Announcements

Drinks

Norwegian Savings Banks: strong profitability set to continue

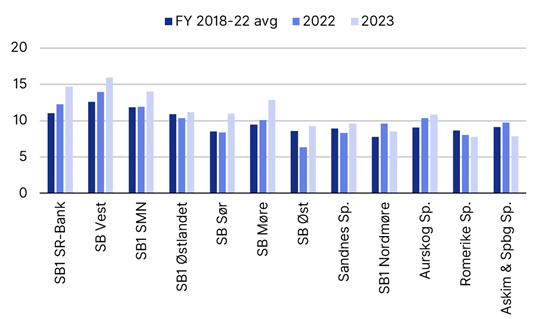

Of our sample of 12 Norwegian savings, those using the standardised approach (SB Sør, SB Øst, Sandnes, SB1 Nordmøre, Aurskog, Romerike and Askim & Spydeberg) achieved an average return on equity of 9.2% in 2023. Banks using the Internal Ratings based approach (SB1 SR-Bank, SB Vest, SB1 SMN, SB1 Østlandet and SB Møre) delivered an average RoE of 13.7% in 2023.

RoAE (return on average equity, %)

Source: SNL, Scope Ratings

“Costs have been elevated in the past year and this will also continue into 2024, but we expect banks to be able to cope with increased costs through their solid earnings capabilities,” said Andre Hansen, an analyst in Scope’s banking team. “Asset quality was resilient in 2023 although there has been some softening in the corporate sector. But this comes from a strong starting point and we expect any potential weakening to remain manageable on the back of the banks’ ability to generate earnings.”

Scope expects to see more losses across the corporate sector in 2024 and these will vary by industry. Commercial real estate and construction remain as well flagged points of risk in banks’ portfolios.

Norwegian savings banks continue to chase deposits in a competitive market as wholesale funding continues to be more costly. Capital levels are expected to remain resilient in 2024, reinforced by organic capital generation. Requirements increased in 2023 in the form of a higher countercyclical capital buffer (to 2.5% effective 31 March) and a higher systemic risk buffer (to 4.5% from 31 December) for standardised model banks.

A multitude of bank’s have benefited from capital relief from January 2024 as Pillar 2 requirements can be met with a mix of capital opposed to purely CET1 capital. “Looking forward toward 2025, bank’s using standardised models can expect to receive further capital relief in the form of regulatory updates that will increase their CET1 ratios,” Hansen said.

Download the full report here.

Stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.