Announcements

Drinks

Egypt gains room for manoeuvre but vulnerability to external shocks remains

By Thomas Gillet and Elena Klare, Sovereign and Public Sector

Egypt’s economic growth remains robust supporting the expected debt-to-GDP decline in the years ahead, which, should help stabilise country’s credit outlook particularly if the government continues to pursue the recent pace of reform. Scope affirmed Egypt’s ratings at B- and revised the Outlook to Stable on 12 April 2024.

The economy should expand by 3.0% in 2024, and annual output growth is expected to average 5% by 2029 (compared with 3.8% in 2023). Under our revised forecasts, debt-to-GDP should decline to around 65% of GDP by 2029, down from a peak of 96% this year, driven by robust economic growth, a high GDP deflator, and sustained primary surpluses. In a worsened macro-fiscal outlook, reflecting Egypt’s record of uneven progress on reforms and high vulnerability to external shocks, we project government debt to peak around 105% of GDP this year and remain above 90% by 2029.

Still, the government’s interest burden remains a significant rating constraint given the high public debt stock. While interest payments are set to decline over coming years, they will still account for almost half of revenues on average in the period up to 2029, from 40% in 2023, and for about one third of revenues in 2029. This reflects the low revenue mobilisation as well as the relatively short average term to maturity of Egypt’s public debt, standing at 3.4 years in June this year. Egypt’s high interest burden will thus remain one of its main credit challenges compared to peers.

Government continues to run wide budget deficits

The government will continue to run large budget deficits, likely to average more than 6% of GDP over the next five years due to the high interest burden and heavy public spending on welfare and public-sector salaries. These wide fiscal deficits will continue to drive elevated public gross financing needs, estimated at 35% of GDP on average by 2029, significantly above the IMF’s benchmark of 15% for emerging markets, limiting the government’s budget flexibility.

Uncertainties also remain about the future of the exchange rate regime. Regular interventions by the Central Bank of Egypt (CBE) have characterised trading in the Egyptian pound against the US dollar since the devaluation in March. Egypt’s low level of net international reserves relative to external gross financing requirements could test the government’s commitment to a greater exchange rate flexibility – a condition for continued support from the International Monetary Fund (IMF) – in the longer run.

IMF support and Abu Dhabi investments help replenish net international reserves

Nevertheless, Egypt has taken important steps to improve its financial resilience, underscored by the renegotiated agreement with the IMF. Swift progress in implementing the enlarged IMF programme should encourage other donors to proceed with disbursements, including the European Union, with EUR 1bn planned by end-2024 under a EUR 5bn macro-financial assistance programme.

Cumulative external support could amount to around USD 50bn by 2026, equivalent to about 13% of 2023 GDP, including investments worth USD 35bn announced in February 2024 by Abu Dhabi.

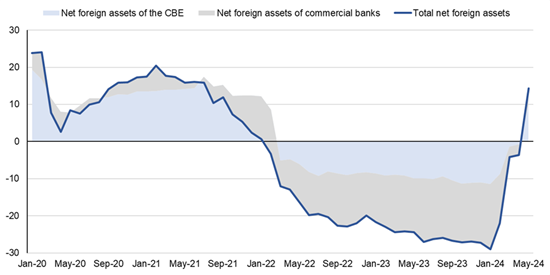

Together, this support improves near- to medium-term foreign currency liquidity. The CBE’s net international reserves recovered at USD 46.1bn at end-June (equivalent to more than six months of imports of goods and services), up from USD 35.3bn as of end-February. High domestic interest rates have also encouraged foreign capital inflows. The net foreign asset position of the banking system turned into a surplus in May for the first time since the start of Russia-Ukraine war.

Figure 1. Egypt’s net foreign assets turned positive thanks to large financial support

USD bn

Source: Macrobond, Scope Ratings

Tight as the government’s fiscal space is, higher foreign currency liquidity facilitates the task of meeting external gross financing needs which we expect to decline steadily in the years ahead. They should fall below USD 20bn in 2025 (6% of GDP) based on lower external debt and lower current account deficits (around 2%-3% of GDP) should reforms be implemented as expected.

Sustained reforms could reduce medium-term economic and fiscal imbalances

Progress on reform in the context of the IMF programme raises the prospect for reduced economic and fiscal imbalances in the medium term. A cabinet reshuffle earlier this month suggests there is renewed impetus behind reforms supporting private sector-led growth and external competitiveness.

In this context, Egypt’s robust growth and likely declining debt-to-GDP in the years ahead together with the government’s commitment to fiscal discipline and budget transparency will likely support the sovereign credit outlook over the medium-term. However, Egypt’s credit trajectory critically depends on the sustained implementation of structural reforms over multiple years, continued political stability, governance continuity, and social cohesion, which are the necessary conditions for the expected macro-economic improvements to materialise.

The authorities have strengthened oversight of public related entities, reducing off-budget expenditure and contingent liability risk on the sovereign balance sheet. The gradual removal of subsidies and the ceiling put on public investment spending should widen the primary budget surplus to 2% of GDP in 2024 and 2.5% in 2025, up from 1.1% in 2023, against the government’s target of 3.5% in 2024/25.

For Scope’s latest rating report on Egypt, please follow this link.

Stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.