months, 6 months, 12 months in pp. Sample includes countries with the 10 largest loan amounts.

Source: EBA risk dashboard, Scope Ratings

Overall, the increase in NPLs stemmed mainly from corporate exposures. Retail exposures have so far been resilient to the current economic slowdown. The largest increase in retail NPL ratios was in Finland and Sweden. In the Netherlands and Italy, a reduction in retail NPLs contributed to the overall improvement.

“We do not see a general deterioration of NPL ratios by corporate sector nor a concentration of issues in specific sectors,” Hardy noted, “although exposure to real estate and construction has been a source of problem loans and remains an area of concern.” The construction sector appears most frequently among the Top 3 sectors with the largest NPL ratios across countries.

This report is the first in a new quarterly series highlighting the key takeaways on NPL formation, from Scope’s perspective, from the EBA’s Risk Dashboard.

Download the full report here.

Stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.