Announcements

Drinks

Italy: tax breaks, investment delays, rising debt-to-GDP increase the need for fiscal consolidation

By Eiko Sievert and Alessandra Poli, Sovereign and Public Sector

The public debt of Italy (rated BBB+/Stable Outlook) will be the highest among European sovereigns as a share of GDP, surpassing that of Greece (BBB-/Stable), in the next three years. The country needs to contain the budget deficit and debt-to-GDP trajectory to reassure investors as it likely faces an excessive deficit procedure (EDP) by June under new European fiscal rules.

Support from European institutions is crucial for Italy’s sovereign rating. If such support were to weaken, refinancing risks for Italy’s high public debt would rise materially. The ECB has confirmed that an EDP does not disqualify countries from its Transmission Protection Instrument (TPI) so long as a country is compliant with achieving its medium-term targets.

The Italian government and the European Commission (EC) will agree on a net expenditure path this year to determine the scale of medium-term fiscal consolidation. Enhancing the efficiency and quality of public spending, reinforcing the sustainability of the pension system, and improving tax compliance will be critical.

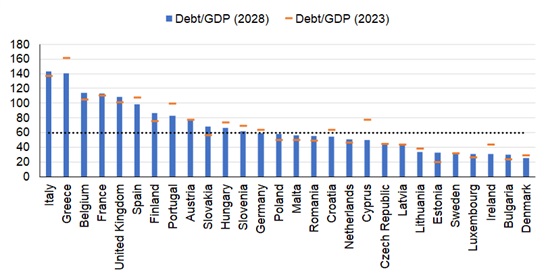

Italy’s public debt will rise to 143.7% of GDP by 2028 from 137.3% in 2023 based on current trends. The 6.4pp increase is in line with other large European economies facing challenging fiscal outlooks such as Belgium (+8.9pps), the United Kingdom (+7.7pps) and France (+2.6pps). Still, the starting points of these countries’ general government debt-to-GDP of around 101-111% at end-2023 are well below Italy’s. Italy also diverges from the countries under European financial assistance programmes during the euro area crisis where past reforms are contributing to falling debt-to-GDP ratios: Greece (-21.8pps), Portugal (A-/Stable; -15.8pps) and Spain (A-/Positive; -9.5pps).

Figure 1. Public debt-to-GDP in Europe (2023 vs 2028 forecast)

% of GDP

Note: EU member states and UK

Source: Scope Ratings

Italy needs fiscal consolidation of around EUR 135bn in years ahead

Italy’s persistently high debt-to-GDP partly reflects heavy use of tax incentives for building renovations since 2020, resulting in higher-than-expected fiscal deficits. Another factor is delays in some investments in the EU-backed Recovery and Resilience Plan (RRP). Spending is now concentrated in 2024-26. Higher interest rates have also pushed up debt-servicing costs, to run at more than 4% of GDP medium term.

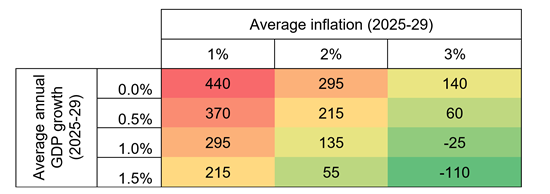

With our baseline of around 1% of economic growth and 2% inflation on average in 2025-29, Italy requires a cumulative improvement in the primary government balance of around 5.8pps of GDP (about EUR 135bn) in 2025-29 to support a gradual decline in debt-to-GDP by 1pp a year from 2027. Lower growth or lower inflation would significantly increase the degree of fiscal consolidation required (Figure 2).

Figure 2. Reducing Italy’s debt-to-GDP remains highly sensitive to growth and inflation

Cumulative fiscal consolidation required in 2025-29 (EUR bn) for debt-to-GDP to decline by 1pp annually

Source: Scope Ratings

Superbonus: fading impact on fiscal deficits, but increasing negative effects on debt levels

The estimated EUR 135bn of needed fiscal consolidation is slightly higher than the cost of tax incentives granted to date for building renovations aimed at improving their energy efficiency, known as the ‘Superbonus’, which has resulted in EUR 122.2bn of tax credits. The scheme has significantly contributed to the elevated, if temporary, impact on the general government deficit of 8.6% of GDP in 2022 and 7.4% in 2023 and will lead to higher debt-to-GDP in 2024-26.

Recent estimates from the Italian Fiscal Council show an average yearly debt increase, related to the Superbonus, of almost 2pps in the next three years, compared with an average 0.5pps increase in 2021-23. A recent proposed amendment to the measure would extend the tax credits from five to 10 years for renovation work carried out from 2024, spreading the impact on public debt over a longer period.

To be sure, the Superbonus has underpinned new real-estate investment of EUR 117.2bn and almost 40% growth in construction-sector activity in 2020-23. While the tax incentives raised GDP by around 2.4pps over 2021-24, according to estimates by Confindustria, much of this economic benefit will prove temporary and is unlikely to offset the underlying fiscal costs.

RRP: spending delays threaten full implementation, reducing economic benefit

Italy’s RRP continues to face spending delays and implementation challenges, casting doubt over whether all planned investments can be realised by 2026. Spending remains comparatively low at 23% or EUR 45bn of EUR 194.4bn allocated at end-March 2024, despite the reception of 53% of all grants and loans to date.

Most investment is now due to take place in 2024-26, equivalent to EUR 150bn or around 7% of GDP, assuming no extension to the 2026 deadline by the EC. Pressure on Italy to identify and start projects more quickly increases the risk of operational and governance bottlenecks. Longer delays could limit the potential boost from the plan to medium-term growth, which is crucial for stabilising Italy’s debt-to-GDP.