Announcements

Drinks

Hungarian corporate bonds: cliff risk rises for high-yield issuers amid tough operating conditions

Most bonds issued in the past three to five years have automatic debt-repayment clauses linked to a deterioration in the issuer’s credit rating or breaches of financial covenants.

“The risk is then that the bonds have to be repaid at relatively short notice – so-called cliff risk – if the issuer cannot restore minimum ratings in time or address the covenant breaches,” says Istvan Braun, associate director for corporate ratings at Scope and author of the report: Hungarian corporate bonds: cliff risk rises.

“Accelerated debt repayments caused by covenant breaches would lead to a severe liquidity squeeze for most of the borrowers concerned.”

Borrowers can use a grace period, typically running at two years in Hungary, to implement measures to restore credit ratings or redefine financial covenants. Negotiating with creditors to obtain covenant waivers and/or receive approval to changes to bond prospectuses are another option for limiting the risk of multi-notch rating downgrades and/or distressed debt restructuring, which Scope might consider as a selective default.

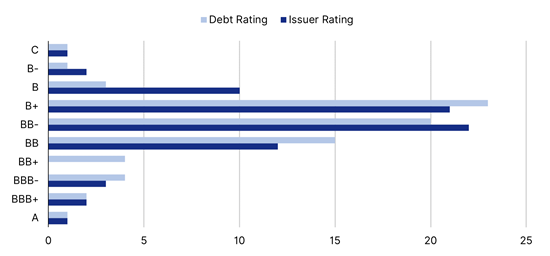

Hungarian non-financial corporate issuer ratings and corresponding debt category/instrument ratings (end-April 2024)

Source: Scope Ratings

High real interest rates, volatile currency, EU dispute weigh down on business outlook

The growing cliff risk has emerged even as Hungary’s economy has bounced back, despite the weaker-than-expected 4Q23 GDP data, after contracting by 0.9% in 2023, with growth set for 2.4% this year. Hungary (BBB/Stable) is benefiting from significant foreign investment from China in the automotive sector, notably in the electric vehicle segment, helping offset slack external demand.

“However, for many domestic companies, the operating environment remains challenging, characterised by persistently high real interest rates, although inflation has fallen from last year’s highs,” says Braun. The volatile exchange rate and the increasing state dominance of various economic sectors adds to uncertainty surrounding the absorption of EU funds which further complicates planning, particularly for industries like construction. The government's unresolved dispute with the EU has adversely affected consumer and business sentiment.

In these circumstances, the Hungarian National Bank (MNB) will play a pivotal role as the country’s largest corporate bond investor, likely to lead negotiations in any debt restructuring. After all, the rapid growth of corporate bond issuance in Hungary in recent years is the result of the MNB’s NKP programme started in 2019.

Maintaining a minimum B+ rating a typical Hungarian corporate bond covenant

One of the most prominent early repayment events included in the standard terms and conditions is the maintenance of at least a B+ debt rating during the tenor of the bond, which is usually 10 years. If the rating falls below the minimum hurdle, issuers usually have a two-year grace period before an early debt repayment can be enforced by the lenders. However, no grace period is provided if a debt rating falls below B- during the tenor of the bond, an event which triggers an immediate bond repayment typically within 15 to 90 business days.

Of four issuers whose bonds Scope currently rates below B+, three have covenants with this minimum rating requirement.

“While the bonds met the minimum rating criteria at the time of the bond issuance, downgrades to below the minimum rating reflect a mix of factors that have impaired credit quality at the companies concerned. The factors range from sluggish demand for discretionary and seasonal products to significant cost increases – especially for energy, labour and raw materials – in addition to liquidity issues related to pressure on working capital, aggressive investment strategies and weakened corporate governance,” says Braun.

There are good chances that companies can remedy the covenant breach and restore their bond rating within the grace period as seen in a number of cases. However, the ratings pressure could rise further if companies do not adequately address covenant breaches and either implement measures that would restore the ratings or negotiate a waiver with the creditors well in advance of the end of the grace periods. In such cases, cliff risks and significant rating downgrades could materialise.

Stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.