Announcements

Drinks

Belgium: stable government and policy coordination key for budget consolidation

By Thomas Gillet and Brian Marly, Sovereign and Public Sector

The potentially significant development following the June 2024 federal and regional elections in Belgium (AA-/Negative) is the progress towards forming a narrower coalition in which the Nieuw-Vlaamse Alliantie (N-VA, Flemish nationalist) is likely to have a leading role. This sets the stage for improved coordination over fiscal policy across the federal and regional governments.

However, addressing persistent and wide budget deficits – which underpinned our assignment of a Negative rating Outlook in September 2023 – will require sustained consolidation over multiple years. While the N-VA has made fiscal consolidation a policy priority, other potential coalition partners are likely to challenge the Flemish party’s budgetary agenda and test the limit of more favourable policy setting. This could leave Belgium’s fiscal deficit durably above 3% of GDP and government debt, set to reach 107% of GDP in 2024, on a slight upward trajectory.

Narrower coalition most likely outcome from the ongoing negotiations at federal level

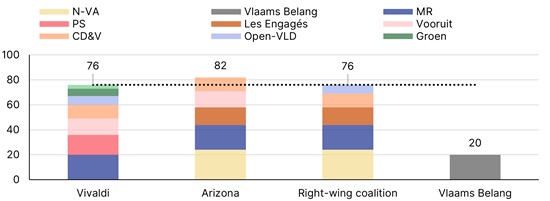

Negotiations led by N-VA met some setbacks given the sensitivity surrounding fiscal policy. The proposal of a capital gains tax undermined initial coalition talks. Still, the most plausible outcome remains a five-party so-called Arizona coalition comprising the N-VA, the Christian Democratic and Flemish party (CD&V), the Mouvement Réformateur (MR, francophone liberals), Les Engagés (francophone liberals) and Vooruit (Flemish socialists).

Alternative options, including a repeat of the outgoing Vivaldi coalition or a right-wing coalition, appear unlikely: their majority is razor-thin and some parties (PS, Open VLD, Groen) have ruled out forming a governing coalition after their losses in the June ballot. The still broadly accepted ‘cordon sanitaire’ against Vlaams Belang, the Flemish nationalist, Eurosceptic party should exclude it from government.

Figure 1. Federal elections may lead to more stable government coalition

Number of seats in parliament

Source: Federal Public Service Interior, Scope Ratings

An Arizona configuration would likely be more cohesive than the seven-party Vivaldi coalition given fewer and more ideologically aligned parties, despite the inclusion of the social-democratic Vooruit party. This should help a new federal government reach consensus on structural reforms and budget consolidation, improving the prospects for addressing Belgium’s challenging fiscal position.

Necessary compromise likely to moderate scope of fiscal consolidation

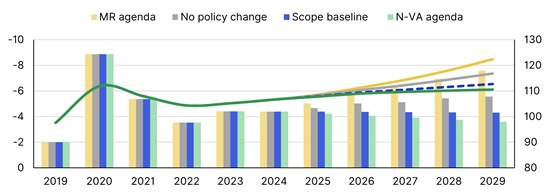

The N-VA is likely to water down its ambitious agenda to compromise with other coalition members. Ahead of the elections, Belgium’s Federal Planning Bureau (FDB) estimated that the implementation of N-VA’s agenda would result in a reduction of the general government deficit to 3.6% of GDP by 2029, from 4.4% of GDP in 2023, and contain the rise in government to around 110%.

In comparison, the measures proposed by other coalition partners would maintain the fiscal deficit between 5% (Les Engagés) and 8% of GDP (MR) by 2029 according to the FDB and public debt on a firm upward trajectory to around 115-122% of GDP.

Even so, all parties that could form the next federal government will need to make concessions, underpinning our view that the fiscal deficit will remain below 4.5% of GDP by 2029 and public debt below 115% of GDP. This outcome would be more favourable for public finances than a no-policy-change scenario in which the deficit rises to 5.6% by 2029 and public debt to around 117%.

Figure 2. Public debt expected to rise steadily under a no-policy change scenario

General government deficit (LHS), general government debt (RHS) – % of GDP

Note: Based on estimates from the FPB, the MR has the costliest policy platform and the N-VA the most favourable one for public finances. Source: Federal Planning Bureau, Scope Ratings

Closer political alignment with Wallonia and Flanders may further support fiscal outlook

We expect greater policy alignment between the federal and regional governments as the five Arizona coalition parties are likely to control Wallonia (MR & Les Engagés) and Flanders (N-VA, CD&V and Vooruit). This may facilitate the consolidation of public finances as those are the two largest federated entities in Belgium, where more than a third of general government spending is conducted at the regional level.

In Wallonia, the new government is in place, with the backing of a liberal, centre-right coalition (MR & Les Engagés), replacing the previous centre-left government. The new administration is committed to consolidating public finances, notably with a push to lower spending partly through increased cooperation with the French-speaking community. The administration has also committed to reduce the debt-to-revenue to 180% over the next decade from 220% today and to make this threshold a binding ceiling.

In Flanders, the next government could similarly ensure a better degree of alignment. Talks are underway between N-VA, CD&V and Vooruit over a coalition which would have an absolute majority without the participation of Vlaams Belang or the Marxist PVDA.

Still, prolonged coalition negotiations could hinder Belgium's ability to address its fiscal challenges. With the caretaker government indicating that it would request an extension until 15 October to submit its national medium-term fiscal structural plan in response to the Excessive Deficit Procedure, much near-term uncertainty still hangs over Belgium’s credit outlook.