Announcements

Drinks

Italy: fiscal consolidation needed as foreign investors’ share of bond holdings set to rise

By Eiko Sievert and Alessandra Poli, Sovereign and Public Sector

Italy, which we recently affirmed at BBB+/Stable, will need to implement a credible fiscal consolidation plan, not only because of the European Commission’s excessive deficit procedure but also due to increased reliance on foreign investors to buy sovereign bonds. Efforts to raise the share of debt held by domestic retail investors are unlikely to suffice.

Without decisive measures to reduce persistent deficits, Italy’s headline general government deficit is set to remain above 3% of GDP over the coming years, resulting in a rising debt-to-GDP ratio. We forecast debt will climb to 143% of GDP in 2029 from 137% in 2023.

Once approved by the EU Council, the government will be required to undertake medium-term fiscal consolidation to reduce public debt. Critically, the required annual fiscal consolidation of about 0.6% of GDP appears achievable, at least until 2026, provided Italy maintains a minimum level of public investment in line with the seven-year adjustment horizon under recently adopted EU fiscal rules.

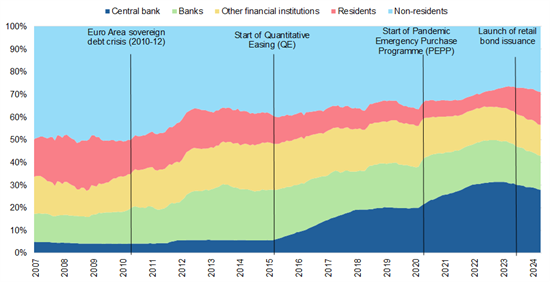

However, if targets agreed under the excessive deficit procedure are not met, Italian debt securities may not be eligible for the ECB’s Transmission Protection Instrument designed to contain sharp rises in government bond yields. This is all the more relevant as the central bank reduces its holdings of Italian and other euro area sovereign debt, increasing Italy’s vulnerability to shifts in foreign investors’ risk appetite.

Figure 1. Italy’s general government debt securities by holding sector, 2007-24

%

Source: Bank of Italy, Scope Ratings

Retail bonds increase share of debt held by residents, but unlikely to fully replace ECB holdings

The ECB confirmed in July the continuation of quantitative tightening (QT) by no longer investing principal payments from maturing securities under its Asset Purchase Programmes and by reducing its PEPP (Pandemic Emergency Purchase Programme) portfolio by an average of EUR 7.5bn per month.

Since the start of QT in March 2023, the amount of debt securities held by Italian residents (other than financial institutions) increased by EUR 133bn, reaching an all-time high of EUR 353bn in April 2024. This increased the share of Italy’s outstanding general government debt held by residents by 5pps to 15%, offsetting declines in the ECB’s debt holdings worth EUR 42bn, and EUR 64bn held by financial institutions.

Non-residents increased their holdings of Italian public debt by EUR 85bn over the same period to 29% of outstanding debt, although this remains well below the 50% share prior to the 2012-13 euro area crisis.

The introduction of BTP Valore, Italian sovereign bonds sold exclusively to retail investors, has thus helped to achieve the government’s goal of increasing the share of Italian government debt held by residents.

Strong demand for BTP Valore coincided with the upward swing in interest rates. In addition to higher interest rates, favourable tax treatment encouraged savers to shift some of their bank deposits into the bonds, particularly as Italian banks have been relatively slow to pass on the benefits of higher rates to depositors.

However, strong retail demand is unlikely to be enough to replace the gradual decline in the ECB’s holdings of Italian government bonds amid still rising government debt. Deposits held in Italian banks of EUR 2.03bn as of Q1 2024 are mainly overnight deposits, with around 24% having agreed maturities or being redeemable at notice. This is below previous highs of around 36% reached in 2012/13.

If depositors were to shift their current savings held as overnight deposits into BTP Valore to a level similar to the 36% highs of deposits with agreed maturities or being redeemable at notice, they would absorb around EUR 251bn of additional government debt. But this remains well below current central bank holdings of around EUR 674bn, so demand from foreign investors will remain crucial.

Demand for retail bonds follows similar trends in other European countries

Retail sovereign bonds, particularly in countries with high debt levels, are important. The first three issues of BTP Valore in June and October 2023, and February 2024 raised around EUR 54bn.

Retail demand for sovereign debt has also been high in other euro area countries. At the start of 2022, Belgium (AA-/Negative) reintroduced medium and long-term State Notes, which saw record demand of EUR 21.9bn in September 2023. Similarly, in March 2023, Croatia (BBB+/Positive) issued around EUR 1.3bn of bonds directed at retail investors while Portugal’s (A-/Positive) retail demand held in household-targeting saving certificates peaked at EUR 34bn in October 2023.

In the first half of this year, however, retail demand across Europe started to slow.

The latest issue of BTP Valore resulted in EUR 11.3bn of funds raised, well below previous issues but still exceeding the Italian finance ministry’s expectations. At the same time, an offering of Belgian retail bonds in March drew demand of just EUR 500m, a fraction of the demand seen in September 2023.

Large pools of domestic investors can help reduce reliance on more volatile foreign investors. Still, the need to address structural fiscal pressures, implement reforms and investment to raise potential economic growth while economising on public expenditure remains key.

Stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.