Announcements

Drinks

TUESDAY,

13/08/2024 - Scope Ratings GmbH

Download PDF

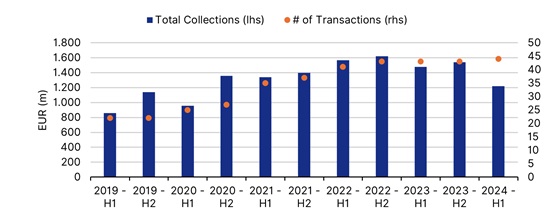

Italian NPL collections: first-half volumes fall 20%

Italian NPL collections in the first half of 2024 were 20% below the same periods of 2022 and 2023. The decline was driven by DPOs (down EUR 90m or 28%) and note sales (-EUR 66m, 62%). Judicial proceeds were broadly stable (down EUR 17m, 3%).

Seasoned transactions i.e. those rated before the pandemic show a steeper decline in DPOs than those rated more recently. In other words, the more transactions age, the more evident the fall in DPOs is.

In June 2024, collections rose by 23% month-on-month to EUR 255m but this was 31% below the June average of the last two years.

Semi-annual gross proceeds (EUR m)

Source: Scope calculations on servicing reports

Download the Italian NPL monthly here.

Stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.